SEC Says Spot Bitcoin ETF Filings Are Inadequate, But...

Gary Gensler's crusade against crypto continues... but today's news may be a silver lining.

The Wall Street Journal reports, citing people familiar with the matter, The Securities and Exchange Commission said a recent wave of applications filed by asset managers to launch spot bitcoin exchange-traded funds are inadequate.

Gensler's goons reportedly told BlackRock, Fidelity, and a wave of other asset managers that the filings aren’t sufficiently clear and comprehensive.

Cathie Wood’s Ark Investment Management, Invesco, WisdomTree, Bitwise Asset Management and Valkyrie all reactivated or amended their applications for a spot bitcoin ETF in recent days.

An ETF that tracks the actual price of bitcoin would mark a watershed moment for the industry because it would provide wider access to the cryptocurrency.

It would allow investors to buy and sell bitcoin through a brokerage account as easily as shares of stock.

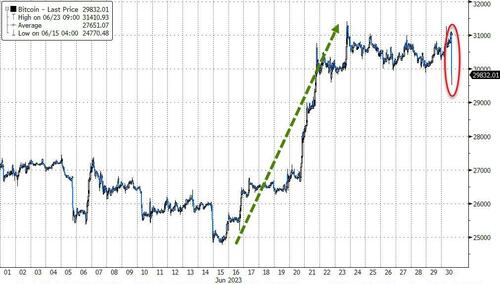

The kneejerk reaction was to sell Bitcoin, pushing it back to $30,000...

The SEC has repeatedly rejected such funds going back to 2017 on the grounds that they are vulnerable to fraud and market manipulation.

At least half a dozen ETFs that own bitcoin futures are already on the market.

As WSJ concludes, some industry watchers predicted that BlackRock’s filing would appease the SEC’s concerns through an agreement to share “surveillance” of a spot bitcoin-trading platform with Nasdaq, which would list the ETF.

Interestingly, while the initial reaction appears to be negative, one could argue this is actually positive with the SEC engaging with asset managers and offering suggestions on what they should do.

Specifically, the SEC told the exchanges that it returned the filings because they didn’t name the spot bitcoin exchange with which they are expected to have a “surveillance-sharing agreement” or provide enough information about the details of those surveillance arrangements. Indeed, as Bloomberg ETF guru Eric Balchunas writes:"this isn't as bad as headline. The key paragraph is deep in story. Basically SEC wants them to name the "crypto exchange" and give more details on SSA. That's understandable, arguably good news. I was under impression they'd have to update that as well."

Hold up a second, this isn't as bad as headline. The key paragraph is deep in story. Basically SEC wants them to name the "crypto exchange" and give more details on SSA. That's understandable, arguably good news. I was under impression they'd have to update that as well. pic.twitter.com/bh9qn65Xh2

— Eric Balchunas (@EricBalchunas) June 30, 2023

And As ETF Store's Nate Geraci adds, this may actually be a greenlighting for the Blackrock ETF

My guess? There’s only one ETF issuer that can definitively name that spot crypto exchange & confidently say they’ll have a surveillance sharing agreement in place… https://t.co/dBFdAyrgY8

— Nate Geraci (@NateGeraci) June 30, 2023