This Is What Hedge Funds Are Doing After A Brutal Rollercoaster Week: Goldman PB

This article is so good

it's for premium members only.

Does that sound like you?

PREMIUM

ONLY $30/MONTH

BILLED ANNUALLY OR $35 MONTHLY

All BASIC features, plus:

- Premium Articles: Dive into subscriber-only content, market analysis, and insights that keep you ahead of the game.

- Access to our Private X Account, The Market Ear analysis, and Newsquawk

- Ad-Free Experience: Enjoy an uninterrupted browsing experience.

PROFESSIONAL

ONLY $125/MONTH

BILLED ANNUALLY OR $150 MONTHLY

All PREMIUM features, plus:

- Research Catalog: Access to our constantly updated research database, via a private Dropbox account (including hedge fund letters, research reports and analyses from all the top Wall Street banks)

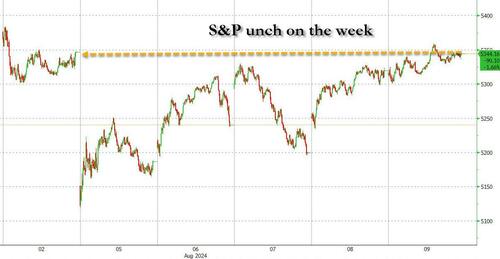

After a rollercoster week for markets, the S&P ended the week.... unchanged, even though investors experienced one of the highest velocity weeks across global risk assets in years amid a multitude of macro and technical cross-currents, stop outs, margin calls, and P&L swings.

Broken down by factor, GLP-1 Exposed, Secular Growth, and China ADRs outperformed on the week, while Renewables, Regional Banks, and Housing Exposed were among the themes that logged the most losses.