According to ATTOM’s Q1 2024 U.S. Residential Property Mortgage Origination Report, a total of 1.28 million mortgages secured by residential properties (comprising 1 to 4 units) were issued in the United States during the first quarter, reflecting a 6.8 percent decrease from the previous quarter. This decline represents the 11th in the last 12 quarters, reaching the lowest level since 2000.

ATTOM’s latest analysis found that the recent decline resulted in total residential lending activity being 4.8 percent lower than a year ago and 69.3 percent below the peak reached in 2021. This occurred during a period of rising mortgage interest rates and high home prices, which remain unaffordable for many American households, compounded by a low supply of homes for sale.

The newly released Q1 2024 mortgage origination report also found that the ongoing decline in lending activity during the first quarter was driven by losses across all major categories of residential lending. Purchase-loan activity fell by an additional 9.9 percent quarterly, to approximately 565,000 loans. Refinance deals decreased by 1.9 percent, to 491,000, while home-equity credit lines dropped by 9 percent, to 222,000.

Also according to the report, in monetary terms, lenders issued $405.6 billion worth of residential mortgages in the first quarter of 2024. This represents a decrease of 4.8 percent from the fourth quarter of 2023 and a 4.5 percent decline from the first quarter of the previous year.

ATTOM’s first-quarter mortgage origination analysis reported that for homes purchased with financing in the first quarter of 2024, the median loan amount rose to $329,800. This marks a 7.4 percent increase from $307,000 in the previous quarter and a 7.2 percent increase from $307,722 a year earlier. This quarterly rise is the largest since the second quarter of 2021.

The report stated that in the first quarter of 2024, the median down payment on single-family homes purchased with financing was $26,700. This represents a 20.9 percent decrease from $33,750 in the fourth quarter of 2023 and a 3.1 percent decline from the previous year.

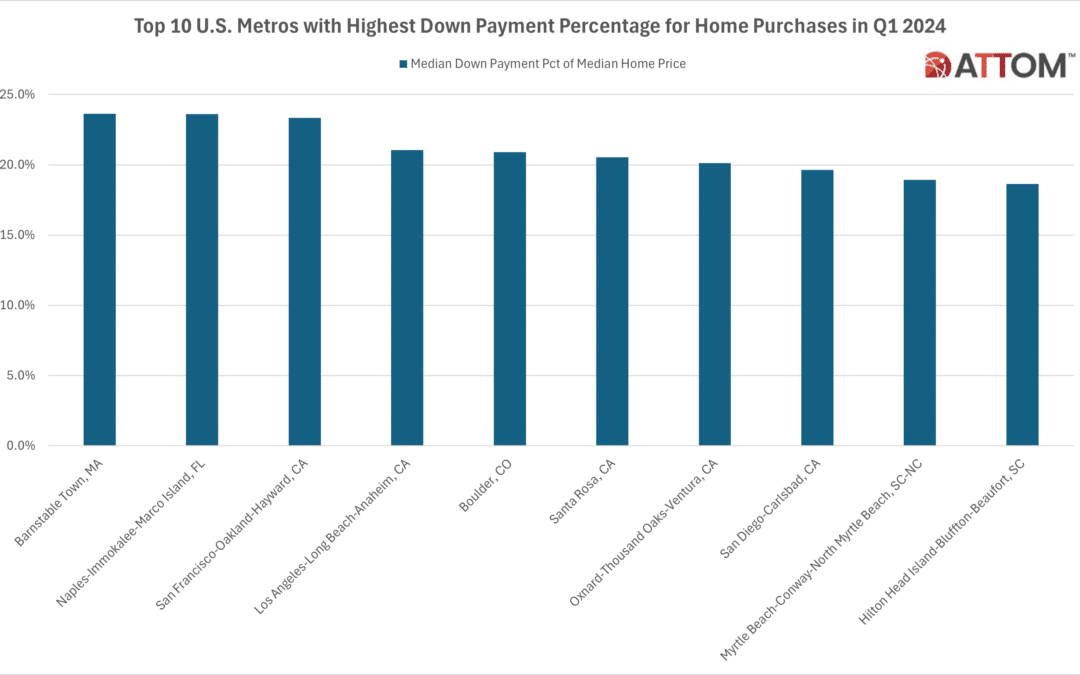

In this post, we take a deep dive into the data behind the latest ATTOM mortgage origination report to uncover the top 10 U.S. metros with the highest median down payment percentage for home purchases in Q1 2024.

Those metros include: Barnstable Town, MA (23.6 median down payment percent of median home price); Naples-Immokalee-Marco Island, FL (23.6 percent); San Francisco-Oakland-Hayward, CA (23.3 percent); Los Angeles-Long Beach-Anaheim, CA (21.1 percent); Boulder, CO (20.9 percent); Santa Rosa, CA (20.5 percent); Oxnard-Thousand Oaks-Ventura, CA (20.1 percent); San Diego-Carlsbad, CA (19.6 percent); Myrtle Beach-Conway-North Myrtle Beach, SC-NC (18.9 percent); and Hilton Head Island-Bluffton-Beaufort, SC (18.6 percent).

Want to learn more about mortgage origination trends in your area? Contact us to find out how!