Technology

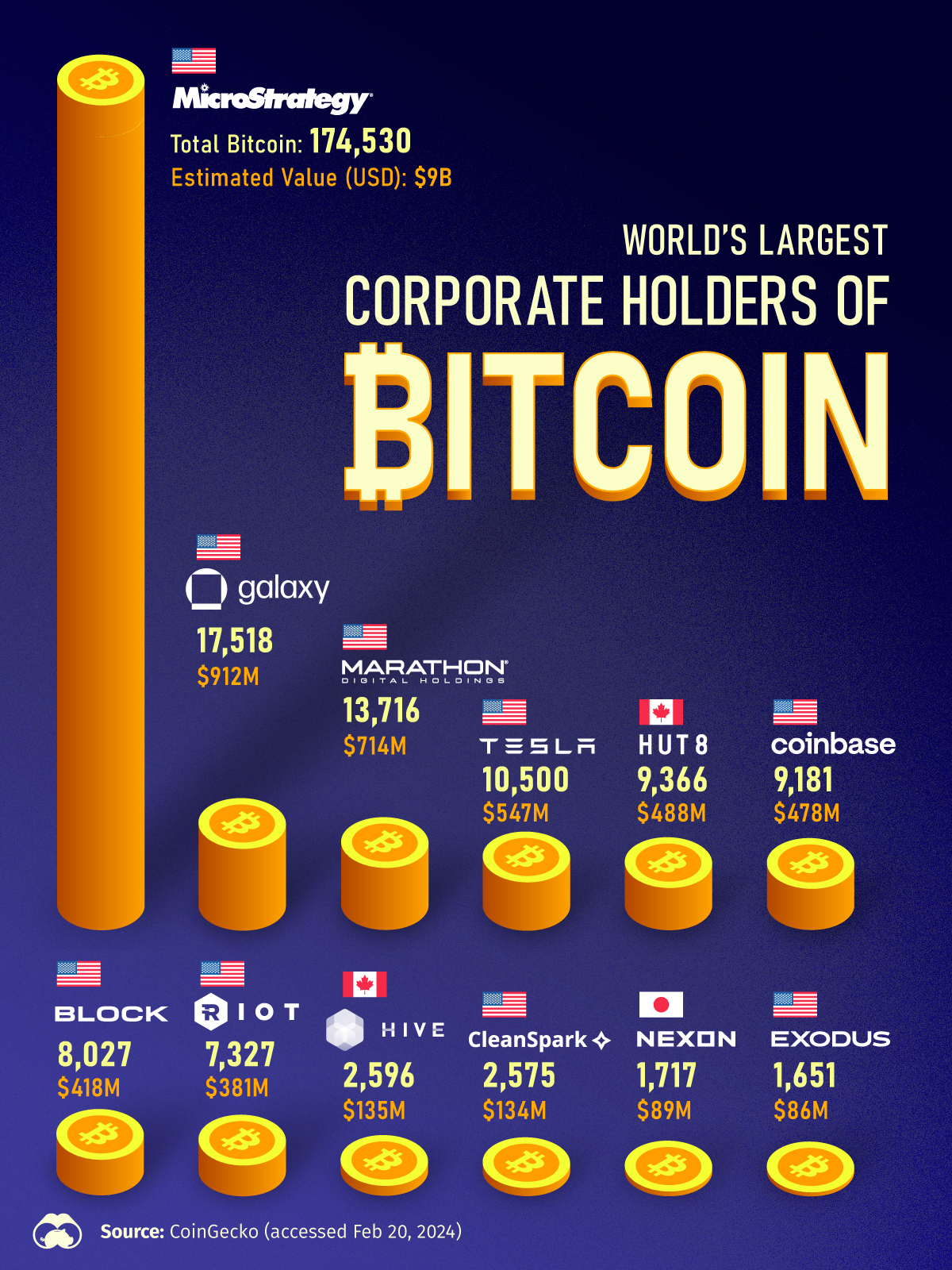

The World’s Largest Corporate Holders of Bitcoin

![]() See this visualization first on the Voronoi app.

See this visualization first on the Voronoi app.

The World’s Largest Corporate Holders of Bitcoin

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Who holds the most bitcoins across publicly traded companies?

While Tesla is the most familiar name across the world’s largest corporate buyers, several companies have amassed far more bitcoin—leading their share prices to skyrocket in value last year. At the same time, the vast majority are found in North America, with the exception of Nexon, a Japanese-based video game publisher.

This graphic shows the public companies that own the most bitcoin, based on data from CoinGecko.

MicroStrategy at the Top

As the world’s largest corporate owner of bitcoin, MicroStrategy holds 174,530 bitcoin valued at an estimated $9.1 billion as of February 22, 2024.

Headquartered in Virginia, the intelligence software firm first began buying bitcoin in 2020 and has since grown its holdings to become roughly 10 times bigger than the next highest corporate owner. MicroStrategy shares soared over 350% in 2023 thanks to its scale of bitcoin holdings.

Here’s who holds the most bitcoins globally across public companies as of February 22, 2024:

| Rank | Company | Country | Total Bitcoin | Estimated Value as of Feb 22, 2024 |

|---|---|---|---|---|

| 1 | MicroStrategy | 🇺🇸 U.S. | 174,530 | $9.1B |

| 2 | Galaxy Digital | 🇺🇸 U.S. | 17,518 | $912.1M |

| 3 | Marathon Digital | 🇺🇸 U.S. | 13,716 | $714.1M |

| 4 | Tesla | 🇺🇸 U.S. | 10,500 | $546.7M |

| 5 | Hut 8 | 🇨🇦 Canada | 9,366 | $487.6M |

| 6 | Coinbase | 🇺🇸 U.S. | 9,181 | $478.0M |

| 7 | Block Inc. | 🇺🇸 U.S. | 8,027 | $417.9M |

| 8 | Riot Platforms | 🇺🇸 U.S. | 7,327 | $381.5M |

| 9 | Hive Blockchain | 🇨🇦 Canada | 2,596 | $135.2M |

| 10 | CleanSpark | 🇺🇸 U.S. | 2,575 | $134.1M |

| 11 | NEXON | 🇯🇵 Japan | 1,717 | $89.4M |

| 12 | Exodus | 🇺🇸 U.S. | 1,651 | $86.0M |

Tesla is the fourth-largest owner on the list, with bitcoin holdings worth $546.7 million.

In 2021, the company announced that it bought $1.5 billion in bitcoin to help boost the company’s bottom line. It also served as a way to provide liquidity to customers who could buy its products with the cryptocurrency. Yet the following year, the company sold a large share of its holdings at a steep loss during the crypto crash.

Two Canadian companies, Hut 8 and Hive Blockchain, are top holders of bitcoin. These cryptocurrency mining companies have seen their shares surge over 191% and 144%, respectively.

With even stronger returns, bitcoin miner CleanSpark saw its shares boom over 425% in 2023. This year, the company announced plans to purchase four new facilities for mining bitcoin. Three of these are located in Mississippi, purchased for a total of $19.8 million.

As bitcoin climbs to fresh record highs, corporate interest in bitcoin may continue to increase in tandem with a wider scope of buyers. Newly regulated spot bitcoin ETFs have also fueled demand, leading bitcoin’s market cap to hit $1 trillion for the first time since 2021.

Technology

Charting the Next Generation of Internet

In this graphic, Visual Capitalist has partnered with MSCI to explore the potential of satellite internet as the next generation of internet innovation.

Could Tomorrow’s Internet be Streamed from Space?

In 2023, 2.6 billion people could not access the internet. Today, companies worldwide are looking to innovative technology to ensure more people are online at the speed of today’s technology.

Could satellite internet provide the solution?

In collaboration with MSCI, we embarked on a journey to explore whether tomorrow’s internet could be streamed from space.

Satellite Internet’s Potential Customer Base

Millions of people live in rural communities or mobile homes, and many spend much of their lives at sea or have no fixed abode. So, they cannot access the internet simply because the technology is unavailable.

Satellite internet gives these communities access to the internet without requiring a fixed location. Consequently, the volume of people who could get online using satellite internet is significant:

| Area | Potential Subscribers |

|---|---|

| Households Without Internet Access | 600,000,000 |

| RVs | 11,000,000 |

| Recreational Boats | 8,500,000 |

| Ships | 100,000 |

| Commercial Aircraft | 25,000 |

Advances in Satellite Technology

Satellite internet is not a new concept. However, it has only recently been that roadblocks around cost and long turnaround times have been overcome.

NASA’s space shuttle, until it was retired in 2011, was the only reusable means of transporting crew and cargo into orbit. It cost over $1.5 billion and took an average of 252 days to launch and refurbish.

In stark contrast, SpaceX’s Falcon 9 can now launch objects into orbit and maintain them at a fraction of the time and cost, less than 1% of the space shuttle’s cost.

| Average Rocket Turnaround Time | Average Launch/Refurbishment Cost | |

|---|---|---|

| Falcon 9* | 21 days | < $1,000,000 |

| Space Shuttle | 252 days | $1,500,000,000 (approximately) |

Satellites are now deployed 300 miles in low Earth orbit (LEO) rather than 22,000 miles above Earth in Geostationary Orbit (GEO), previously the typical satellite deployment altitude.

What this means for the consumer is that satellite internet streamed from LEO has a latency of 40 ms, which is an optimal internet connection. Especially when compared to the 700 ms stream latency experienced with satellite internet streamed from GEO.

What Would it Take to Build a Satellite Internet?

SpaceX, the private company that operates Starlink, currently has 4,500 satellites. However, the company believes it will require 10 times this number to provide comprehensive satellite internet coverage.

Charting the number of active satellites reveals that, despite the increasing number of active satellites, many more must be launched to create a comprehensive satellite internet.

| Year | Number of Active Satellites |

|---|---|

| 2022 | 6,905 |

| 2021 | 4,800 |

| 2020 | 3,256 |

| 2019 | 2,272 |

| 2018 | 2,027 |

| 2017 | 1,778 |

| 2016 | 1,462 |

| 2015 | 1,364 |

| 2014 | 1,262 |

| 2013 | 1,187 |

Next-Generation Internet Innovation

Innovation is at the heart of the internet’s next generation, and the MSCI Next Generation Innovation Index exposes investors to companies that can take advantage of potentially disruptive technologies like satellite internet.

You can gain exposure to companies advancing access to the internet with four indexes:

- MSCI ACWI IMI Next Generation Internet Innovation Index

- MSCI World IMI Next Generation Internet Innovation 30 Index

- MSCI China All Shares IMI Next Generation Internet Innovation Index

- MSCI China A Onshore IMI Next Generation Internet Innovation Index

MSCI thematic indexes are objective, rules-based, and regularly updated to focus on specific emerging trends that could evolve.

Click here to explore the MSCI thematic indexes

-

Technology1 week ago

Technology1 week agoCountries With the Highest Rates of Crypto Ownership

While the U.S. is a major market for cryptocurrencies, two countries surpass it in terms of their rates of crypto ownership.

-

Technology1 week ago

Technology1 week agoMapped: The Number of AI Startups By Country

Over the past decade, thousands of AI startups have been funded worldwide. See which countries are leading the charge in this map graphic.

-

Technology3 weeks ago

Technology3 weeks agoAll of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

-

Technology3 weeks ago

Technology3 weeks agoVisualizing AI Patents by Country

See which countries have been granted the most AI patents each year, from 2012 to 2022.

-

Technology3 weeks ago

Technology3 weeks agoHow Tech Logos Have Evolved Over Time

From complete overhauls to more subtle tweaks, these tech logos have had quite a journey. Featuring: Google, Apple, and more.

-

AI1 month ago

AI1 month agoRanked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

-

Markets1 week ago

Markets1 week agoMapped: The Most Valuable Company in Each Southeast Asian Country

-

Personal Finance6 days ago

Personal Finance6 days agoVisualizing the Tax Burden of Every U.S. State

-

Mining7 days ago

Mining7 days agoWhere the World’s Aluminum is Smelted, by Country

-

Technology1 week ago

Technology1 week agoCountries With the Highest Rates of Crypto Ownership

-

Money1 week ago

Money1 week agoCharted: What Frustrates Americans About the Tax System

-

Economy1 week ago

Economy1 week agoMapped: Europe’s GDP Per Capita, by Country

-

Stocks1 week ago

Stocks1 week agoThe Growth of a $1,000 Equity Investment, by Stock Market

-

Healthcare1 week ago

Healthcare1 week agoLife Expectancy by Region (1950-2050F)

/>

/>