‘Excess mortality’ continuing surge causes concerns

(Editor's Note: See this story for the latest update.)

Despite some signs that excess mortality rates are declining, life insurance executives and actuaries believe the numbers are alarming and could continue to drag earnings and surge death claims for years to come.

Excess mortality is the difference between the total number of deaths for a specific time period and the number that would have been expected. The numbers were naturally forecasted to climb during the pandemic, but some industry and health authorities are concerned the rates haven’t greatly diminished as COVID infection rates have declined.

Life insurers paid record levels of claims in 2021 as the pandemic drove mortality higher and the issue was widely cited in earnings reports as the drag on profits. In 2021, the most recent year for which data is available, the industry distributed a record $100.28 billion in total death benefits, according to BestLink. The higher-than-normal payouts began in 2020, the first year of the pandemic when insurers saw death benefits rise 15.4% , the biggest one-year increase since the 1918 Spanish Flu epidemic. The 2021 increase was 10.8%, but fell during the first nine months of 2022, from $74.27 billion in the same period in 2021. But that’s still higher than the $59.18 billion paid out during the same period in 2019 before the pandemic hit, according to BestLink.

No standard for measuring excess mortality

“There’s no standard way to measure excess mortality,” said Josh Stirling, founder of the Insurance Collaboration to Save Lives, a non-profit organization that seeks mitigate mortality losses by providing life insurers with tests to screen policyholders for health problems. “But if you use the data that seems most reliable it looks like, generally, we’re at 13.9 deaths per 100,000, which is up perhaps 7% from where it should have been. Is that catastrophic? Maybe not, but it should be lower.”

The Society of Actuaries polls of its members found that in August of last year 85% thought excess morality rates would continue to 2025. Two months ago, the same poll found that 79% believed excess mortality rates will continue through 2026.

The issue is clouded because figures vary widely depending on how the data is cut and adjusted for the time period, age, specific pathologies, and many other factors. Some executives think the current numbers are temporary or seasonal and don’t require the industry to react.

“We believe that insured population will continue to see declining excess deaths over the next several years reaching about 0% excess deaths by 2030,” said Fred Tavan, chief pricing officer at Legal & General America, a Maryland-based insurer and major provider of term life insurance in the U.S. “This is one of the reasons there haven’t seen any significant changes in insurance premiums during COVID or even after. A scan of insurance premiums across the industry from different carriers proves this out.”

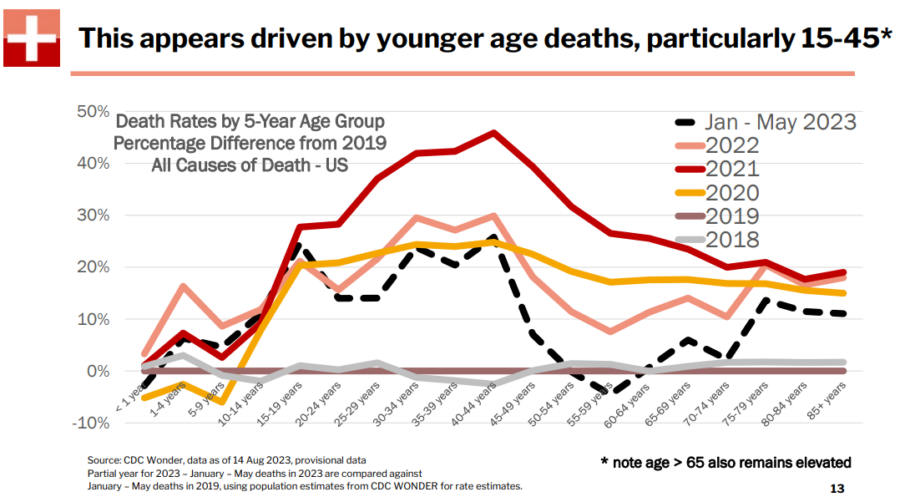

Younger adult death rate up 20% in 2023

Others aren’t so sanguine and point to statistics from the U.S. Center of Disease Control that show mortality rates alarmingly rising for different categories. For example, younger adult mortality rates are up more than 20% in 2023, the CDC said. Cause of death data show increased cardiac mortality in all ages. And even as COVID-related causes declined in 2022, others rose, particularly stroke, diabetes, kidney and liver diseases.

“Consider the ripples of COVID-19 and its varying impacts, leading to higher rates of depression, suicide, and increased substance abuse,” said Samantha Chow, global leader for Life, Annuity and Benefits Sector at Capgemini, the giant multinational Paris-based consulting company. “This has set off a domino effect. From a life insurer's standpoint, and those dealing in retirement and long-term care solutions, there's a larger conversation at hand. Can the industry handle a sudden spike in claims? The surge in excess deaths caught carriers off guard, and our aging population is becoming more susceptible to illnesses or passing due to natural causes.”

Chow said there’s a real question of whether the insurance industry can sustain the enormous payouts the excess mortality rates will dictate.

“The real concern for life insurers lies in preparing for an unexpected wave of death claims and the impact on their assets under management,” she said. “Do they have enough reserves to weather these outflows, given the excess deaths? It's not just about death or health. It is about the industry's ability and readiness to manage this monumental outflow.”

Capgemini just published its World Life Insurance Report that revealed the upcoming largest inter-generational wealth transfer in history that is expected to cause a massive outflow of nearly 40% of life insurers’ assets under management (AUM), totaling $7.8 trillion, by 2040.

“When we factor in the rise of payouts on death claims, the magnitude of the situation demands urgent attention by the industry,” the report said.

Industry response questioned

Some observers think the industry has been slow to grasp the burgeoning problem, relying on old industry models that say “mortality rates always give back, and have for nearly 500 years,” according to one senior executive.

Stirling believes that expanded, aggressive and proactive health screening of policyholders would save lives and be a significant cost benefit for insurers. Though a startup, Stirling says his organization is poised to announce partnerships with major carriers to institute its mitigation programs. Members of his organization’s board include current and former executives from Farmers Group, Progressive, the Fortegra Group, the Indiana Public Retirement System, and the life and health actuary for the state of Georgia’s Commissioner of Insurance.

“We are led by insurance people trying to drive risk management around health into the insurance industry to empower and engage global insurers to save lives through bracket screening and intervention,” he said. “Screen test and triage is sort of our tagline. We would look a lot like the Insurance Institute for Highway Safety for life insurers, which was funded by the industry and brought airbags and seatbelt to autos year ago. However, we're also trying to disrupt the industry and create an ecosystem of for-profit companies that will make this happen.”

Doug Bailey is a journalist and freelance writer who lives outside of Boston. He can be reached at doug.bailey@innfeedback.com.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

The surge continues – annuity sales up 11% in Q3, 21% for the year

Future proofing insurance companies for the next shock

Advisor News

- Industry groups praise tax reform provisions in ‘Big Beautiful Bill’

- Pennsylvania hospitals expected to lose out under ‘Big Beautiful Bill’

- Rep. Begich celebrates passage of tax-cut bill that could cause thousands of Alaskans to lose health coverage

- Houses passes Trump budget making 2017 tax cuts permanent

- International stocks are having their moment. Will it last?

More Advisor NewsAnnuity News

- MetLife Declares Third Quarter 2025 Common Stock Dividend

- CT insurance commissioner to court: loosen moratorium on PHL Variable

- AM Best Affirms Credit Ratings of New York Life Insurance Company and Its Subsidiaries

- Chariot Re Launches with Co-Sponsorship by MetLife and General Atlantic

- The retirement shuffle: How the industry can adapt

More Annuity NewsHealth/Employee Benefits News

- The big, beautiful truth about Medicaid reform

- TRICARE Contract Changeover: After 6 Months of Challenges, What's Next?

- Researchers at Johns Hopkins University Have Reported New Data on Reconstructive Microsurgery (Insurance Coverage for Hyperbaric Oxygen Therapy In Acutely Compromised Tissues): Health and Medicine – Reconstructive Microsurgery

- Rural hospitals will be hit hard by Trump's signature spending package

- Officials warn cuts will hurt rural hospitals

More Health/Employee Benefits NewsLife Insurance News