Markets

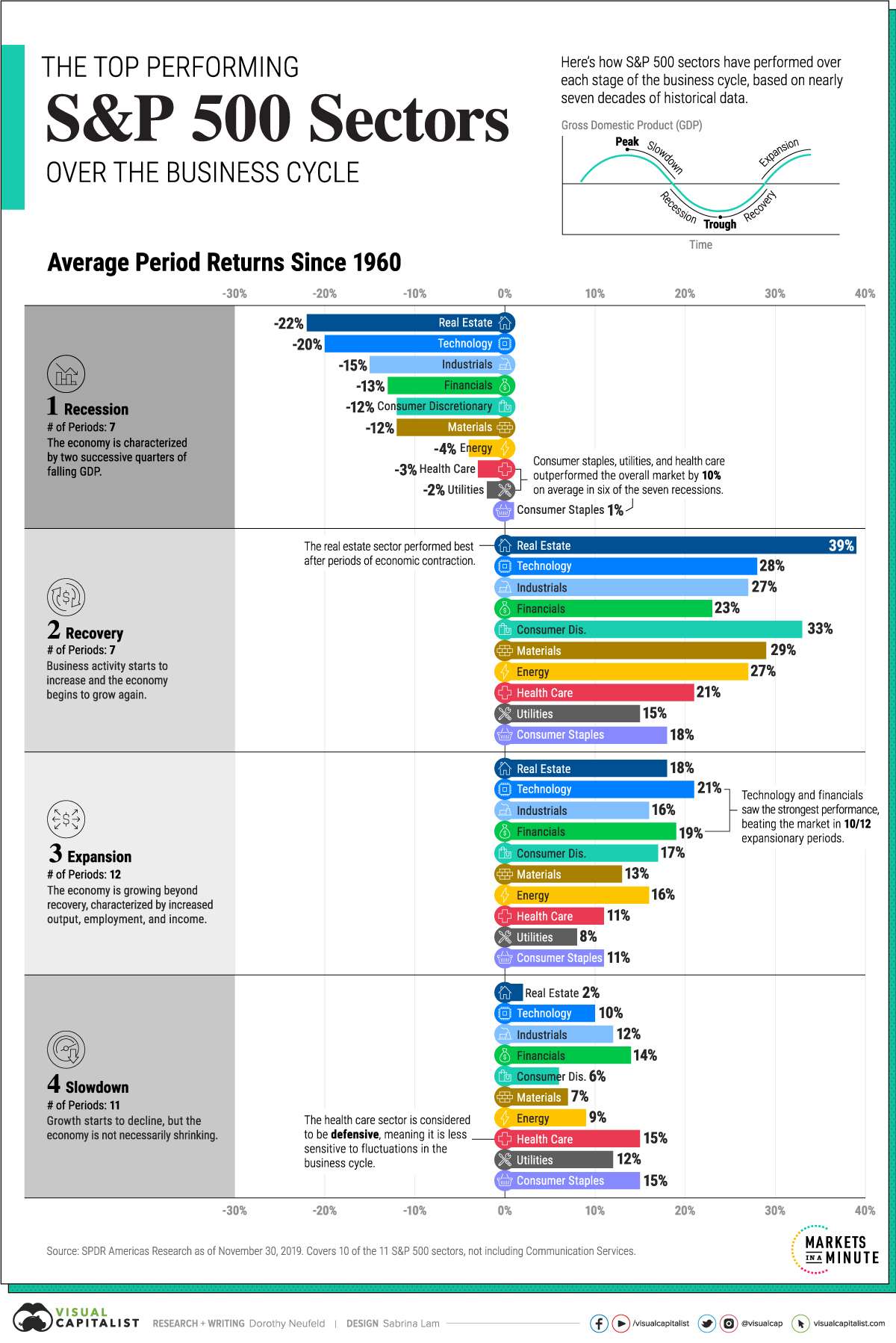

The Top Performing S&P 500 Sectors Over the Business Cycle

Subscribe to the Advisor Channel free mailing list for more like this

The Top Performing S&P 500 Sectors Over the Business Cycle

This was originally posted on Advisor Channel. Sign up to the free mailing list to get beautiful visualizations on financial markets that help advisors and their clients.

The business cycle fluctuates over time, from the highs of an expansion to the lows of a recession, and each phase impacts the performance of S&P 500 sectors differently.

And though affected sectors have different levels of average performance, any given period may see the outperformance of certain sectors due to external factors, such as technological advancements or high-impact global events (i.e. global pandemics, international conflicts, etc.)

The above graphic uses data from SPDR Americas Research to show the top performing sectors through the business cycle over almost 70 years.

The Business Cycle: Methodology

The dataset is based on the Conference Board’s Leading Economic Index, which assesses U.S. economic activity. This index includes 10 economic indicators that reveal typical turning points in the business cycle covering employment, consumer expectations, and financial conditions.

Overall from December 1, 1960 to November 30, 2019, the dataset covers:

- 7 recessions

- 7 recoveries

- 12 expansions

- 11 slowdowns

Returns are shown for all of the S&P 500 sectors with the exception of the communication services sector. This is because the sector was created relatively recently in 2018 and comprises previous technology, consumer discretionary, and telecommunication stocks already covered in the dataset.

1. Recession

Broadly speaking, a recession is a period of temporary economic decline characterized by two successive quarters of falling GDP.

During this period, consumer staples was the top performing S&P 500 sector, and the only one that has averaged a positive return. Utilities and health care, traditionally defensive sectors, followed next in line. Together, these sectors averaged 10% higher returns than the overall market during six of the seven recessions.

| Rank | S&P 500 Sector | Average Period Return |

|---|---|---|

| 1 | Consumer Staples | +1% |

| 2 | Utilities | -2% |

| 3 | Health Care | -3% |

| 4 | Energy | -4% |

| 5 | Consumer Discretionary | -12% |

| 6 | Materials | -12% |

| 7 | Financials | -13% |

| 8 | Industrials | -15% |

| 9 | Technology | -20% |

| 10 | Real Estate | -22% |

Real estate has been the worst performer during recessions, given its high sensitivity to discretionary spending as both household income and business activity tend to decline.

2. Recovery

A recovery is the phase following a recession where economic activity starts to increase and the economy begins to grow again.

Real estate outperformed all other sectors with an average 39% return. As monetary policy eases and interest rates fall historically after recessions, this makes purchasing real estate more affordable, in turn supporting the sector’s performance.

| Rank | S&P 500 Sector | Average Period Return |

|---|---|---|

| 1 | Real Estate | +39% |

| 2 | Consumer Discretionary | +33% |

| 3 | Materials | +29% |

| 4 | Technology | +28% |

| 5 | Industrials | +27% |

| 6 | Energy | +27% |

| 7 | Financials | +23% |

| 8 | Health Care | +21% |

| 9 | Consumer Staples | +18% |

| 10 | Utilities | +15% |

We can see in the above table that all sectors posted double-digit returns as consumer confidence and labor market conditions improved during recoveries.

3. Expansion

In this phase of the business cycle, the economy is growing beyond recovery. It is characterized by increased economic output, employment, and income.

Interestingly, market returns were the second-best overall after recoveries. Top sectors included technology (21%), financials (19%), and real estate (18%) as economic activity climbed to its peak.

| Rank | S&P 500 Sector | Average Period Return |

|---|---|---|

| 1 | Technology | +21% |

| 2 | Financials | +19% |

| 3 | Real Estate | +18% |

| 4 | Consumer Discretionary | +17% |

| 5 | Industrials | +16% |

| 6 | Energy | +16% |

| 7 | Materials | +13% |

| 8 | Consumer Staples | +11% |

| 9 | Health Care | +11% |

| 10 | Utilities | +8% |

The utilities sector has historically seen the slowest growth across all sectors as investors tend to favor cyclical S&P 500 sectors that rise with an expanding economy.

4. Slowdown

This phase is often considered a peak in the business cycle, where growth starts to decline, but the economy is not necessarily shrinking.

With 15% average returns, health care excelled during slowdowns. Often, investors reduce their exposure to cyclical sectors as they prepare for an economic downturn, looking for more defensive investments. Similarly, consumer staples saw strong performance on average.

| Rank | S&P 500 Sector | Average Period Return |

|---|---|---|

| 1 | Health Care | +15% |

| 2 | Consumer Staples | +15% |

| 3 | Financials | +14% |

| 4 | Utilities | +12% |

| 5 | Industrials | +12% |

| 6 | Technology | +10% |

| 7 | Energy | +9% |

| 8 | Materials | +7% |

| 9 | Consumer Discretionary | +6% |

| 10 | Real Estate | +2% |

Just as real estate saw a steep drop-off during recessions, it witnessed the lowest relative returns when the economy slows and costs tend to increase.

The Case for Diversification

The above data highlights how having a diversified portfolio of investments can help reduce sector-specific risk given the distinct performance trends of individual sectors over the business cycle.

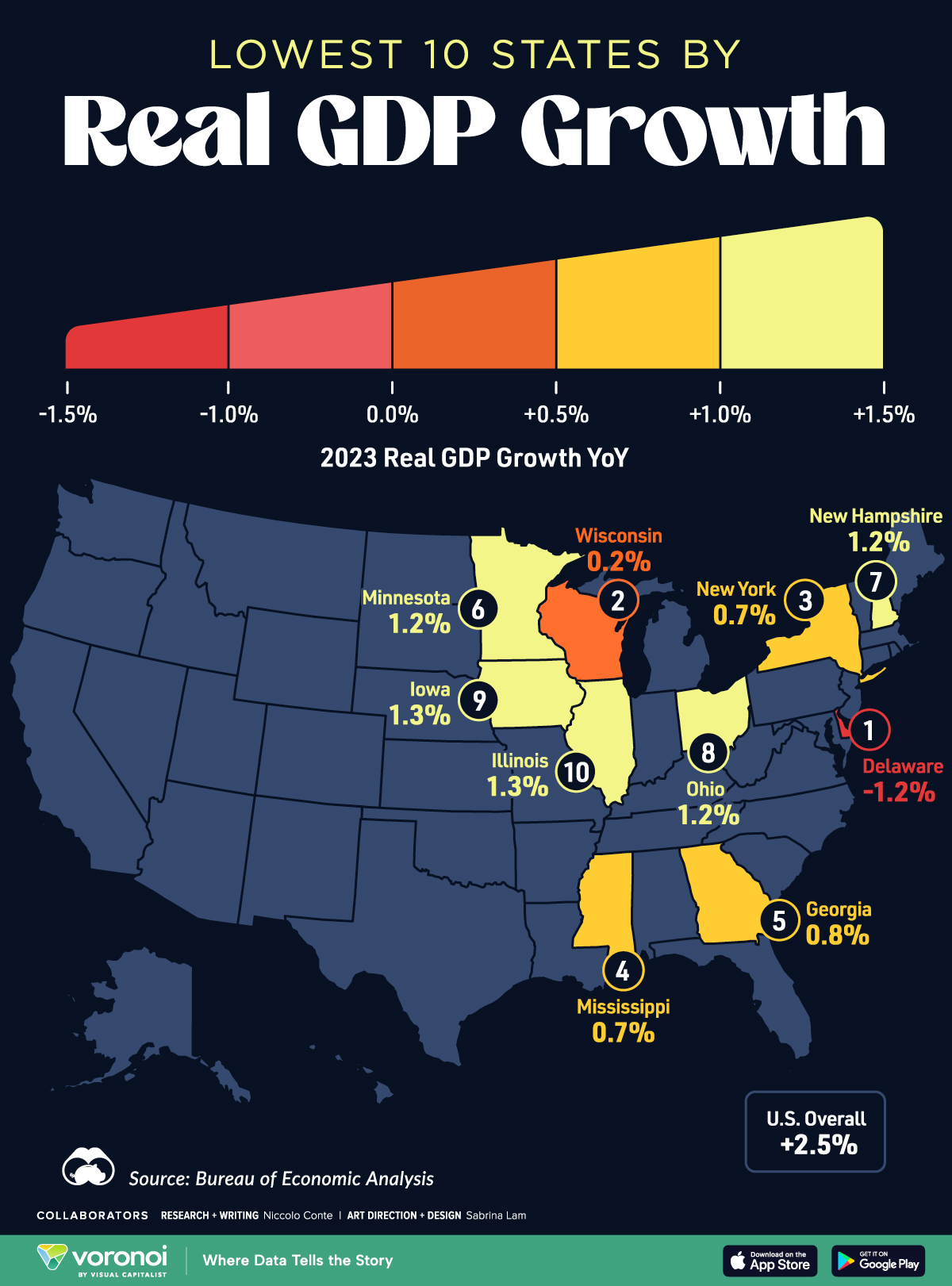

Maps

Mapped: The 10 U.S. States With the Lowest Real GDP Growth

In this graphic, we show where real GDP lagged the most across America in 2023 as high interest rates weighed on state economies.

The Top 10 U.S. States, by Lowest Real GDP Growth

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

While the U.S. economy defied expectations in 2023, posting 2.5% in real GDP growth, several states lagged behind.

Last year, oil-producing states led the pack in terms of real GDP growth across America, while the lowest growth was seen in states that were more sensitive to the impact of high interest rates, particularly due to slowdowns in the manufacturing and finance sectors.

This graphic shows the 10 states with the least robust real GDP growth in 2023, based on data from the Bureau of Economic Analysis.

Weakest State Economies in 2023

Below, we show the states with the slowest economic activity in inflation-adjusted terms, using chained 2017 dollars:

| Rank | State | Real GDP Growth 2023 YoY | Real GDP 2023 |

|---|---|---|---|

| 1 | Delaware | -1.2% | $74B |

| 2 | Wisconsin | +0.2% | $337B |

| 3 | New York | +0.7% | $1.8T |

| 4 | Missississippi | +0.7% | $115B |

| 5 | Georgia | +0.8% | $661B |

| 6 | Minnesota | +1.2% | $384B |

| 7 | New Hampshire | +1.2% | $91B |

| 8 | Ohio | +1.2% | $698B |

| 9 | Iowa | +1.3% | $200B |

| 10 | Illinois | +1.3% | $876B |

| U.S. | +2.5% | $22.4T |

Delaware witnessed the slowest growth in the country, with real GDP growth of -1.2% over the year as a sluggish finance and insurance sector dampened the state’s economy.

Like Delaware, the Midwestern state of Wisconsin also experienced declines across the finance and insurance sector, in addition to steep drops in the agriculture and manufacturing industries.

America’s third-biggest economy, New York, grew just 0.7% in 2023, falling far below the U.S. average. High interest rates took a toll on key sectors, with notable slowdowns in the construction and manufacturing sectors. In addition, falling home prices and a weaker job market contributed to slower economic growth.

Meanwhile, Georgia experienced the fifth-lowest real GDP growth rate. In March 2024, Rivian paused plans to build a $5 billion EV factory in Georgia, which was set to be one of the biggest economic development initiatives in the state in history.

These delays are likely to exacerbate setbacks for the state, however, both Kia and Hyundai have made significant investments in the EV industry, which could help boost Georgia’s manufacturing sector looking ahead.

-

Personal Finance1 week ago

Personal Finance1 week agoVisualizing the Tax Burden of Every U.S. State

-

Misc7 days ago

Misc7 days agoVisualized: Aircraft Carriers by Country

-

Culture1 week ago

Culture1 week agoHow Popular Snack Brand Logos Have Changed

-

Mining1 week ago

Mining1 week agoVisualizing Copper Production by Country in 2023

-

Misc1 week ago

Misc1 week agoCharted: How Americans Feel About Federal Government Agencies

-

Healthcare1 week ago

Healthcare1 week agoWhich Countries Have the Highest Infant Mortality Rates?

-

Demographics1 week ago

Demographics1 week agoMapped: U.S. Immigrants by Region

-

Maps1 week ago

Maps1 week agoMapped: Southeast Asia’s GDP Per Capita, by Country