Markets

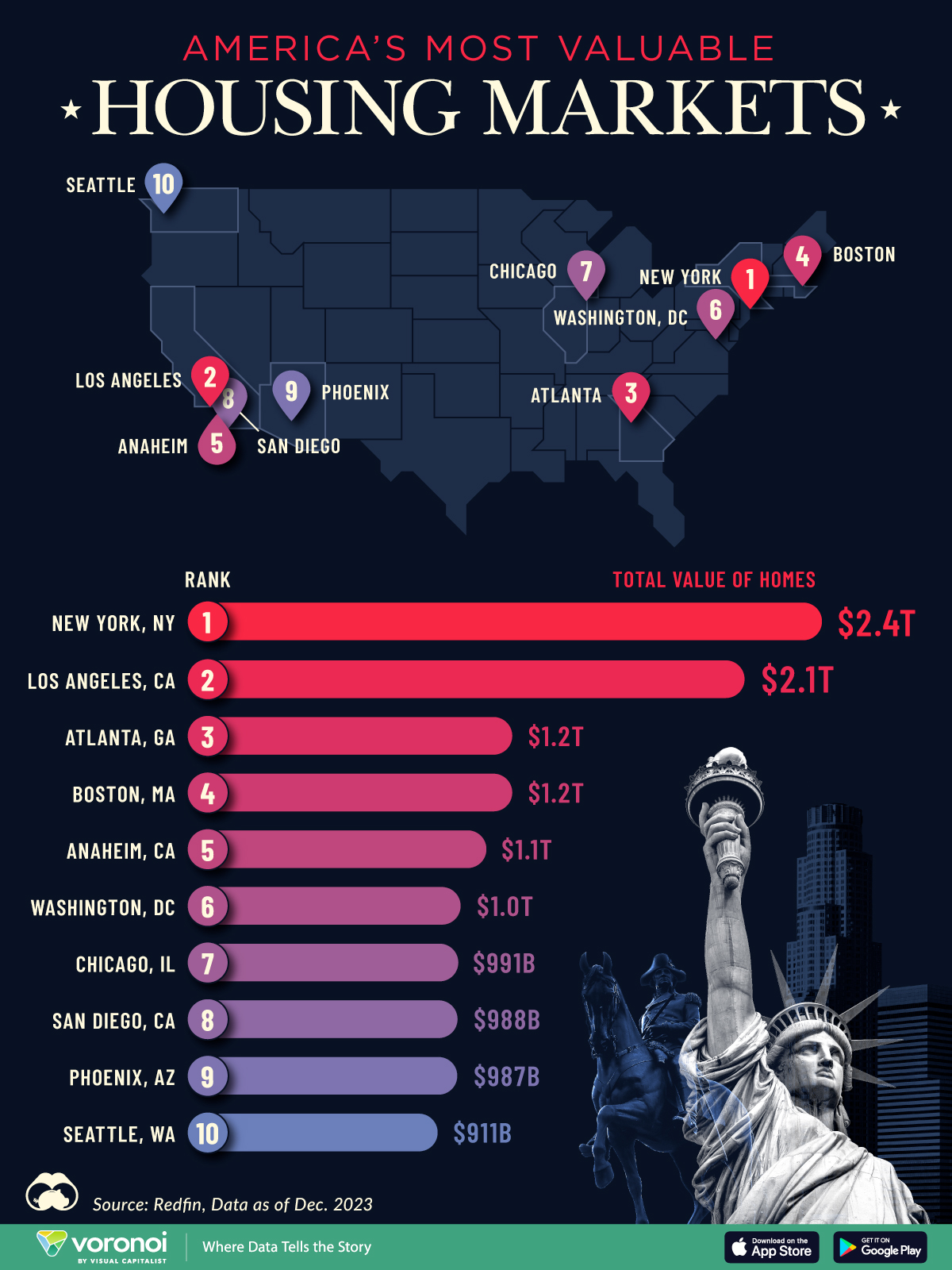

Ranked: The Most Valuable Housing Markets in America

![]() See this visualization first on the Voronoi app.

See this visualization first on the Voronoi app.

The Most Valuable Housing Markets in America

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

The residential real estate market in the U.S. stands as one of the largest asset classes in the country, worth $47.5 trillion in 2023.

Despite a slowdown in home sales, the total value of homes increased $2.4 trillion last year as low inventory levels pushed up prices. Affordable metropolitan areas saw steady price growth, while expensive metros experienced slower price appreciation.

This graphic shows America’s most valuable housing markets, using data from Redfin.

Top U.S. Residential Real Estate Markets

To calculate the largest U.S. housing markets, Redfin analyzed 90 million properties covering single-family homes, townhouses, condos, and two-to four-unit multifamily properties.

Below, we show the most valuable residential markets as of December 2023:

| Rank | U.S. Metro | Total Value of Homes | Total Value of Homes YoY Change |

|---|---|---|---|

| 1 | New York, NY | $2.4T | -1.0% |

| 2 | Los Angeles, CA | $2.1T | +4.3% |

| 3 | Atlanta, GA | $1.2T | +6.2% |

| 4 | Boston, MA | $1.2T | +8.3% |

| 5 | Anaheim, CA | $1.1T | +8.0% |

| 6 | Washington, DC | $1.0T | +6.2% |

| 7 | Chicago, IL | $991B | +7.4% |

| 8 | San Diego, CA | $988B | +9.4% |

| 9 | Phoenix, AZ | $987B | +4.2% |

| 10 | Seattle, WA | $911B | +4.6% |

With a housing market worth $2.4 trillion, New York, NY tops the list.

Unlike the majority of large U.S. cities, the aggregate value of homes declined as buyers became increasingly priced out of the market. At the same time, homeowners hesitated to sell in order to lock in low mortgage rates. In fact, more than 80% of mortgage holders in New York City have interest rates that are 5% or lower.

Los Angeles, CA falls in second, with a residential real estate market worth $2.0 trillion. Last year, existing home sales tumbled 24.8%, falling to the lowest point since 2007. However, the housing shortage led prices to increase amid high demand. The median sale price climbed to $975,000 in February 2024, a 5.9% jump compared to the same time last year.

Atlanta, GA ranks third and is the most overpriced housing market in the country according to one countrywide analysis. Homes have been selling for 41.7% more than their worth as of the February 2024 data update.

People are flocking to the city for many reasons. General housing affordability is a major driver, along with its thriving tech center. Along with this, state tax credits have increasingly made it a hub for the TV and film industries, earning it the moniker “Y’allywood”. Another factor in Atlanta’s inflating housing market are large investment firms, which own a huge footprint of homes in the city.

Editor’s note: For those wondering about the Bay Area, the data groups cities like San Francisco ($657 billion), San Jose ($821 billion), and Oakland ($881 billion) as individual entities, which puts them outside the cutoff. See the Redfin data for the full list of cities.

Markets

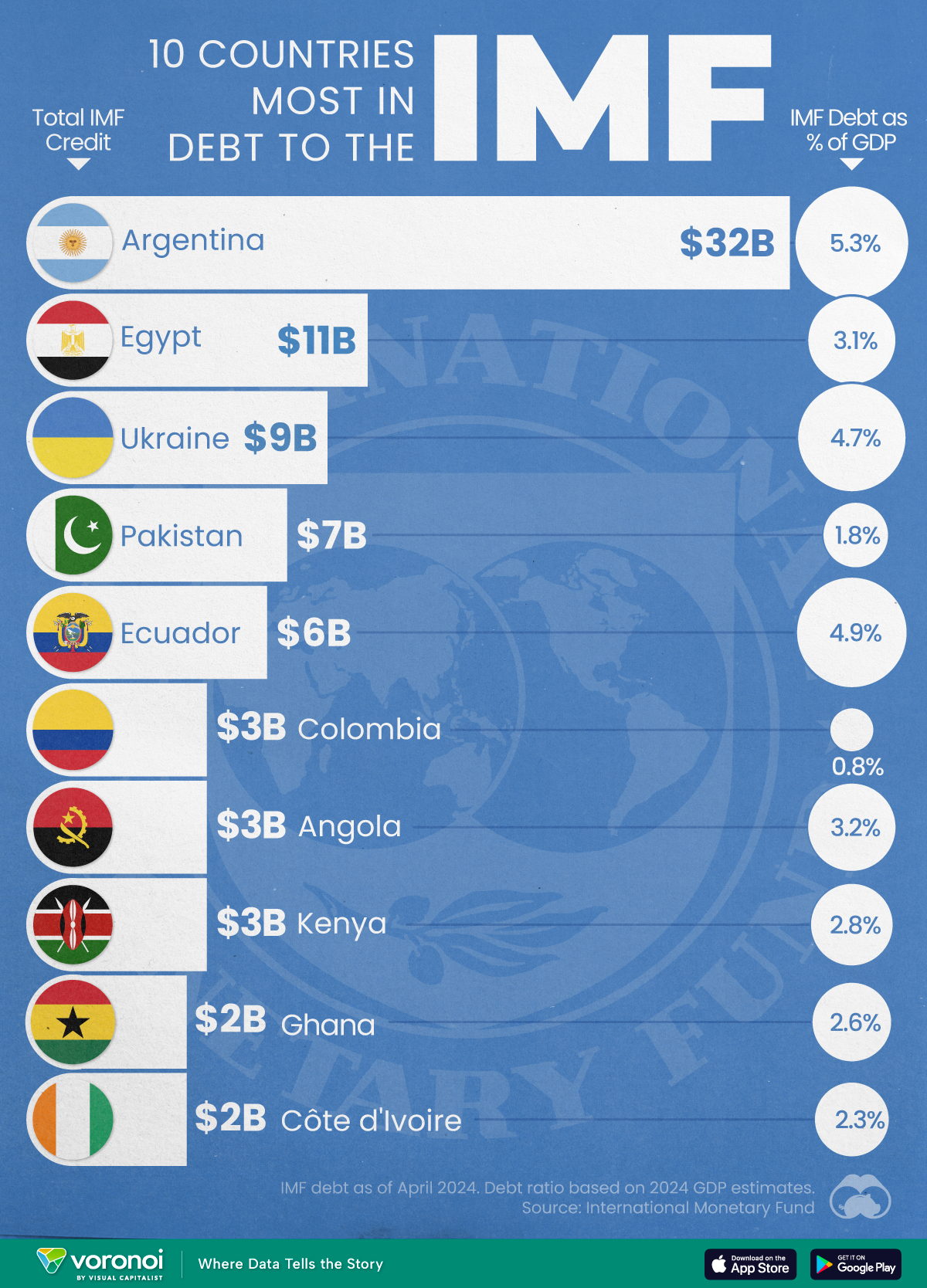

Top 10 Countries Most in Debt to the IMF

Argentina tops the ranking, with a debt equivalent to 5.3% of the country’s GDP.

Top 10 Countries Most in Debt to the IMF

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Established in 1944, the International Monetary Fund (IMF) supports countries’ economic growth by providing financial aid and guidance on policies to enhance stability, productivity, and job opportunities.

Countries seek loans from the IMF to address economic crises, stabilize their currencies, implement structural reforms, and alleviate balance of payments difficulties.

In this graphic, we visualize the 10 countries most indebted to the fund.

Methodology

We compiled this ranking using the International Monetary Fund’s data on Total IMF Credit Outstanding. We selected the latest debt data for each country, accurate as of April 29, 2024.

Argentina Tops the Rank

Argentina’s debt to the IMF is equivalent to 5.3% of the country’s GDP. In total, the country owns more than $32 billion.

| Country | IMF Credit Outstanding ($B) | GDP ($B, 2024) | IMF Debt as % of GDP |

|---|---|---|---|

| 🇦🇷 Argentina | 32 | 604.3 | 5.3 |

| 🇪🇬 Egypt | 11 | 347.6 | 3.1 |

| 🇺🇦 Ukraine | 9 | 188.9 | 4.7 |

| 🇵🇰 Pakistan | 7 | 374.7 | 1.8 |

| 🇪🇨 Ecuador | 6 | 121.6 | 4.9 |

| 🇨🇴 Colombia | 3 | 386.1 | 0.8 |

| 🇦🇴 Angola | 3 | 92.1 | 3.2 |

| 🇰🇪 Kenya | 3 | 104.0 | 2.8 |

| 🇬🇭 Ghana | 2 | 75.2 | 2.6 |

| 🇨🇮 Ivory Coast | 2 | 86.9 | 2.3 |

A G20 member and major grain exporter, the country’s history of debt trouble dates back to the late 1890s when it defaulted after contracting debts to modernize the capital, Buenos Aires. It has already been bailed out over 20 times in the last six decades by the IMF.

Five of the 10 most indebted countries are in Africa, while three are in South America.

The only European country on our list, Ukraine has relied on international support amidst the conflict with Russia. It is estimated that Russia’s full-scale invasion of the country caused the loss of a third of the country’s economy. The country owes $9 billion to the IMF.

In total, almost 100 countries owe money to the IMF, and the grand total of all of these debts is $111 billion. The above countries (top 10) account for about 69% of these debts.

-

Maps7 days ago

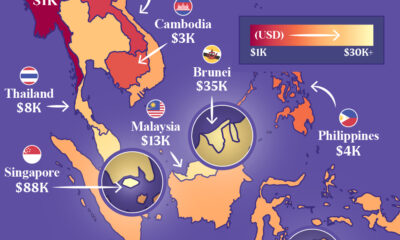

Maps7 days agoMapped: Southeast Asia’s GDP Per Capita, by Country

-

Markets2 weeks ago

Markets2 weeks agoVisualizing Global Inflation Forecasts (2024-2026)

-

United States2 weeks ago

United States2 weeks agoCharted: What Southeast Asia Thinks About China & the U.S.

-

United States2 weeks ago

United States2 weeks agoThe Evolution of U.S. Beer Logos

-

Healthcare1 week ago

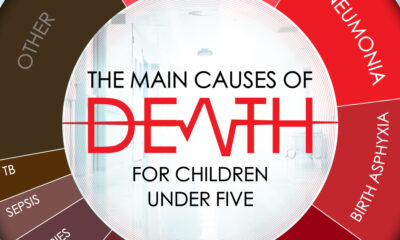

Healthcare1 week agoWhat Causes Preventable Child Deaths?

-

Energy1 week ago

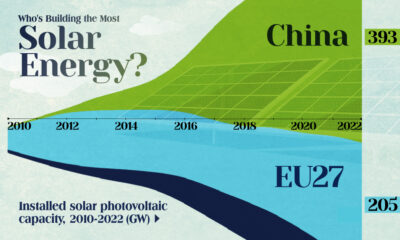

Energy1 week agoWho’s Building the Most Solar Energy?

-

Markets1 week ago

Markets1 week agoMapped: The Most Valuable Company in Each Southeast Asian Country

-

Technology1 week ago

Technology1 week agoMapped: The Number of AI Startups By Country