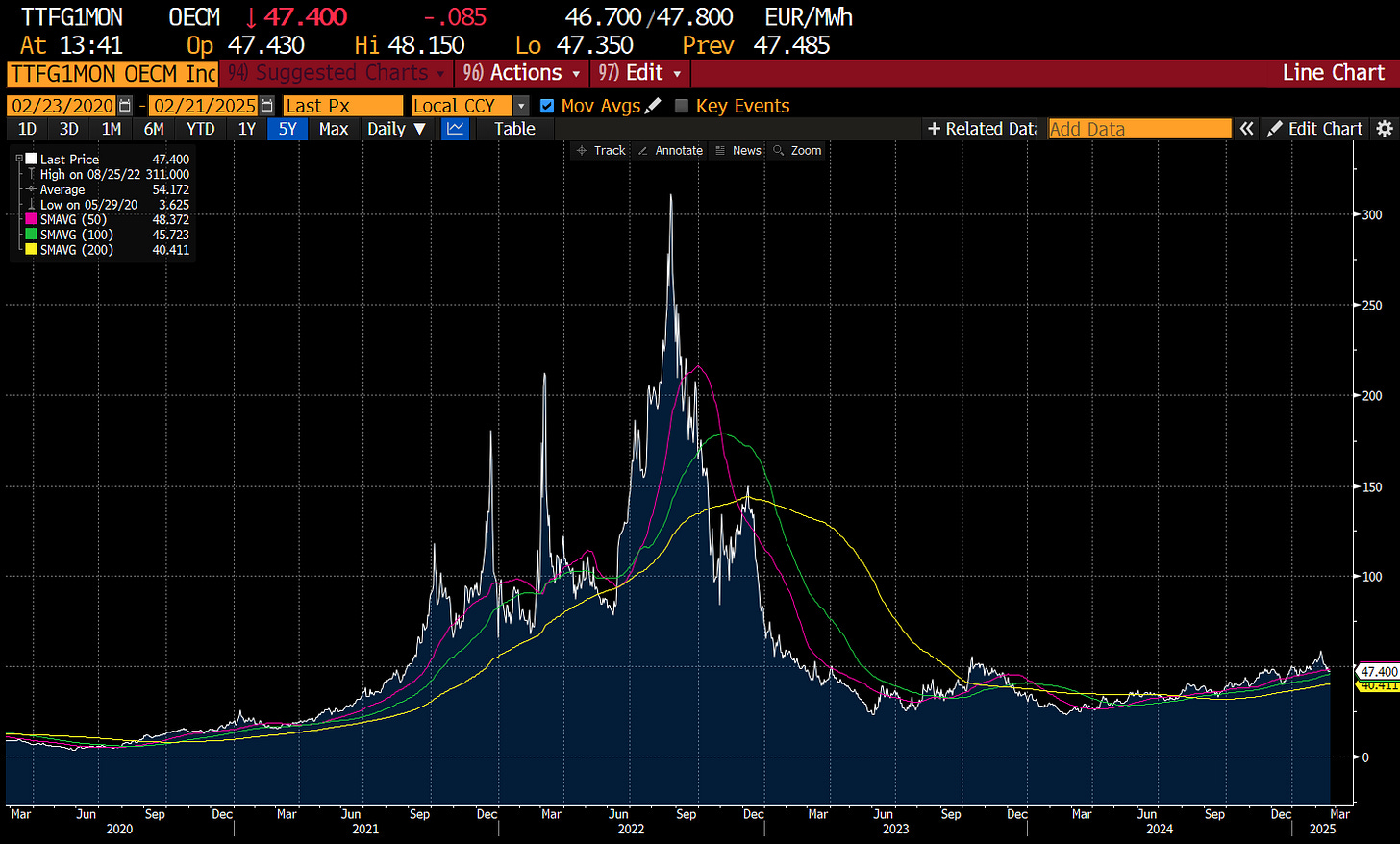

Trump has done exactly what he said he was going to do, and negotiated with Russia directly to end the war in Ukraine. The Trump deal with Russia could be very bullish for Europe, as it could see Russian sanctions lifted, and oil and gas prices fall. This would be particularly bullish for Germany, as it has suffered from high energy prices. Although far less than in 2022, European energy prices are far higher than in the US or Russia.

Likewise, increased food supply from Ukraine and Russia could be bring down food prices - which would be bullish.

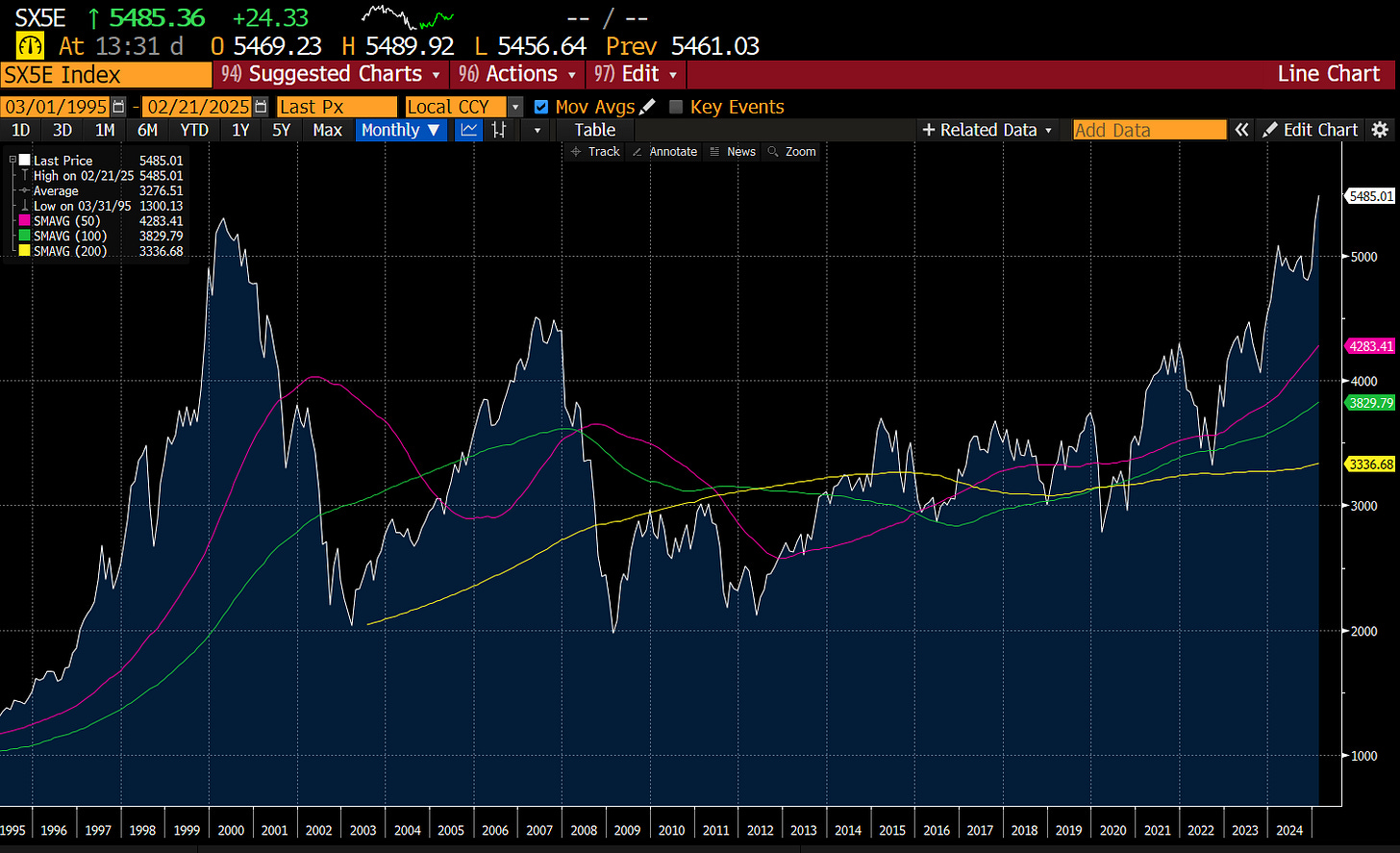

After decades of stagnation, Europe has broken out of its range, even as the Trump deal with Putin would seemingly be a negative.

It is easy to argue the opposite way. Generally speaking, when a dictator has succeeded in using force to increase their power and prestige, it is difficult for them to give up the gun, and the Baltics, like Ukraine used to be part of the Soviet Union. It is hard to find any equity weakness in this area. MSCI Baltics has ripped.

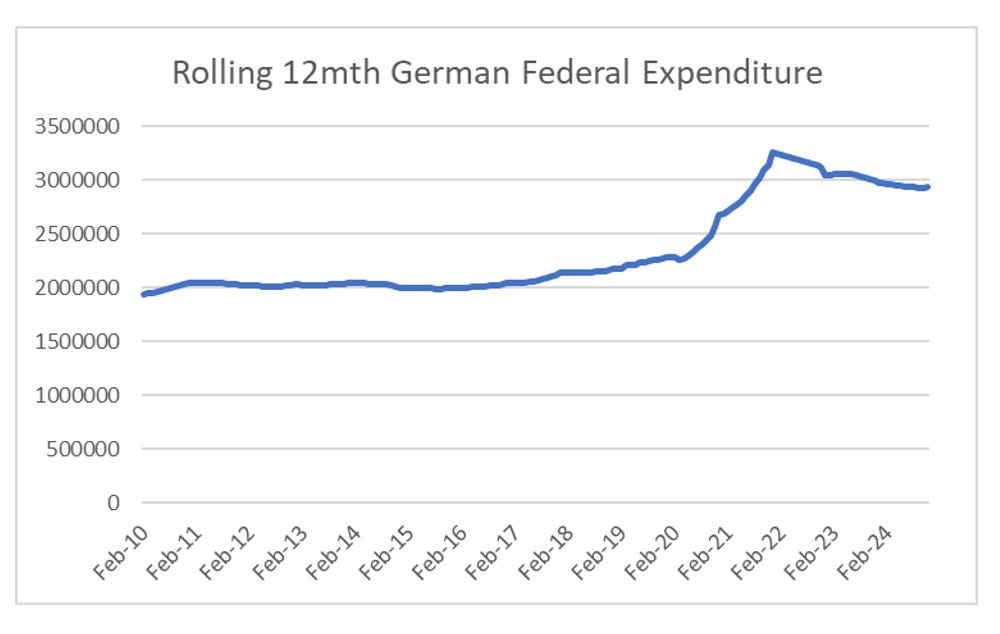

My best guess for all this bullishness would be the likelihood that the German government is going to abandon is fiscal austerity, and move to a more US style fiscal expansion - which should be good for equities and bad for bonds. That is Trump abandoning Ukraine has forced Germany to abandon austerity - and that is bullish.

The more interesting question is whether this is good for China or bad for China? On first blush, the market has decided it good. To be fair, for the Chinese tech sector we have also seen the emergence of DeepSeek and the rehabilitation of Jack Ma, and so the Hang Seng Tech index has doubled in 6 months.

On a more geo-political view, the implication is that President Trump is moving to a sphere of influence model - where Europe has to deal with Russia and its neighbours, while the US deals with its neighbours how it sees fit. The logic then is that China is free to deal with its neighbours how it sees fit too - and will not suffer consequences. In other words, China can harass and absorb Taiwan with impunity. For investors in Chinese assets this is bullish as you can now discount the risk of sanctions - which is what hurt foreign investors into Russia assets. Gazprom London listing is an example of this risk.

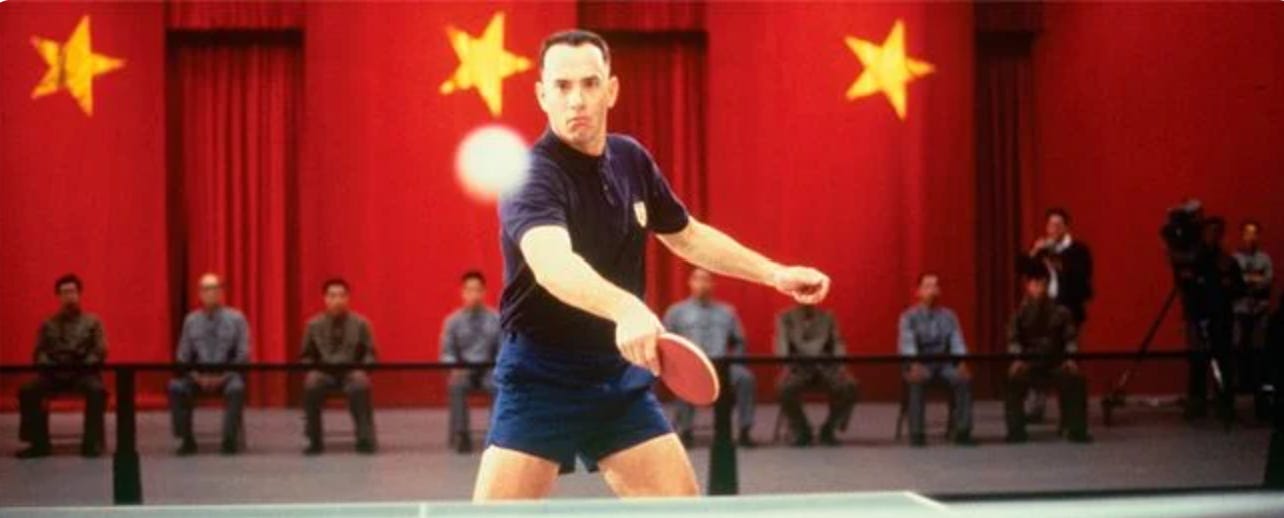

If Kissinger, who talked to Trump extensively during his first time, was still alive, then I would say this was unequivocally bad for China. “How so?” you might ask? Kissinger was instrumental in the ping pong diplomacy of the 1970s, that saw China and the US establish diplomatic relationships. For those you who learn history from popular culture (I learnt more about the royal family from “The Crown” that I ever learnt from any history class), Forrest Gump playing table tennis in China was basically seen as a way for the US to reach out to China. Kissinger was a prime mover in this. The driver of this détente was to isolate USSR- and from a economic point of view, betting on China versus Russia from this point of time made you a sure fire winner.

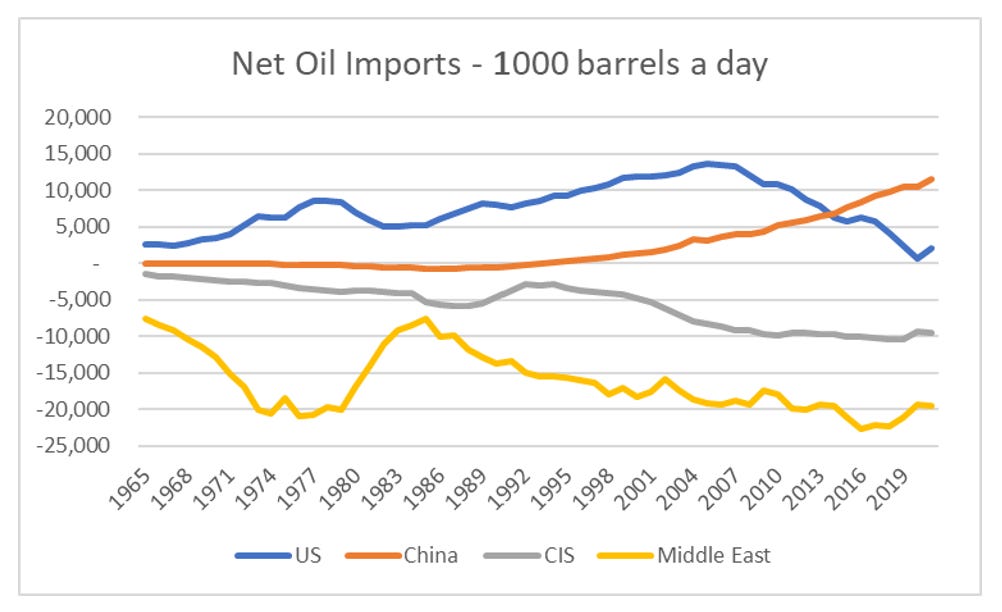

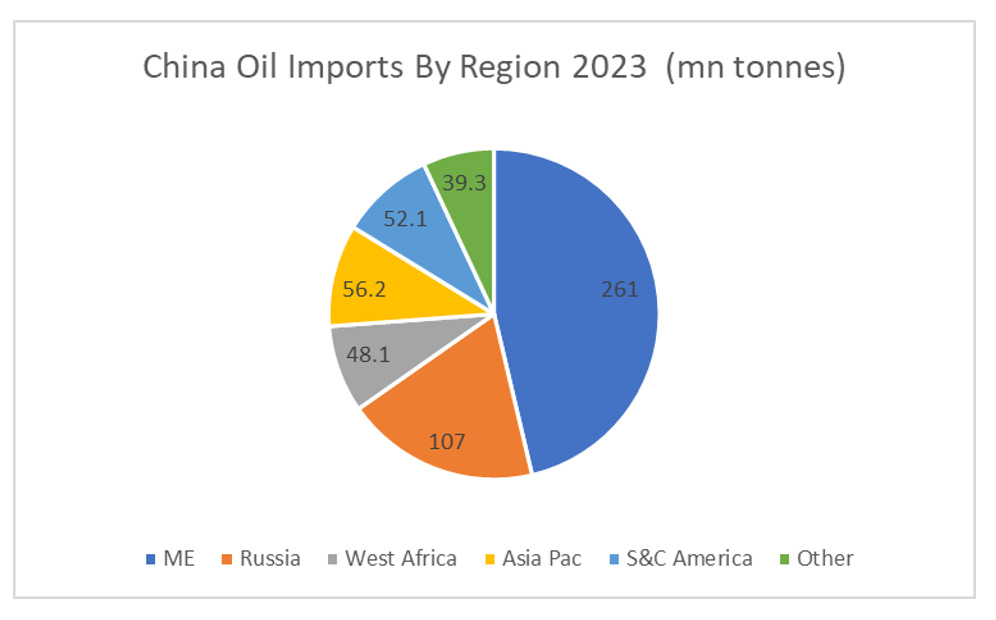

First of all there are two things to remember - China and Russia will always be important nations, by dint of the their population and land mass respectively. When they are aligned, they are very difficult to defeat, as we have seen in Ukraine, where Chinese technology has kept Russia in the game. But China and Russia are not natural allies - for most of their history they have faced off against each other. Hard to believe now, but the Soviet Union was not even that supportive of the Chinese Communist Party in its civil war for control of China, at least until the end of the Second World War. Prior to this, China/Russian relations has been defined by battle for control of the far east. If the US can bring Russia into the fold, then China become extremely exposed on oil imports, just at the US was in the 1970s.

China like the US in the 1970s is now heavily reliant on the Middle East for its oil. Bringing Russia into the fold would make energy a choke point for the Chinese economy.

Kissinger is no longer with us - so I don’t know if this is part of the plan. But Trump has always signalled that China is the true enemy of the US, not Russia. And a secure Russia would probably go along with a strategy that weakened China, if only to prove the importance of Russia to both the US and China. The thing is Kissinger had a clear aim of avoiding an open clash between the USSR and USA. Trumps aims tend to be less clear, at least to me. If it is the Kissinger line of thinking, then the current rally in Chinese tech is clear trap. But if we are moving to sphere of influence, and deal with China, then perhaps they are a buy. I find geo-politics difficult to read - but all I know is that government spending is going to go up globally - and that is bad for bonds. Japanese bonds continue to be weak.

Politics is a funny thing I have found. It is not always clear how politicians are going to behave - which I why I suspect voters loved the move to free markets in the 1980s and 1990s - it was a move away from domineering politicians. Having fallen out of love with free markets - we are moving back to domineering politicians. Markets think a deal with Russia is bad for oil prices and good for China - but I could see the reverse being true.

I think we're talking about two interrelated things here

1) The Nixon shock of 1971 - this effectively established free capital flows and floating exchange rates as the norm, with US Treasuries supplanting Gold as the main reserve asset

2) The Kissinger shock 1972 - with Nixon in China, shifting recognition from the ROC to PRC and favoring China over the Soviet Union

With 1) this allowed fund managers like Quantum (Soros) to profit immensely, and also imposed discipline on governments that didn't want to play along with market-oriented principles. It also eventually led to the problem in US politics we have today: the US dollar has to be structurally overvalued, hurting the Industrial Midwest while benefiting Wall St and the Tech Moguls of both Coasts.

With 2) it was a geopolitical masterpiece, coupled with the oil price crash in 1985 it led to the disintegration of the Soviet Union.

I don't think Trump in Moscow will be like Nixon in China, modern Russia is a lot less powerful than the former Soviet Union, and Putin (or his successor) knows that Trump can turn on a dime, he can't commit past 2028 anyway.

The bigger fear that all fund managers should have, is if the current series of trade wars and politics turns into an anti-Nixon shock moment. If we return to a world of capital controls and tariffs, this would be very bad for asset prices globally, especially in the US. And so much of the modern financial industry: not just in the US, but even in Australia, Hong Kong, Singapore etc... depends on having elevated asset prices. Even the HK government budget is struggling because land sale revenue is weak.

I have got into this argument with some people many times: there are many new 'Global South' commentators like Kishore Mahbubani who seem to relish the idea of US decline and neo-isolationism. I can understand where they are coming from politically, but I urge them and other Chinese or Russian sympathizers to think more rationally: where would the Singapore, Hong Kong, Dubai or London economy be if the S&P 500 crashed by 70%? Sure Gold would trade well in such a scenario, but the revenues from being a gold trading hub pale in comparison to the land sale revenue, equity derivatives and other assorted industries that are a mainstay of global finance.

If 2025 indeed becomes and anti-1971, the post-Industrial Midwest like Ohio, Pennsylvania and Illinois would be the place to be, not Singapore, Hong Kong or London.

Theoretically I do think rust best areas look more interesting. I am pretty sure house prices in Newcastle have done better than London in recent years.

The more interesting question is if the US dollar does decline - this would open the door for China to open up its capital account, and truly take on the free trade mantle that the US has thrown off. For now, I still think we head for a capital scarce future as the world is remade

Interesting you mention house prices in the North of England vs London

Contrary to popular perception, London housing prices have actually been pretty flat in real terms since 2015.

Can you really say that London property, is a safe store of value anymore?

Japan's inflation is getting pretty bad - I wouldn't be surprised to see 2% on the 10Y JGB before year's end.

In the "old days" - I would be running long yen, long treasuries and short everything at 10 yr JGBS at 2% - but those days are gone I think...

Thanks for this - much food for thought. In terms of the conclusion on politicians being more 'in the room' now, 'm reminded of the old line attributed to Churchill: "Americans Will Always Do the Right Thing — After Exhausting All the Alternatives". The Bull Market of the 80s onwards was obviously partly due to interest rates peaking due to Volcker, but I like your free market suggestion as another contributor. So I fear that politicians getting involved again will be a Net negative for the markets.

I suspect it will be like the 70s... brutal bear market in real terms, but ok in nominal terms

Thanks for another great note, Russell. What do you think the forcing function is for higher energy prices stemming from a U.S./Russia detente?

Great article, Mr Clark- you got straight to the important issues and provided credible answers as to why markets are behaving this way, too!