Money

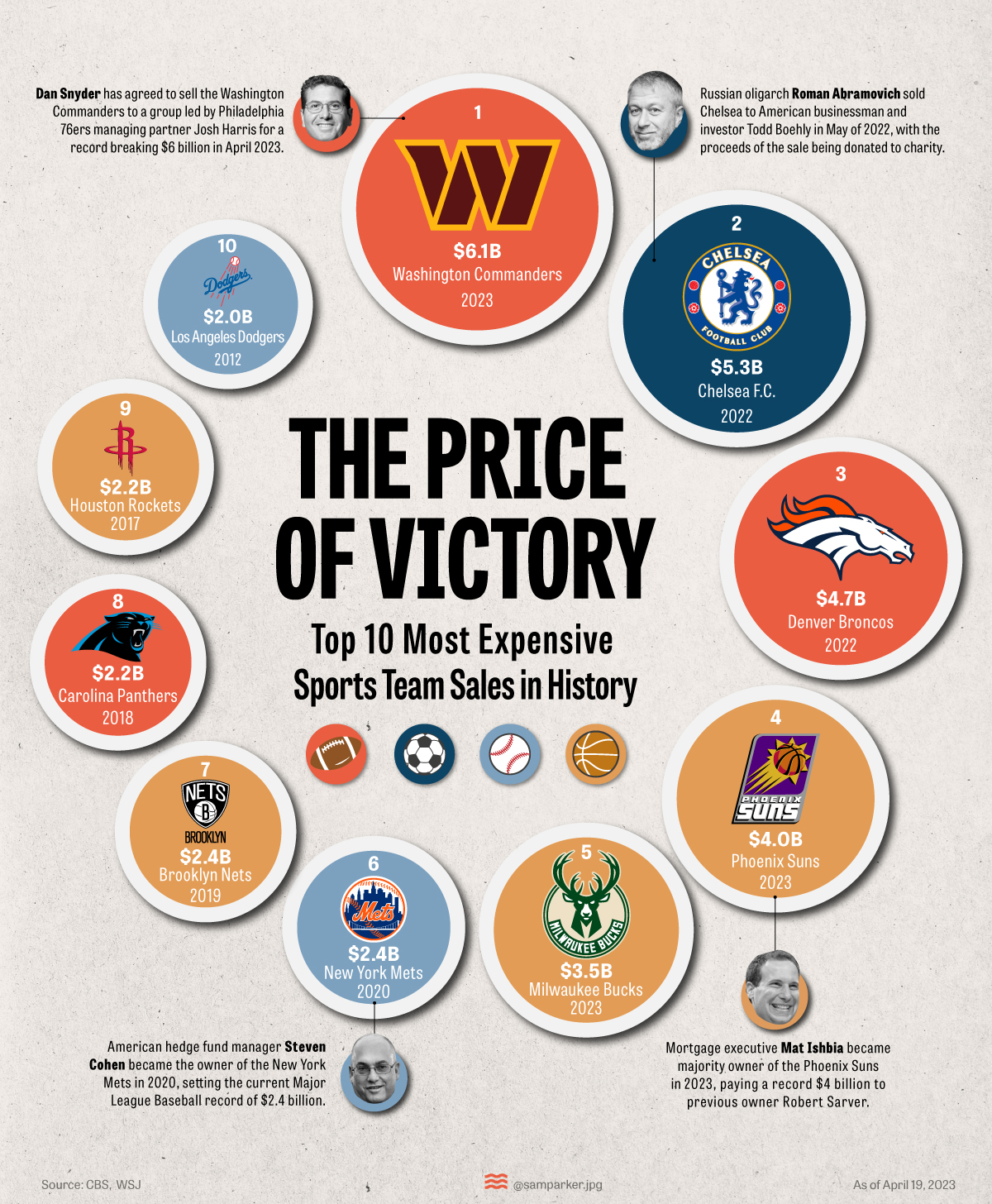

Ranked: The Most Expensive Sports Team Sales in History

Ranking the Biggest Sports Team Sales in History

After a record-setting year in 2022, professional sports team sales are on an uptick yet again.

The tentative $6.05 billion Washington Commanders sale, already approved by other NFL owners, will be the highest amount paid for a sports team once completed.

This graphic from Sam Parker shows how the Commanders’ April 2023 deal measures up against the biggest sports team sales in history, using data from the Wall Street Journal and CBS Sports.

Washington Commanders Sale vs. Other Franchise Fortunes

Valuations have become significantly larger in the last couple of years, with the largest sales all occurring after 2010. Here are the 10 most highly-priced sales for a professional sports team franchise globally.

| Rank | Team | Price | Year of Sale |

|---|---|---|---|

| 1 | 🏈 Washington Commanders | $6.1B | 2023 |

| 2 | ⚽ Chelsea Football Club | $5.3B | 2022 |

| 3 | 🏈 Denver Broncos | $4.7B | 2022 |

| 4 | 🏀 Phoenix Suns | $4.0B | 2023 |

| 5 | 🏀 Milwaukee Bucks | $3.5B | 2023 |

| 6 | ⚾ New York Mets | $2.4B | 2020 |

| 7 | 🏀 Brooklyn Nets | $2.4B | 2019 |

| 8 | 🏈 Carolina Panthers | $2.2B | 2018 |

| 9 | 🏀 Houston Rockets | $2.2B | 2017 |

| 10 | ⚾ Los Angeles Dodgers | $2.0B | 2012 |

The Washington Commanders sale takes the top spot at $6.1 billion, even though it could still be de-throned. It’s been reported that a $7 billion dollar bid for the team is still in play as well.

Dan Snyder, the current owner of the team, is one of the world’s richest people in sports. He purchased the team for $800 million in 1999 and, if the $6.1 billion sale completes, will have made a cumulative return of over 650%.

Chelsea Football Club is the only non-U.S. sale on the list. The sports team was previously owned by Roman Abramovich, a Russian oligarch who was subject to sanctions after Russia’s invasion of Ukraine and was forced to sell the team.

Hedge fund billionaire Todd Boehly, who was part of the consortium that purchased Chelsea, is also part owner of number 10 on the list: the LA Dodgers. Boehly is said to have helped with one of the “most dramatic turnarounds in North American sports” through his purchase of the Dodgers in 2012 for $2.0 billion, with the team wining the MLB World Series in 2020.

Will any sale top the Washington Commanders number? NFL teams specifically are some of the world’s most valuable teams, so the sale of a team such as the Dallas Cowboys or Los Angeles Rams could be worth more.

Other competition could come from soccer teams, including Chelsea rivals Manchester United or Liverpool. Manchester United’s owners put the club up for sale in 2022, hoping for a valuation of £5 billion to £6 billion ($6.2 billion to $7.5 billion).

Why Are Sports Team Sale Prices So High?

Sports teams haven’t always collected such sky-high prices like the Washington Commanders sale. In fact, sports teams used to be the investment of choice for eccentric entrepreneurs and were considered money-losing propositions.

So what’s changed? There are a number of factors driving high valuations and passionate interest from billionaires:

- Media deals: Digitization means sports now have a global audience, and broadcast rights have become a major driver of leagues’ revenue growth. For example, the NFL has $115 billion in long-term media rights deals with major TV networks, Amazon, and Google’s YouTube TV.

- Industry monopoly: There were once a handful of professional baseball leagues, but Major League Baseball earned an exemption from antitrust (pro-competition) laws in 1922. Other sports leagues have conglomerated to become the biggest and best representatives of their sport, making it nearly impossible for new entrants to compete.

- League benefits: Contracts negotiated at a league level are equally split between every league’s sports team. The Packers, the only NFL team with public financial statements, earned 60% of their income from national sources in 2022. Most leagues also have salary caps which limit player costs.

- Favorable Taxes: In 2004, the U.S. federal government introduced a rule allowing sports team owners to write off most of their purchase price against team profits over 15 years.

Beyond these factors, perhaps the biggest driver of sports team value is the prestige associated with owning one.

“Sports teams are a bit of a vanity asset, like owning a Picasso, and the highest bidder is going to be a very rich person who wants to own the team so they (can) call themselves an owner of a sports team.” — Stephen Dodson, Portfolio Manager of Bretton Fund

This article was published as a part of Visual Capitalist's Creator Program, which features data-driven visuals from some of our favorite Creators around the world.

Wealth

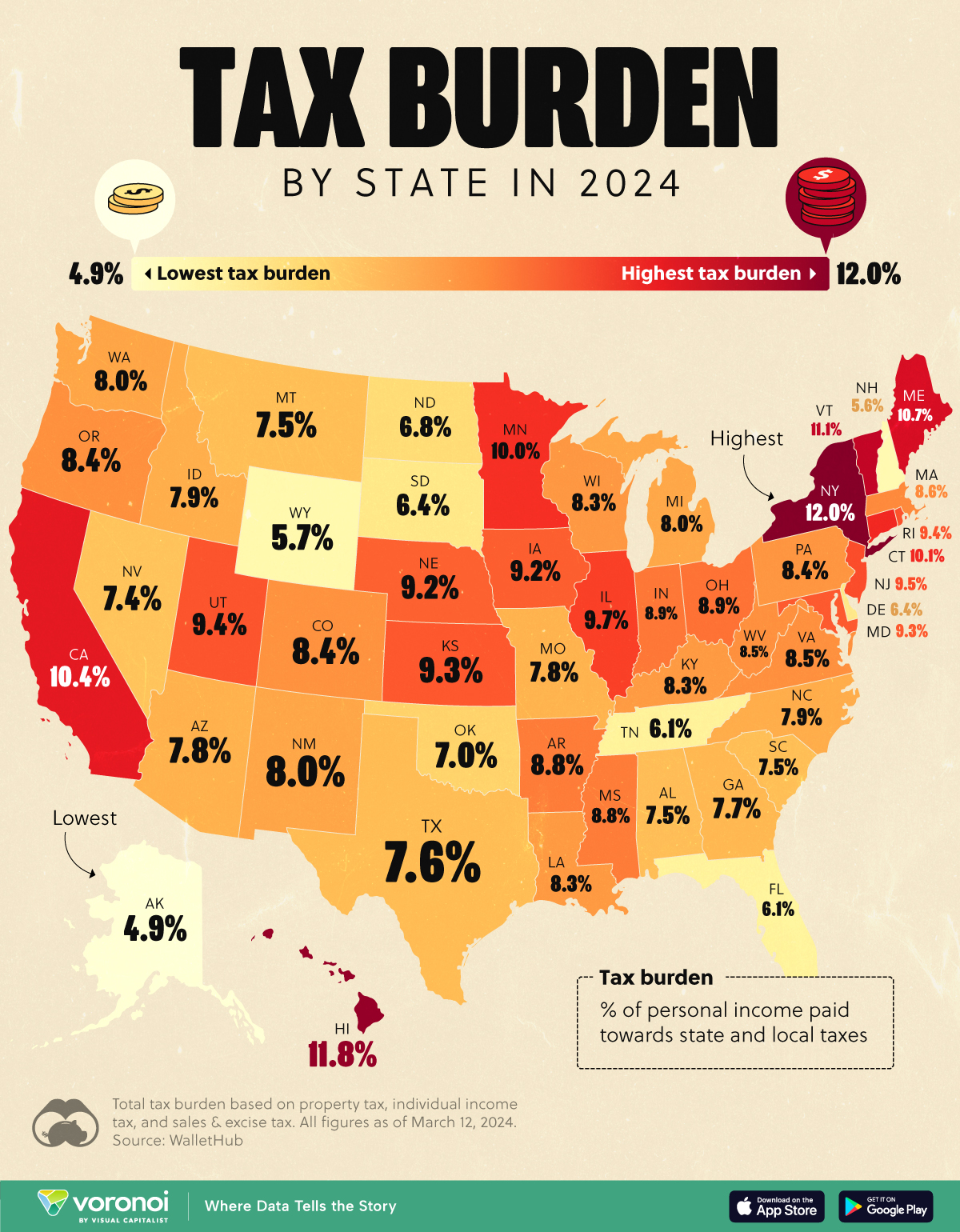

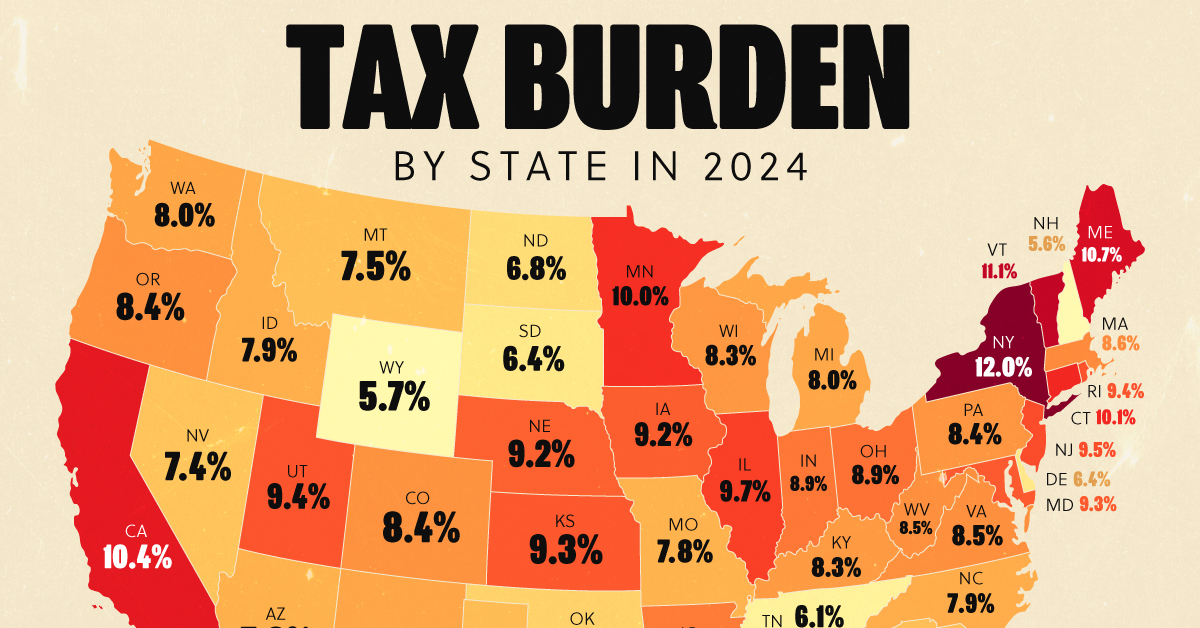

Visualizing the Tax Burden of Every U.S. State

Tax burden measures the percent of an individual’s income that is paid towards taxes. See where it’s the highest by state in this graphic.

Visualizing the Tax Burden of Every U.S. State

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This map graphic visualizes the total tax burden in each U.S. state as of March 2024, based on figures compiled by WalletHub.

It’s important to understand that under this methodology, the tax burden measures the percent of an average person’s income that is paid towards state and local taxes. It considers property taxes, income taxes, and sales & excise tax.

Data and Methodology

The figures we used to create this graphic are listed in the table below.

| State | Total Tax Burden |

|---|---|

| New York | 12.0% |

| Hawaii | 11.8% |

| Vermont | 11.1% |

| Maine | 10.7% |

| California | 10.4% |

| Connecticut | 10.1% |

| Minnesota | 10.0% |

| Illinois | 9.7% |

| New Jersey | 9.5% |

| Rhode Island | 9.4% |

| Utah | 9.4% |

| Kansas | 9.3% |

| Maryland | 9.3% |

| Iowa | 9.2% |

| Nebraska | 9.2% |

| Ohio | 8.9% |

| Indiana | 8.9% |

| Arkansas | 8.8% |

| Mississippi | 8.8% |

| Massachusetts | 8.6% |

| Virginia | 8.5% |

| West Virginia | 8.5% |

| Oregon | 8.4% |

| Colorado | 8.4% |

| Pennsylvania | 8.4% |

| Wisconsin | 8.3% |

| Louisiana | 8.3% |

| Kentucky | 8.3% |

| Washington | 8.0% |

| New Mexico | 8.0% |

| Michigan | 8.0% |

| North Carolina | 7.9% |

| Idaho | 7.9% |

| Arizona | 7.8% |

| Missouri | 7.8% |

| Georgia | 7.7% |

| Texas | 7.6% |

| Alabama | 7.5% |

| Montana | 7.5% |

| South Carolina | 7.5% |

| Nevada | 7.4% |

| Oklahoma | 7.0% |

| North Dakota | 6.8% |

| South Dakota | 6.4% |

| Delaware | 6.4% |

| Tennessee | 6.1% |

| Florida | 6.1% |

| Wyoming | 5.7% |

| New Hampshire | 5.6% |

| Alaska | 4.9% |

From this data we can see that New York has the highest total tax burden. Residents in this state will pay, on average, 12% of their income to state and local governments.

Breaking this down into its three components, the average New Yorker pays 4.6% of their income on income taxes, 4.4% on property taxes, and 3% in sales & excise taxes.

At the other end of the spectrum, Alaska has the lowest tax burden of any state, equaling 4.9% of income. This is partly due to the fact that Alaskans do not pay state income tax.

Hate Paying Taxes?

In addition to Alaska, there are several other U.S. states that don’t charge income taxes. These are: Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming.

It’s also worth noting that New Hampshire does not have a regular income tax, but does charge a flat 4% on interest and dividend income according to the Tax Foundation.

Learn More About Taxation From Visual Capitalist

If you enjoyed this post, be sure to check out this graphic which ranks the countries with the lowest corporate tax rates, from 1980 to today.

-

Markets5 days ago

Markets5 days agoMapped: The Most Valuable Company in Each Southeast Asian Country

-

Markets2 weeks ago

Markets2 weeks agoThe Top Private Equity Firms by Country

-

Jobs2 weeks ago

Jobs2 weeks agoThe Best U.S. Companies to Work for According to LinkedIn

-

Economy2 weeks ago

Economy2 weeks agoRanked: The Top 20 Countries in Debt to China

-

Politics1 week ago

Politics1 week agoCharted: Trust in Government Institutions by G7 Countries

-

Energy1 week ago

Energy1 week agoMapped: The Age of Energy Projects in Interconnection Queues, by State

-

Mining1 week ago

Mining1 week agoVisualizing Global Gold Production in 2023

-

Markets1 week ago

Markets1 week agoVisualized: Interest Rate Forecasts for Advanced Economies