Gold prices: beyond inflation and real yields

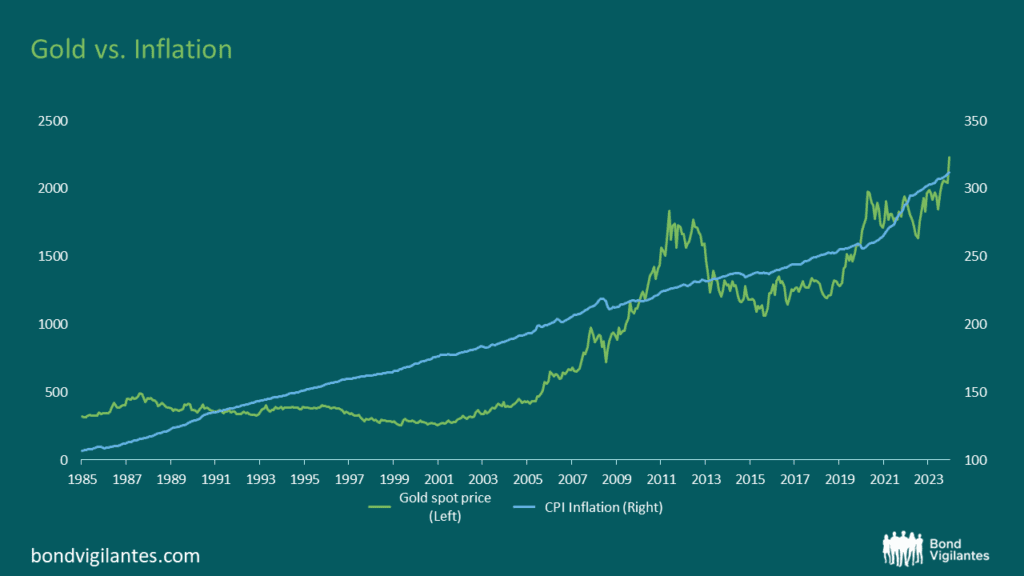

Renowned for its role as a hedge against economic uncertainty and inflation, gold has long captivated investors. One key factor influencing gold’s price is the relationship between real yields and inflation. Over the long term, gold has protected one against the pernicious effects of inflation and remains a powerful diversifier within an investment portfolio:

Source: M&G, Bloomberg, 23 April 2024

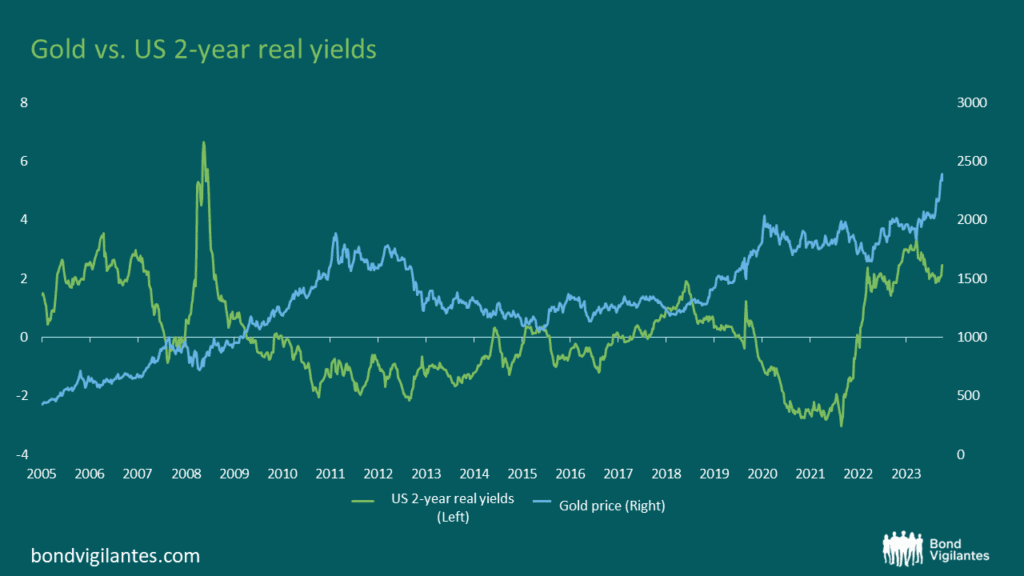

Real yields, also known as inflation-adjusted yields, represent the return on an investment after accounting for inflation. They are calculated by subtracting the inflation rate from the nominal yield of a financial instrument, such as a government bond. Real yields provide a more accurate measure of an investor’s purchasing power and the true return on their investment. Historically, gold prices have exhibited an inverse correlation with real yields. When real yields are low or negative, indicating that inflation-adjusted returns on fixed-income investments are meagre or eroded by inflation, investors seek alternative stores of value, such as gold. Conversely, when real yields are high, offering attractive returns relative to inflation, the opportunity cost of holding gold increases, leading to downward pressure on the gold price.

The below chart demonstrates this general trend:

Source: M&G, Bloomberg, 23 April 2024

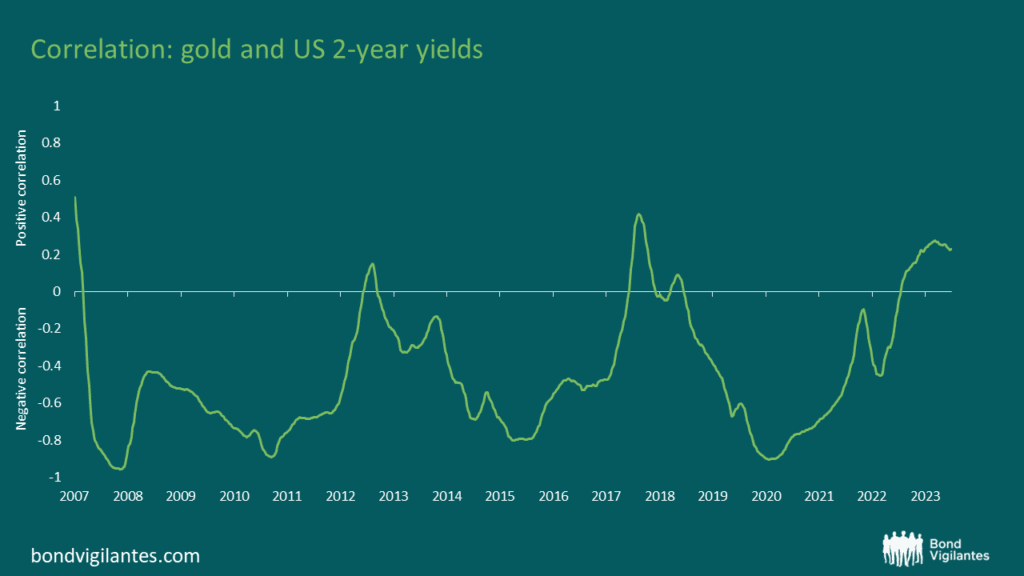

While the trend is not perfect, the following chart demonstrates that correlations have been negative for the bulk of the time:

Source: M&G, Bloomberg, 23 April 2024

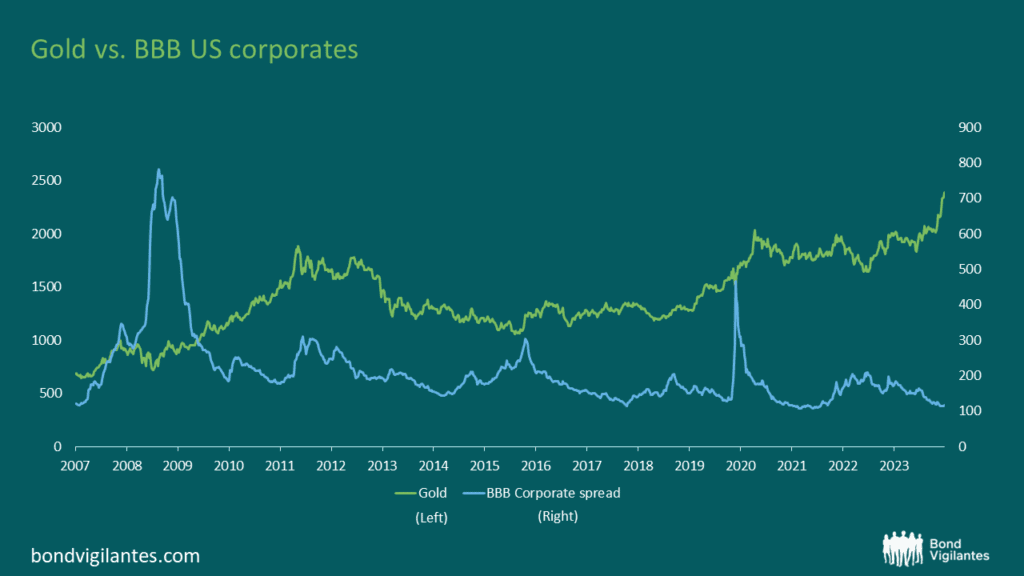

So why is gold going up? If these correlations hold and real yields are moving higher, the gold price should be trending lower. There is something else at play. Investors will generally point to global instability, with geopolitical concerns being obvious. The other would be the challenging fiscal backdrop of many major economies, which I have written about. These concerns are well founded; however, they do not seem to be showing up in other risk assets.

BBB US corporates are trading at their all-time tights, so there is nothing to see here:

Source: M&G, Bloomberg, 23 April 2024

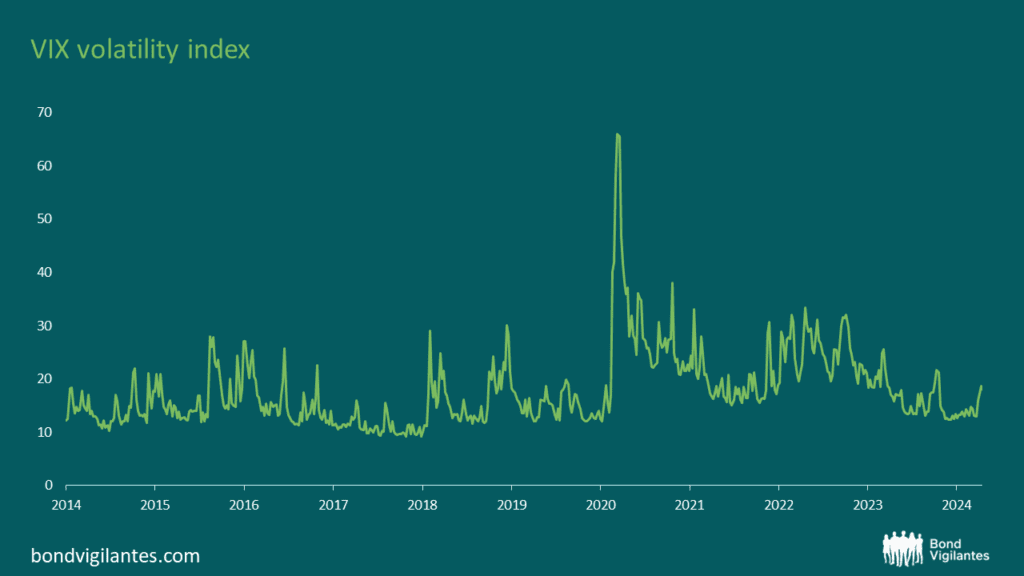

Volatility is not exploding, as shown by the volatility index VIX:

Source: M&G, Bloomberg, 23 April 2024

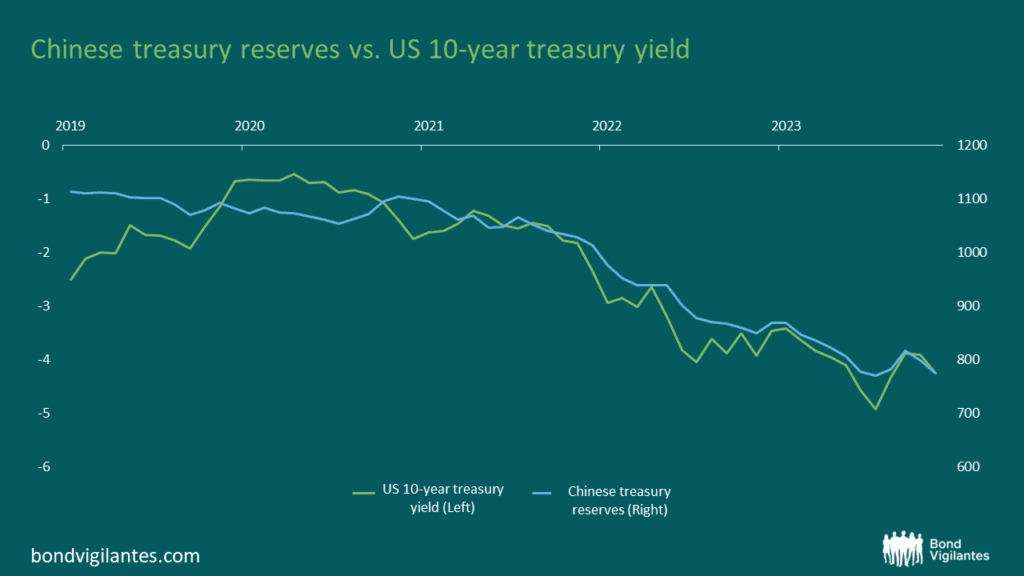

A quick look at China shows some interesting developments. We know why interest rates have gone up: to combat inflation. However, yields may still be pressured higher due to countries selling down their treasury reserves. China, for example, has been reducing its treasury reserves for some years. This is not the sole reason for higher yields but will be a contributory factor. The below chart shows Chinese treasury reserves falling plotted against the 10-year treasury yield (inverted):

Source: M&G, Bloomberg, 23 April 2024

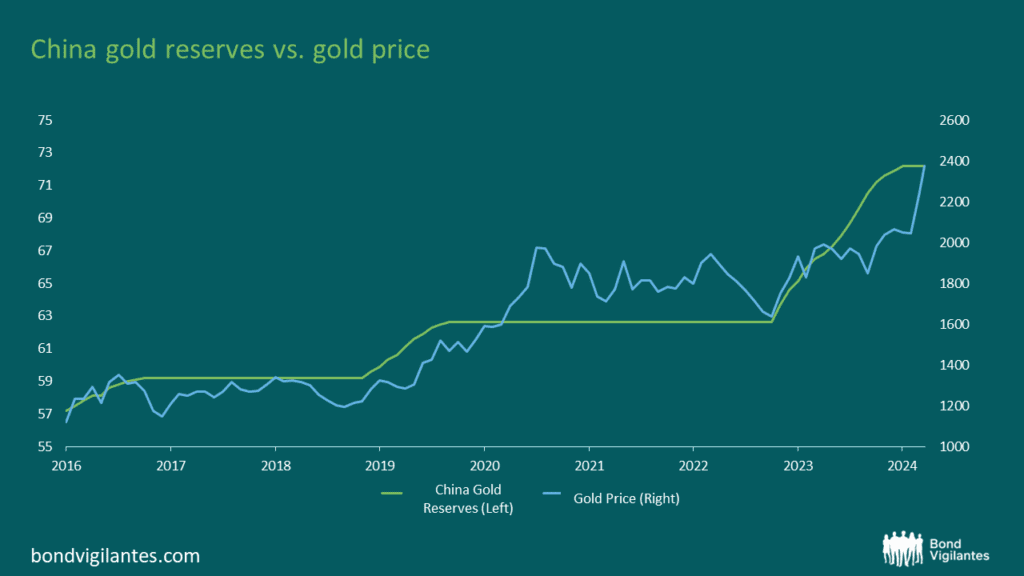

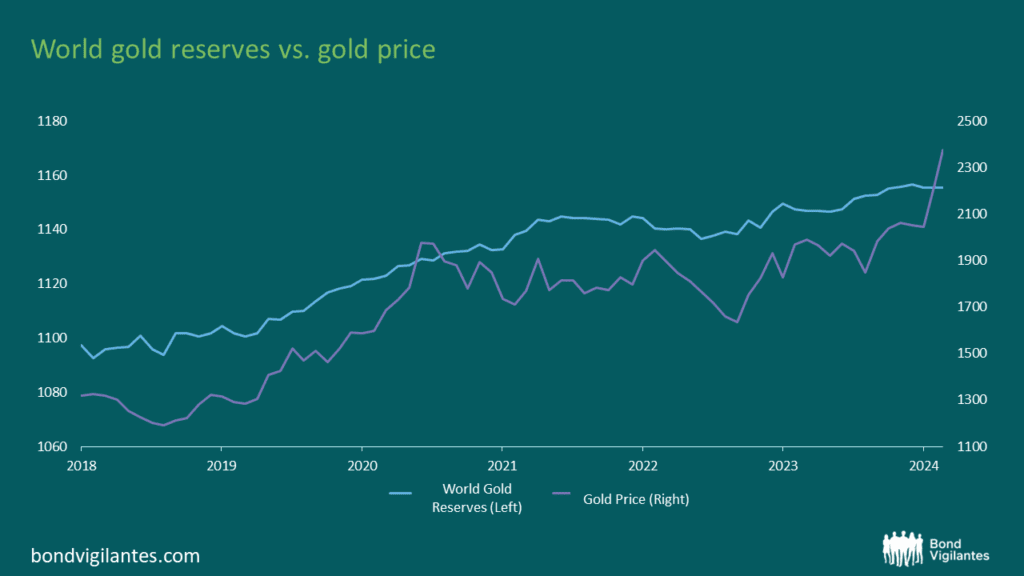

Where are these funds going? Bolstering gold reserves it would seem, and China is not alone in this thinking:

Source: M&G, Bloomberg, 23 April 2024

Source: M&G, Bloomberg, 23 April 2024

We have witnessed many responses with the onset of the war in Ukraine, one of which is sanctions. The sanctions have attempted to lock out a country from its reserves. The West’s freezing of Russia’s gold and forex reserves in response to the conflict appears to have triggered this shift. More recently, there have been threats to confiscate Russian reserves and use these funds to support Ukraine’s efforts. This will undoubtedly make other countries somewhat nervous, especially those not 100% aligned with the West’s worldview. Clearly, the Gold price is influenced by a multitude of factors, and one cannot point to any one single issue. However, it doesn’t seem as though gold is currently being bought for its safe-haven appeal at this stage. Where would the gold price be if the Fed starts cutting and the geopolitics worsen?

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.