Four Core Risk Themes

Wealth preservation drives the VON GREYERZ service, and physical precious metals directly address the four core risk themes facing global investors. Select a Category:

Political / Historical Risk

History Repeating Itself

For thousands of years, from 3rd Century Rome to 18th Century France, 1930s Europe or current western inflationary woes, history offers clear lessons. Specifically, and without exception, all empires, nations or regimes which find themselves at fatal debt levels eventually resort to the seductive (as well as desperate) call to devaluing their currency and increasing their economic and political controls. We’ve seen current examples, from lockdowns, media censorship, misreported inflation data and the curtailment of civil liberties to the slow rise of CBDC as a surveillance/control instrument, masquerading as an efficient “payment system.” Of course CBDC is just nothing more than fiat money in a digital form; it will do nothing to protect currencies from further creation, and hence further debasement.

Devaluing Currencies to Pay Debts Ends Badly

Such measures, which begin slowly at first, eventually become addictions, as weaker and weaker currencies are rolled out with increasing speed to mask otherwise unsustainable over-spending policies and unpayable debt burdens.

Initially, currency expansion feels almost miraculous, but the end result is always the same: A tragic transition from economic boom to bust follows. What equally follows is the destruction of the underlying currency and greater social unrest contained by increased political centralisation and controls from the extreme political left or right.

Higher Risks Today

Central banks have promulgated a fantasy that such artificial measures are sustainable. This included the growing popularity of “unlimited QE” under economic theories like Modern Monetary Theory (MMT) which have been wrongly presented as a viable and sustainable policy solution.

Understanding Yesterday, Preparing for Tomorrow

Debt cannot be solved with more debt paid for by currencies created out of thin air. The inevitable end-game is always the same: Currencies collapse in value and purchasing power, a fact playing out in real-time today. As the following report makes clear, currencies are always the last bubble to “pop.”

Banking Risk

Despite years of central bank support and headline-making bailouts in 2008 and 2020, commercial banks face a myriad of ongoing operational and structural risks.

The Derivatives Market— A Ticking Time-Bomb

Forefront among these risks is bank exposure to a now irrationally over-valued derivatives market. The notional value of this market is far greater than a quadrillion-dollars. Banks face massive counter-party and concentration risk in this inflated sector.

Dangerous price swings in sovereign bonds have been equally disruptive to the value of bank balance sheets, prompting the recent and future failure of more regional banks and hence greater consolidation, as well as centralisation, among the larger banks. Ultimately, central banks, and CBDC, will replace traditional banking and cash practices, as well as personal privacy.

Holding Gold in Banks Invites Counter-Party Risk

Investors bracing for any and all macro eventualities recognise that holding physical gold within such banks (or ETF “paper gold” held at these institutions) invites far too much operational and counter-party risk.

Physical gold held in the banking system, even in segregated or specially allocated accounts, is vulnerable to inherent counter-party risk. In the event banks or their intermediary custodians or managers ever experience illiquidity or other structural failure, client gold is compromised.

In such circumstances, investors would find themselves standing in line as second priority holders rather than direct owners of their own precious metal assets. In short, it’s not just cash deposits which are at risk during a bank “run;” one’s precious metals are equally vulnerable.

Direct Solutions Through Direct Ownership

At VON GREYERZ, our investors enjoy direct and unencumbered ownership of their assets with significantly reduced counter-party risk. This is a critical component of our long-term risk management, client-focused philosophy.

Such direct ownership sets us far above other precious metal service providers.

For more details on the critical importance of owning physical precious metals outside a highly compromised banking system, click the button below:

Currency Risk

Money Printing Gone Too Far

Sophisticated individuals, families and institutions recognise that record-high global debt levels accompanied by historically declining GDP growth rates represents a fractured financial system, whose global debt-to-income ratio is currently 3 to 1.

Such a disconnect between rising debt levels and stagnating GDP can only be sustained by equally record-high levels of global fiat currency creation (i.e. Quantitative Easing, or “money printing”).

Masking Reality with Fake Paper Money

Fabricated paper/electronic money rather than actual income from robust trade, manufacturing and sound corporate and political governance has been abusively used to mask these otherwise broken economic realities.

Global policy makers are effectively buying their own sovereign and corporate debt with money created from nothing.

A Dangerous Game

This is a dangerous game played throughout history, and one which, without exception, always ends badly for those who lacked the foresight to hold physical gold and silver as insurance against the declining purchasing power of their respective currency.

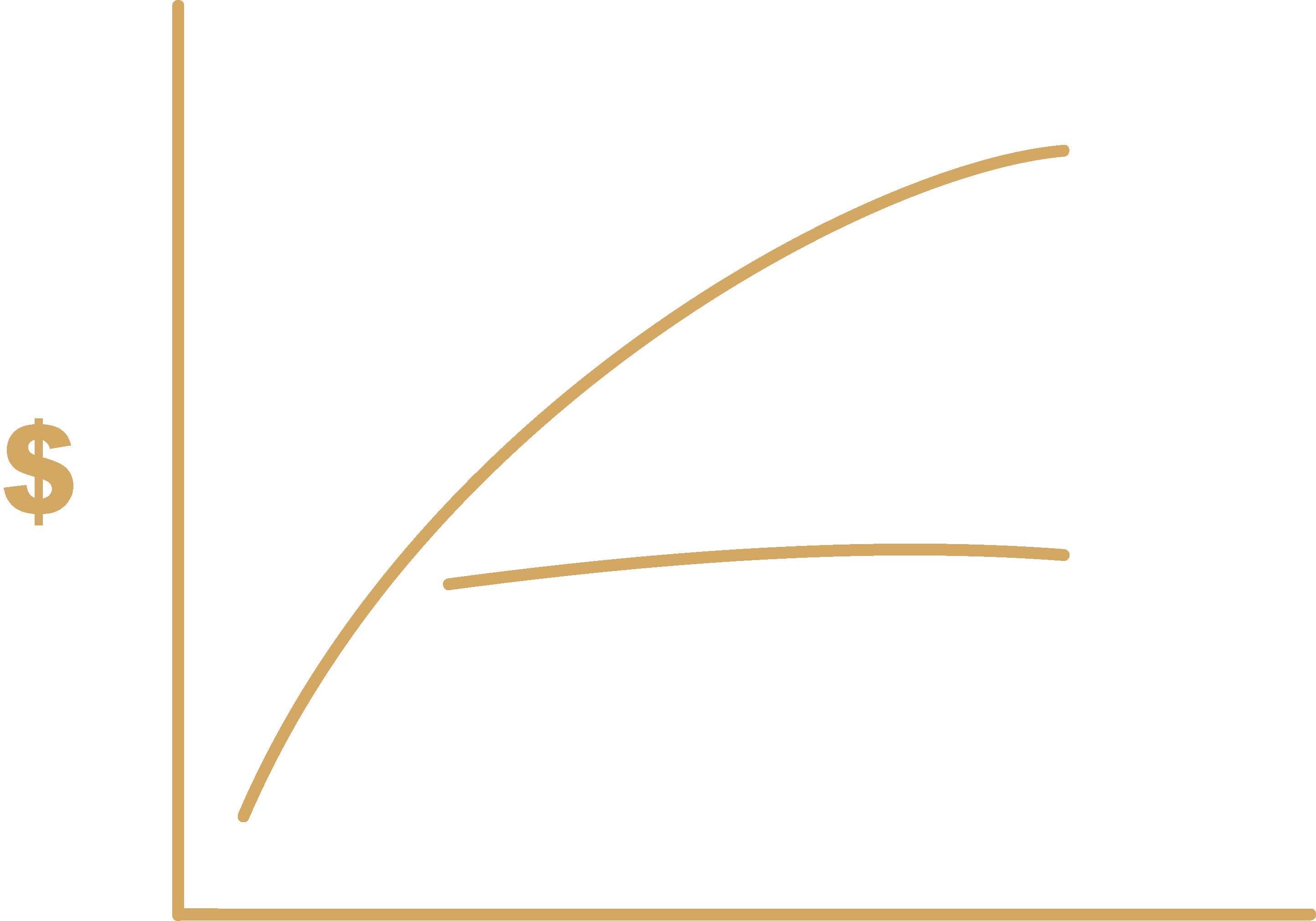

Too many pundits focus on a currency’s “relative” strength yet overlook the real question—namely its inherent purchasing power. Using the Euro and US Dollar as key examples, the decline of their purchasing power as measured against gold is not only self-evident, but

increasing.

Extreme Currency Creation Results in Extreme Currency Devaluation

The staggering level of fiat money creation and zero-to-negative interest rate policies (effectively using debt to solve a debt crisis) which emerged after the Great Financial Crisis of 2008 is now beyond dispute. The direct impact such policies have had upon declining global currencies is, again, both self-evident and deeply concerning, despite interim efforts (beginning in 2022) by the US Fed to raise rates and strengthen the USD.

These policies (along with a weaponised USD following the Ukraine War) have only encouraged the BRICS and numerous other nations to slowly but steadily de-dollarize in a global financial and currency setting increasingly marked by competing trade and currency blocks.

In the end, of course, ALL fiat currencies, throughout history, ultimately go to zero, which explains why central banks, since 2010, have been net-buyers of gold. In 2022, central banks in general, and eastern central banks in particular, bought physical gold at levels never seen before in the five decades of central bank gold reporting. The implications of this inevitable, as well as predictable, trend are beyond dispute.

Market Risk

Stocks Follow Money Printers

The correlation of rising stock prices to extreme money printing and interest rate suppression by post-08 central banks is objectively obvious.

Equally obvious is the impact subsequent rate hike policies (too much, too late, too fast) have had on credit, equity, real estate and financial markets, from Silicon Valley Bank to Credit Suisse. In short: markets follow central bank policies, and those policies are failing.

Market Volatility Ahead

Such central-bank-distorted market highs and lows ultimately lead to increased price swings and hence market volatility against which precious metals have consistently served as a reliable buffer in the past as well as present.

Bonds: No Longer a “Safe Haven”

Traditionally, sovereign and corporate bonds were perceived as a counter-force and/or safe-haven asset to offset extreme stock market volatility. Unfortunately, years of central bank rate manipulations have placed bonds at risk. They fall with, rather than protect against, falling stocks.

Credit markets across the globe have and will gyrate from gross over-valuation to sudden de-valuation, as witnessed throughout 2022-23.