The New Recession Narrative - Market Opportunities

Subscribe on our website www.gmgresearch.com

This week’s research:

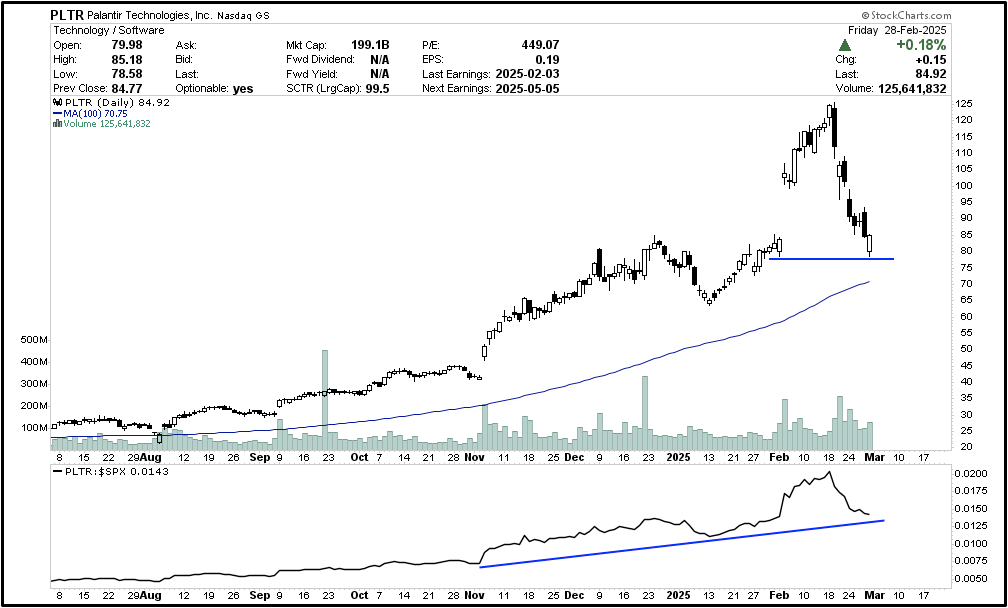

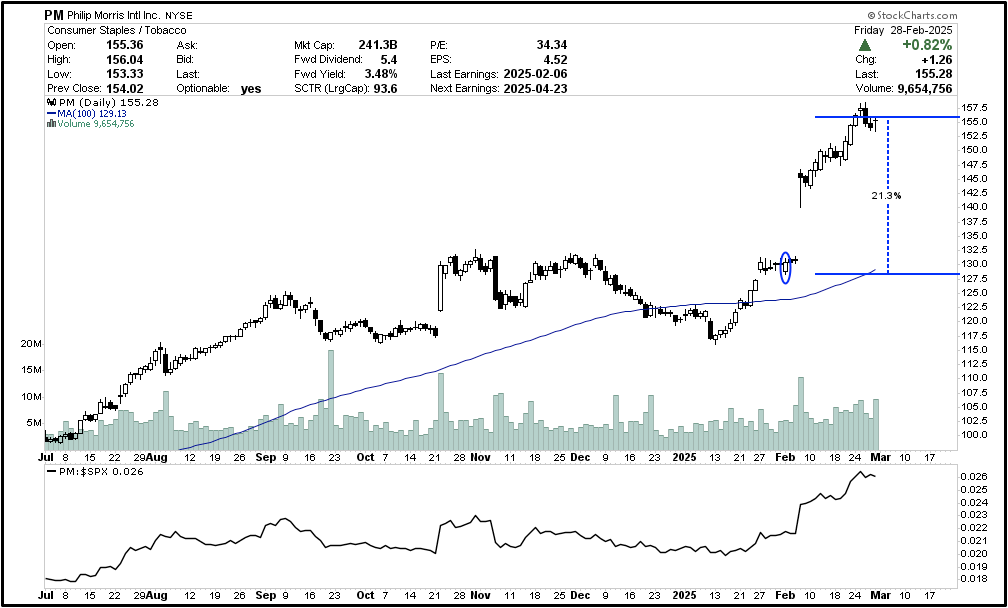

Tesla, Meta, Palantir, PM, AST Spacemobile

What to avoid: India, Small Caps

Mainland Chinese investors are buying this dip in Chinese tech big time.

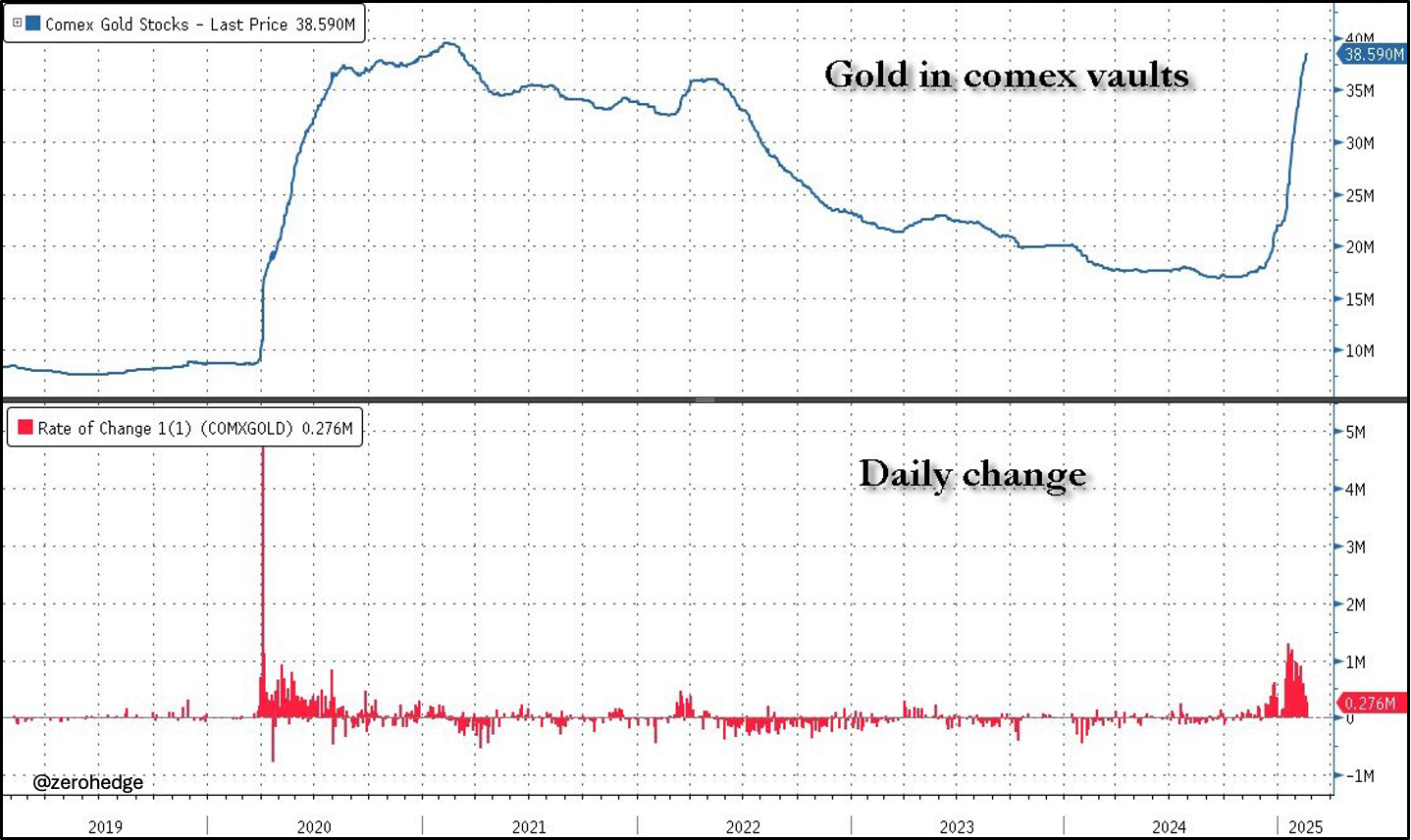

Gold is being vaulted in the US at record rates.

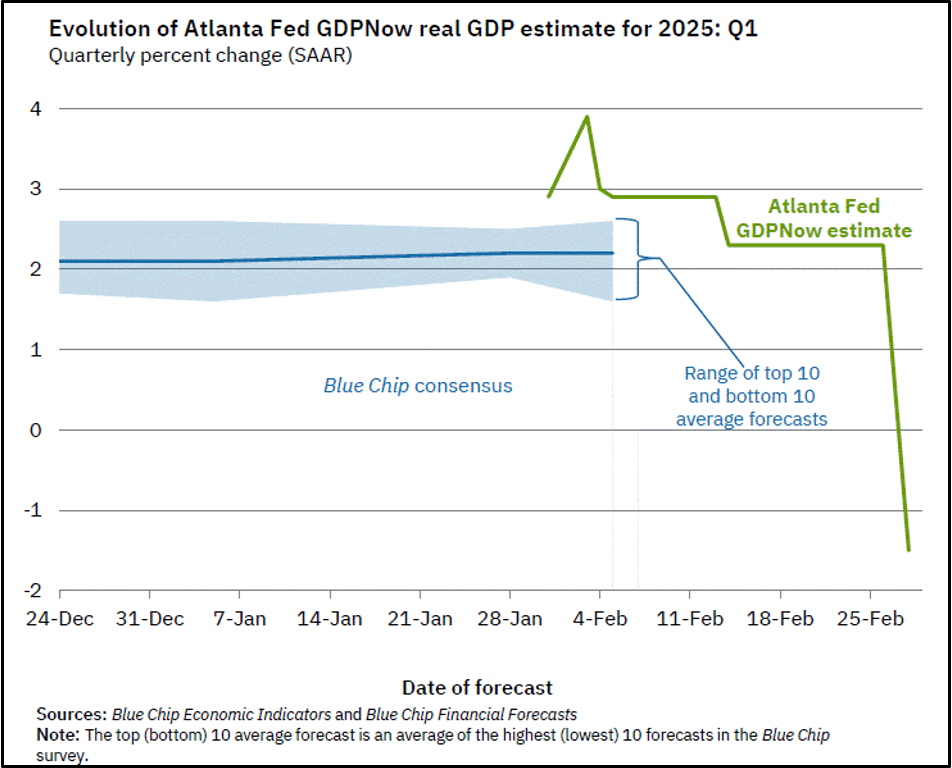

Bonds are rallying on GDP weakness

Big Story To Monitor

Media outlets will amplify the recent GDP prediction drop from 2.3% to -1.5%, signaling a contraction due to sharp government spending cuts—which is actually positive. Don’t fall into the fear. Embrace the dip as an opportunity, as it gives the Fed cover to cut rates once or twice more this year. This is why bonds have been rallying for the last two weeks.