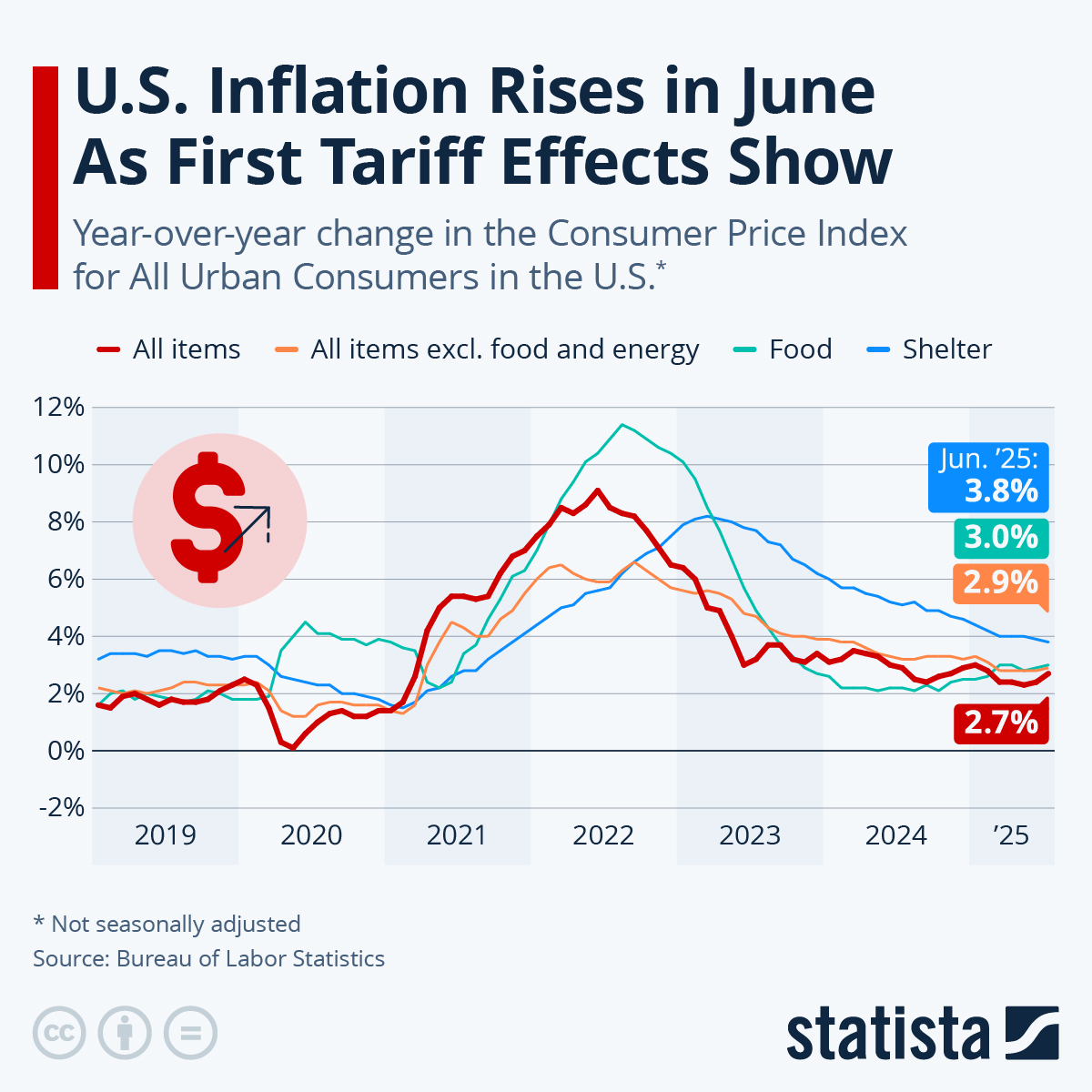

Consumer prices in the U.S. ticked up more modestly than expected in May, as both headline inflation and the core index excluding more volatile food and energy prices didn't show signs of a widely-feared tariff bump. According to data published by the Bureau of Labor Statistics on Wednesday, the Consumer Price Index for All Urban Consumers (CPI-U) increased 2.4 percent over the last 12 months before seasonal adjustment, a slight acceleration from 2.3 percent in April, but level with the 2.4 percent reading from March. The core index remained flat at 2.8 percent for the third consecutive month after dropping below 3 percent for the first time since early 2021 in March. On a monthly basis, consumer prices increased 0.1 percent in May, which is a deceleration from an 0.2-percent increase in April.

Aside from gasoline prices, which dropped 12 percent year-over-year and 2.6 percent on a monthly basis in May, new vehicles and apparel were among the categories that saw prices decline in May, indicating that the costs of new tariffs have yet to pass through to consumers. The shelter price index increased 3.6 percent year-over-year in May, marking the slowest increase since November 2021. Due to its weight in the Consumer Price Index - shelter is by far the largest expenditure category in the virtual goods basket - housing costs have been a major contributor to inflation over the past year. Excluding the impact of shelter, inflation would been at or below the Fed's target level of 2 percent in 20 of the past 24 months, illustrating that housing costs have been the most stubborn driver of elevated inflation lately.

In a reaction to the latest CPI report, President Donald Trump repeated his call for more rate cuts, urging the Fed to cut its policy rate by a full percentage point in a social media post. According to the CME FedWatch Tool, market's are seeing no imminent rate cuts, pricing in a zero-percent probability for such a move at the upcoming FOMC meeting next week. Looking ahead further, there's a 19-percent probability of a 25 basis point cut next month, but virtually no chance of a cut of the magnitude suggested by Trump happening anytime this year.