Rollercoaster Divergence: "Long-Onlies" And CTAs Liquidate As Hedge Funds Buy The Dip

This article is so good

it's for premium members only.

Does that sound like you?

PREMIUM

ONLY $30/MONTH

BILLED ANNUALLY OR $35 MONTHLY

All BASIC features, plus:

- Premium Articles: Dive into subscriber-only content, market analysis, and insights that keep you ahead of the game.

- Access to our Private X Account, The Market Ear analysis, and Newsquawk

- Ad-Free Experience: Enjoy an uninterrupted browsing experience.

PROFESSIONAL

ONLY $125/MONTH

BILLED ANNUALLY OR $150 MONTHLY

All PREMIUM features, plus:

- Research Catalog: Access to our constantly updated research database, via a private Dropbox account (including hedge fund letters, research reports and analyses from all the top Wall Street banks)

It was one of the most brutal weeks for consensus trades and the most widely held individual stocks, while at the index level US equities struggled this week as the market grappled with continued positioning adjustments and mixed/underwhelming megacap tech earnings – R2K outperformed SPX & NDX for a 3rd straight week. Regional Banks, Housing Exposed, and Most Short outperformed on the week, while Bitcoin Sensitive Equities, Megacap Tech, and AI Enablers were among the laggards.

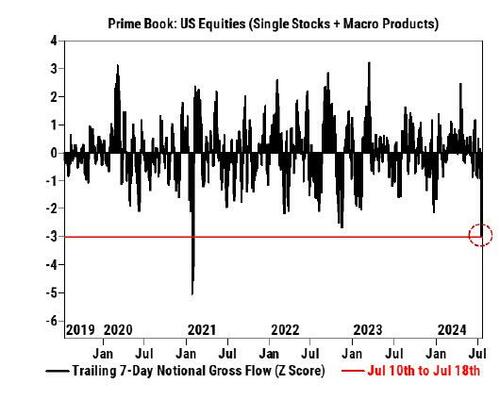

Not surprisingly, one week after we observed the largest hedge fund de-grossing since the Jan 2021 meme stock craze...