Markets

Which Countries Hold the Most U.S. Debt?

Which Countries Hold the Most U.S. Debt in 2022?

Today, America owes foreign investors of its national debt $7.3 trillion.

These are in the form of Treasury securities, some of the most liquid assets worldwide. Central banks use them for foreign exchange reserves and private investors flock to them during flights to safety thanks to their perceived low default risk.

Beyond these reasons, foreign investors may buy Treasuries as a store of value. They are often used as collateral during certain international trade transactions, or countries can use them to help manage exchange rate policy. For example, countries may buy Treasuries to protect their currency’s exchange rate from speculation.

In the above graphic, we show the foreign holders of the U.S. national debt using data from the U.S. Department of the Treasury.

Top Foreign Holders of U.S. Debt

With $1.1 trillion in Treasury holdings, Japan is the largest foreign holder of U.S. debt.

Japan surpassed China as the top holder in 2019 as China shed over $250 billion, or 30% of its holdings in four years.

This bond offloading by China is the one way the country can manage the yuan’s exchange rate. This is because if it sells dollars, it can buy the yuan when the currency falls. At the same time, China doesn’t solely use the dollar to manage its currency—it now uses a basket of currencies.

Here are the countries that hold the most U.S. debt:

| Rank | Country | U.S. Treasury Holdings | Share of Total |

|---|---|---|---|

| 1 | 🇯🇵 Japan | $1,076B | 14.7% |

| 2 | 🇨🇳 China | $867B | 11.9% |

| 3 | 🇬🇧 United Kingdom | $655B | 8.9% |

| 4 | 🇧🇪 Belgium | $354B | 4.8% |

| 5 | 🇱🇺 Luxembourg | $329B | 4.5% |

| 6 | 🇰🇾 Cayman Islands | $284B | 3.9% |

| 7 | 🇨🇭 Switzerland | $270B | 3.7% |

| 8 | 🇮🇪 Ireland | $255B | 3.5% |

| 9 | 🇹🇼 Taiwan | $226B | 3.1% |

| 10 | 🇮🇳 India | $224B | 3.1% |

| 11 | 🇭🇰 Hong Kong | $221B | 3.0% |

| 12 | 🇧🇷 Brazil | $217B | 3.0% |

| 13 | 🇨🇦 Canada | $215B | 2.9% |

| 14 | 🇫🇷 France | $189B | 2.6% |

| 15 | 🇸🇬 Singapore | $179B | 2.4% |

| 16 | 🇸🇦 Saudi Arabia | $120B | 1.6% |

| 17 | 🇰🇷 South Korea | $103B | 1.4% |

| 18 | 🇩🇪 Germany | $101B | 1.4% |

| 19 | 🇳🇴 Norway | $92B | 1.3% |

| 20 | 🇧🇲 Bermuda | $82B | 1.1% |

| 21 | 🇳🇱 Netherlands | $67B | 0.9% |

| 22 | 🇲🇽 Mexico | $59B | 0.8% |

| 23 | 🇦🇪 UAE | $59B | 0.8% |

| 24 | 🇦🇺 Australia | $57B | 0.8% |

| 25 | 🇰🇼 Kuwait | $49B | 0.7% |

| 26 | 🇵🇭 Philippines | $48B | 0.7% |

| 27 | 🇮🇱 Israel | $48B | 0.7% |

| 28 | 🇧🇸 Bahamas | $46B | 0.6% |

| 29 | 🇹🇭 Thailand | $46B | 0.6% |

| 30 | 🇸🇪 Sweden | $42B | 0.6% |

| 31 | 🇮🇶 Iraq | $41B | 0.6% |

| 32 | 🇨🇴 Colombia | $40B | 0.5% |

| 33 | 🇮🇹 Italy | $39B | 0.5% |

| 34 | 🇵🇱 Poland | $38B | 0.5% |

| 35 | 🇪🇸 Spain | $37B | 0.5% |

| 36 | 🇻🇳 Vietnam | $37B | 0.5% |

| 37 | 🇨🇱 Chile | $34B | 0.5% |

| 38 | 🇵🇪 Peru | $32B | 0.4% |

| All Other | $439B | 6.0% |

As the above table shows, the United Kingdom is the third highest holder, at over $655 billion in Treasuries. Across Europe, 13 countries are notable holders of these securities, the highest in any region, followed by Asia-Pacific at 11 different holders.

A handful of small nations own a surprising amount of U.S. debt. With a population of 70,000, the Cayman Islands own a towering amount of Treasury bonds to the tune of $284 billion. There are more hedge funds domiciled in the Cayman Islands per capita than any other nation worldwide.

In fact, the four smallest nations in the visualization above—Cayman Islands, Bermuda, Bahamas, and Luxembourg—have a combined population of just 1.2 million people, but own a staggering $741 billion in Treasuries.

Interest Rates and Treasury Market Dynamics

Over 2022, foreign demand for Treasuries sank 6% as higher interest rates and a strong U.S. dollar made owning these bonds less profitable.

This is because rising interest rates on U.S. debt makes the present value of their future income payments lower. Meanwhile, their prices also fall.

As the chart below shows, this drop in demand is a sharp reversal from 2018-2020, when demand jumped as interest rates hovered at historic lows. A similar trend took place in the decade after the 2008-09 financial crisis when U.S. debt holdings effectively tripled from $2 to $6 trillion.

Driving this trend was China’s rapid purchase of Treasuries, which ballooned from $100 billion in 2002 to a peak of $1.3 trillion in 2013. As the country’s exports and output expanded, it sold yuan and bought dollars to help alleviate exchange rate pressure on its currency.

Fast-forward to today, and global interest-rate uncertainty—which in turn can impact national currency valuations and therefore demand for Treasuries—continues to be a factor impacting the future direction of foreign U.S. debt holdings.

Markets

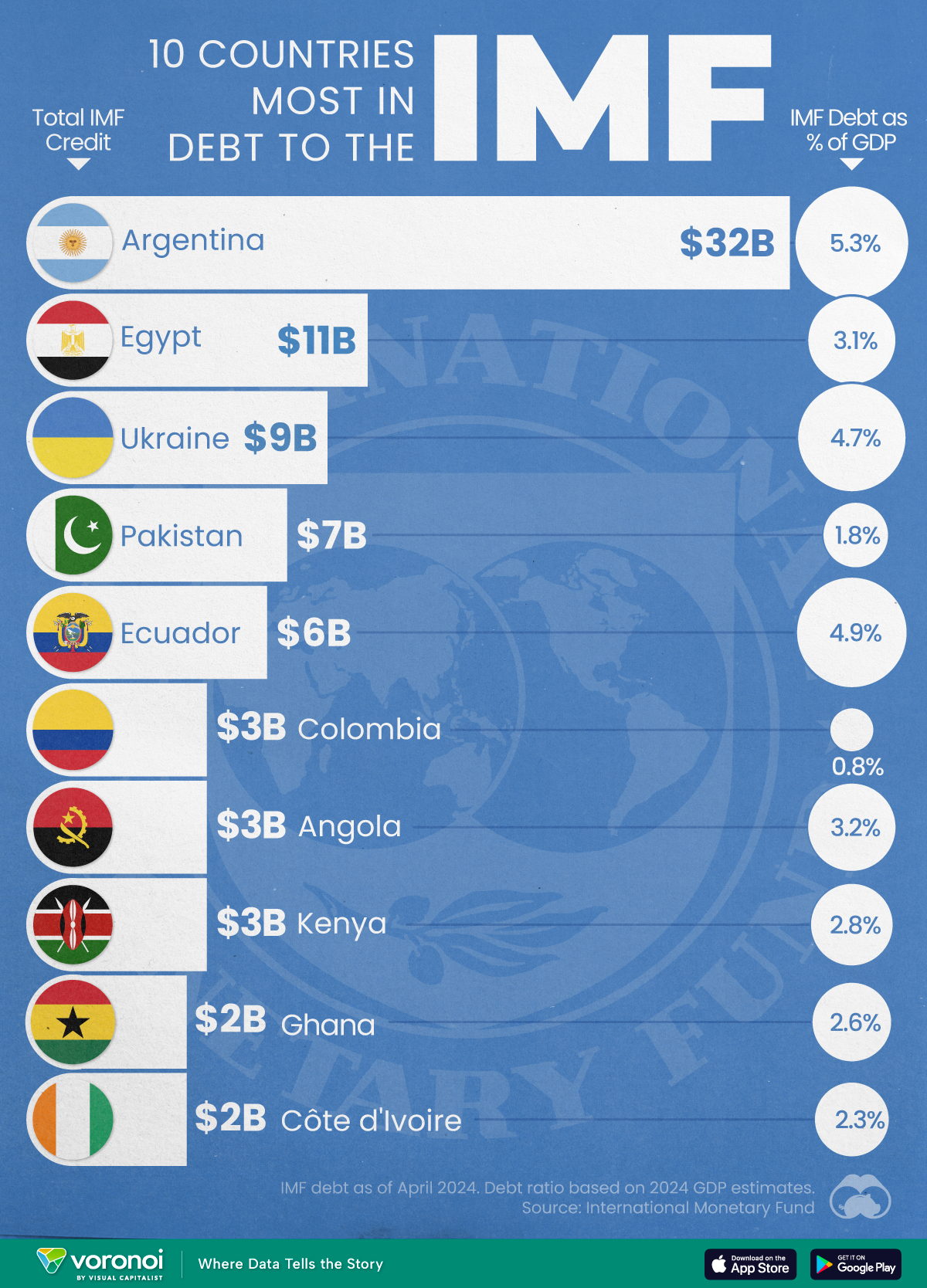

Top 10 Countries Most in Debt to the IMF

Argentina tops the ranking, with a debt equivalent to 5.3% of the country’s GDP.

Top 10 Countries Most in Debt to the IMF

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Established in 1944, the International Monetary Fund (IMF) supports countries’ economic growth by providing financial aid and guidance on policies to enhance stability, productivity, and job opportunities.

Countries seek loans from the IMF to address economic crises, stabilize their currencies, implement structural reforms, and alleviate balance of payments difficulties.

In this graphic, we visualize the 10 countries most indebted to the fund.

Methodology

We compiled this ranking using the International Monetary Fund’s data on Total IMF Credit Outstanding. We selected the latest debt data for each country, accurate as of April 29, 2024.

Argentina Tops the Rank

Argentina’s debt to the IMF is equivalent to 5.3% of the country’s GDP. In total, the country owns more than $32 billion.

| Country | IMF Credit Outstanding ($B) | GDP ($B, 2024) | IMF Debt as % of GDP |

|---|---|---|---|

| 🇦🇷 Argentina | 32 | 604.3 | 5.3 |

| 🇪🇬 Egypt | 11 | 347.6 | 3.1 |

| 🇺🇦 Ukraine | 9 | 188.9 | 4.7 |

| 🇵🇰 Pakistan | 7 | 374.7 | 1.8 |

| 🇪🇨 Ecuador | 6 | 121.6 | 4.9 |

| 🇨🇴 Colombia | 3 | 386.1 | 0.8 |

| 🇦🇴 Angola | 3 | 92.1 | 3.2 |

| 🇰🇪 Kenya | 3 | 104.0 | 2.8 |

| 🇬🇭 Ghana | 2 | 75.2 | 2.6 |

| 🇨🇮 Ivory Coast | 2 | 86.9 | 2.3 |

A G20 member and major grain exporter, the country’s history of debt trouble dates back to the late 1890s when it defaulted after contracting debts to modernize the capital, Buenos Aires. It has already been bailed out over 20 times in the last six decades by the IMF.

Five of the 10 most indebted countries are in Africa, while three are in South America.

The only European country on our list, Ukraine has relied on international support amidst the conflict with Russia. It is estimated that Russia’s full-scale invasion of the country caused the loss of a third of the country’s economy. The country owes $9 billion to the IMF.

In total, almost 100 countries owe money to the IMF, and the grand total of all of these debts is $111 billion. The above countries (top 10) account for about 69% of these debts.

-

Maps7 days ago

Maps7 days agoMapped: Southeast Asia’s GDP Per Capita, by Country

-

Markets2 weeks ago

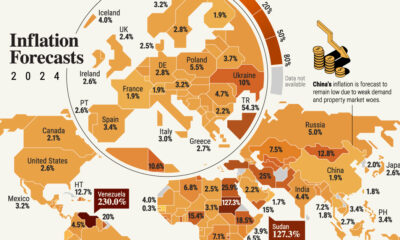

Markets2 weeks agoVisualizing Global Inflation Forecasts (2024-2026)

-

United States2 weeks ago

United States2 weeks agoCharted: What Southeast Asia Thinks About China & the U.S.

-

United States2 weeks ago

United States2 weeks agoThe Evolution of U.S. Beer Logos

-

Healthcare1 week ago

Healthcare1 week agoWhat Causes Preventable Child Deaths?

-

Energy1 week ago

Energy1 week agoWho’s Building the Most Solar Energy?

-

Markets1 week ago

Markets1 week agoMapped: The Most Valuable Company in Each Southeast Asian Country

-

Technology1 week ago

Technology1 week agoMapped: The Number of AI Startups By Country