Trump vs Powell. It’s On!

In pushing for rate cuts the president insults the Fed chairman — but Trump's tariffs are driving prices the other way

Federal Reserve Chairman Jerome Powell spoke Wednesday at The Economic Club in Chicago where he stated that he saw “a strong likelihood” that consumers would face higher prices and that the economy would see higher unemployment as a result of tariffs in the short run.”

Powell went on to say this could create a “challenging scenario” for the central bank because anything it does with interest rates to address inflationary pressures could worsen unemployment, and vice versa.

“It’s a difficult place for a central bank to be, in terms of what to do,” Powell said.

Powell explained that the Fed is still focused on curbing inflation. But, in the words of Ulysses Everett McGill, he’s in a tight spot. Normally, the Fed lowers interest rates when the economy weakens. However, Trump’s tariffs are already triggering inflation. Powell doesn’t want to add to that by lowering interest rates.

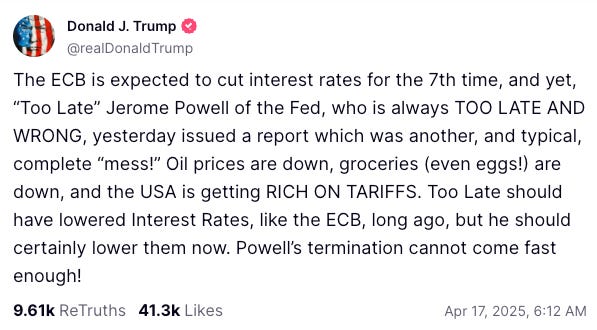

In response to these rather logical points, especially the part about not immediately lowering rates, President Trump — the once self-proclaimed “King of Debt” — exploded Thursday morning:

Trump does not have the power to fire Powell, but there are reports he’s willing to try. That wouldn’t be shocking given how Trump 2.0 has gone so far.

But given that Powell’s term runs until May 2026, my guess is Trump will do what he does best: continue the verbal assaults and make Powell’s life miserable until he can be replaced.

Like he did Monday morning by calling Powell a major loser.

This scene from Breaking Bad comes to mind:

The Fed’s record this century is awful. It should thank its lucky stars that the general public and its elected officials usually have absolutely no idea what the Fed is actually saying and doing. It also helps that nobody seems to care that many of the Fed’s bank presidents (there are 12 Federal Reserve Banks) and governors (who serve on the Federal Reserve Bank Board) trade on inside information or speak to and potentially give material non-public information to a select group of individuals.

Who holds the Fed accountable when Fed bank presidents are caught red-handed trading stocks first and then bailing out the world in 2020? It turns out it’s the Fed! The Fed’s Inspector General investigated the matter and gave little more than slaps on the wrist.

The offending Fed officials were allowed to retire except one, Raphael Bostic, who is still at his post as President of the Federal Reserve Bank of Atlanta. Some, like former Fed Governor Richard Clarida left and went on to a lucrative gig with top money manager PIMCO. When Senator Elizabeth Warren demanded in 2022 that Chairman Powell submit the matter to congressional oversight she was politely told by the Chairman that the matter was closed and to check the Fed website for the new disclosure rules the Fed will adhere to. Responding to this blatant brush-off, Senator Warren responded:

This is the largest ethics scandal in Federal Reserve history, and I’m deeply concerned that Chair Powell risks undermining confidence in the Fed if this matter is not taken more seriously. The inspector general’s inadequate investigation is no substitute for congressional oversight. The Fed needs to turn over the requested information to Congress.

The matter ended with the Fed not turning over any detailed information as well as no new congressional oversight.

The Fed’s failures are not limited to scandals, however.

It completely missed the housing fiasco in the 2000s that caused the Great Financial Crisis and, under Powell, the Fed botched its chance to control inflation in 2021. When Powell gave his bi-annual testimony before Congress in 2021, he said inflation was“transitory” and that “the incoming data are very much consistent with the view that these are factors that will wane over time and then inflation will then move down toward our goals.”

The only thing the Fed seems to be good at is using its vast powers to inject trillions of dollars of liquidity into the financial system to bail out banks from a problem the Feds often “help” the banks create. Former Fed Chairman Ben Bernanke even called the subprime mortgage crises “largely contained” as late as May 2007 when the crisis was turning into an economic tsunami.

Think of the Fed as having the world’s biggest hose and fire hydrant. It just turns it on full blast to put out a fire and worries about the ocean of water it flooded the landscape with at a later date.

The post-COVID flood cleanup is an example.

After it waited too long to hike interest rates (thus, Trump’s moniker for Powell, “Too Late”), the Fed addressed runaway inflation at a rapid pace by raising its policy rate (Fed Funds Effective Rate) from 0.25% to 5.5% a little over 1.5 years. That helped spark the Silicon Valley Bank crisis in 2023 when there was a run on the bank.

The San Francisco Federal Reserve Bank was the primary regulator for SVB and was completely asleep at the wheel as panic throughout the nation’s banking system ensued with many others in a similar situation. The FDIC had to create a “bridge bank” to protect depositors.

Some have said that San Francisco Fed President Mary Daly was too busy focusing on DEI instead of a banking crisis growing right in front of her face. Meanwhile, inflation continues to plague the nation.

Presidents have the power to appoint a Federal Reserve chairman every four years and Federal Reserve Board Governors to four-year terms. The Fed chairman must also give testimony twice a year to Congress.

That’s about all the accountability the Fed has. It perhaps has more unchecked power than all three branches of the government combined.

That can lead to a lot of political tension between presidents and the Fed during times of inflation.

President Lyndon Johnson physically pushed Fed Chairman Bill Martin into a wall to lower rates. President Richard Nixon pressured Chairman Arthur Burns to lower rates going into the 1972 election. Inflation increased in both of those cases.

While we don’t want to go back to physical altercations, there has to be some middle ground between that and what we have now.

Unfortunately, with stocks currently crashing, the U.S. Treasury market showing signs of distress, and the U.S. dollar quickly dropping, answering the question of whether this president can fire this chairman legally right now is like trying to change a tire on a car going 60 MPH down the highway. The one certain thing is the financial system is getting shakier with every verbal assault that Trump levels at Powell.

Correction: A previous version of this story had the wrong first name for the president of the Federal Reserve Bank of Atlanta. He is Raphael Bostic, not Richard.

Started as a snipe at Trump but then catalogued the Fed's crimes, misdemeanors and just plain F ups over the years. Sure the market's tanked over the tariffs. That's what the market does. But if you don't sell into the hysteria, you've lost nothing. And somebody had to inject sanity into world trade; especially bringing China to heel. If not Trump, nobody else would take that on. Certainly not the human turnip who preceded him.

So much corruption, so little time. Rand Paul and his father should be put in charge!! End the Fed. Audit the Fed.