From August 22nd to 24th, BRICS leaders are set to convene in South Africa, marking a pivotal moment for this loosely knit coalition of major non-Western nations including Brazil, Russia, India, China, and South Africa. The conference aims not only to strengthen cooperation but to forge a robust international alliance designed to counteract Western influence. Amidst this strategic push, BRICS seeks to expand its reach, encompassing a multitude of countries from the "Global South," with Africa, Latin America, and the Middle East at its core.

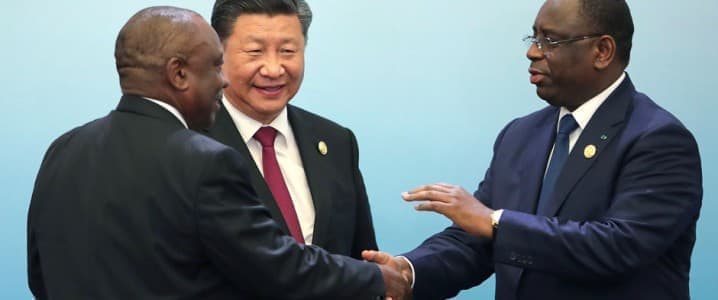

Heads of state such as Russia's President Putin, China's Xi Jinping, and South Africa's President Cyril Ramaphosa have made clear their intentions: challenging the entrenched geopolitical dominance of the West. However, cracks in this united front are already evident. Vladimir Putin's absence, driven by fears of arrest over war crimes in Ukraine, casts shadows over the project. Simultaneously, India, a BRICS heavyweight, is wary of China's ascendancy potentially sidelining its interests within the alliance. Related: Will China’s Appetite For Saudi Oil Return?

Amid the fervor, media attention has swiveled toward the ongoing "de-dollarization" initiatives driven by China, Russia, and others outside the BRICS framework. While this has garnered significant interest due to potential shifts in global trade dynamics, the reality remains that over 90% of global trade continues to be conducted in US dollars. The financial aspect, especially when considering the collective GDP of BRICS versus the G7, holds great significance. The aspiration of non-Western nations to challenge established norms is not new, tracing back to post-colonial times and the subsequent economic successes of China and India.

Although often overlooked, BRICS' expansion efforts encompass a diverse list of countries, with Argentina, Egypt, and Saudi Arabia among those expressing interest. Roughly 40 nations are considering participation, driven by economic incentives and the growing economic might of China and India. While the West's concern is palpable, its focus might be misplaced.

Beneath the surface, a formidable energy-oriented bloc is forming, aligning BRICS with key energy exporters like Saudi Arabia, Egypt, and potentially Algeria and the UAE. Although not officially tied to a BRICS-OPEC+ affiliation, the convergence of interests in the list of participating or invited nations could revolutionize energy and commodity markets. An integrated alliance of energy giants would reshape global energy supply security, possibly prioritizing BRICS routes. This also extends to ambitious global supply chain projects, including China's One Belt One Road, UAE's port expansions, and Saudi's Vision 2030 initiatives.

Simultaneously, BRICS' expansion into Africa, particularly in mining, minerals, and metals, merits attention in the coming months. The inclusion of new members with critical mineral and metal resources could fundamentally shift this coalition, possibly with China and Russia spearheading efforts. Arab nations like Saudi Arabia and the UAE have also entered the global mining sphere, aligning with renewable energy and decarbonization strategies. BRICS' expansion holds implications not just for the US dollar's dominance but for Western influence and access to energy resources and supply chains.

The Biden Administration acknowledges this evolving landscape and is intensifying efforts to manage the perceived fallout. The US's oil and gas reserves, alongside geopolitical influence, provide a cushion, but Europe seems complacent. Despite talk of distancing from China's sway, Europe's reliance on Asian manufacturing and markets grows. European strategies hinge on African minerals, metals, hydrocarbons, and renewable energy sources, all increasingly at the mercy of shifting alliances.

As Riyadh, Abu Dhabi, Cairo, Algiers, and others pivot toward the East, including Russia, a significant challenge emerges. Not just hydrocarbons, but access to supply chains and maritime trade routes, will be high on the agenda. The integration of North Africa and the Middle East into a Beijing-Moscow-led BRICS+ adds pressure. China and Russia are no longer bystanders; they actively undermine Western interests. The potential integration of OPEC and gas-exporting nations into BRICS threatens Western energy interests. The convergence of Saudi Arabia, Egypt, Algeria, Brazil, and Russia empowers BRICS with control over 60% of global energy reserves and production.

Amidst the de-dollarization discourse, practical and security concerns come to the forefront, demanding attention beyond the hype.

By Cyril Widdershoven for Oilprice.com

More Top Reads From Oilprice.com:

- Will China’s Appetite For Saudi Oil Return?

- U.S. Charges Former Vitol Oil Trader In International Bribery Scheme

- Tanker Suspected Of Carrying Iranian Oil Offloads Near Texas