CTA Liquidations Begin: Up To $193 Billion For Sale

This article is so good

it's for premium members only.

Does that sound like you?

PREMIUM

ONLY $30/MONTH

BILLED ANNUALLY OR $35 MONTHLY

All BASIC features, plus:

- Premium Articles: Dive into subscriber-only content, market analysis, and insights that keep you ahead of the game.

- Access to our Private X Account, The Market Ear analysis, and Newsquawk

- Ad-Free Experience: Enjoy an uninterrupted browsing experience.

PROFESSIONAL

ONLY $125/MONTH

BILLED ANNUALLY OR $150 MONTHLY

All PREMIUM features, plus:

- Research Catalog: Access to our constantly updated research database, via a private Dropbox account (including hedge fund letters, research reports and analyses from all the top Wall Street banks)

Late on Sunday we - correctly - warned that the selling was just starting, when we reported that traders on Goldman's desk had "Hit The Panic Button" warning of a "Perfect Sell Storm Of Positioning, Valuation, Breadth, Concentration And Policy." And while there were many factors involved explaining why Goldman S&T had suddenly turned very bearish, these were the three main ones:

- we are nearing S&P 500’s 50dma of 6010 which was the key level to hold going into the close / weekend.

- CTA short term momentum flips from positive to negative with S&P 500 below 6042....AKA below this level $8b of US equities for sale next week.

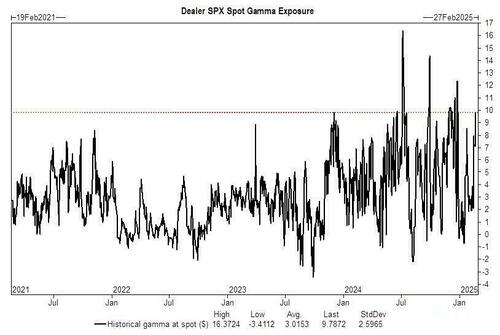

- Meanwhile, the current very high dealer gamma position - which provided a solid buffer for stocks in either direction - rolled off by ~50% after Friday’s option expiration expiry, and "the market will have the ability to move more freely next week".... by which the Goldman trader clearly means continue selling off.