Why is China Stockpiling Silver?

UBS: Silver to Outperform in 2025

Market Rundown | Why is China Stockpiling Silver?

Authored by GoldFix, ZH Edit

Today:

- Discussion: Oil Levels, China Silver, Israel Hostages, Museum Media

- Premium: UBS: Silver's Turn

Clip on China Demand

China has not enabled Silver accumulation by its own citizens (yet) due to the CCP still stockpiling it for high-tech production.

Gold is Money. Silver is More

— VBL’s Ghost (@Sorenthek) January 16, 2025

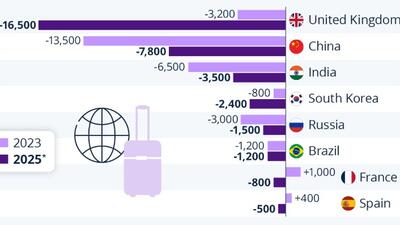

China Silver Demand Update

(Retail, Industrial, Military)

cc: @KingKong9888, @oriental_ghost pic.twitter.com/yoz3O2su4T

China Demand Broken Down

I talked to my friend @oriental_ghost today via DM regarding the potential for a

— Eric Yeung 👍🚀🌕 (@KingKong9888) January 16, 2025

“physical silver accumulate” product (1:1 physically redeemable Silver accounts with super low premiums under 1%) at the Chinese banks and below is his answer:

“I specifically consulted the CCB… pic.twitter.com/jVEfHFH29o

More here

Free Posts To Your Mailbox

NEVER MISS THE NEWS THAT MATTERS MOST

ZEROHEDGE DIRECTLY TO YOUR INBOX

Receive a daily recap featuring a curated list of must-read stories.

Trending on ZeroHedge

Wall Street Panics As Socialist Set To Take Over New York, REITs Tumble At The Idiocy Of It All

Free Speech Travesty: German Pensioner Who Called Green Economic Minister Habeck An 'Idiot' Has Been Convicted