Money

Visualizing the Ranking of 100 Common Careers

If you’re like most Americans, you probably spend more than 40 hours a week on the job.

For this reason, your career of choice plays a big role in determining your overall well-being. Not only does your profession have a massive influence on the potential money you make, but it also impacts your stress, work-life balance, happiness, and feeling of accomplishment.

However, it’s well-known that not all careers are created equally – and while some are stress-free with comfortable salaries, others can be high-stress without the compensation to make up for it.

Ranked: 100 Common Careers

Today’s chart uses data from the 2018 Jobs Rated Report by CareerCast.com, and we’ve used it to rank 100 of the most common careers based on median income, as well as three other categories: stress, growth outlook, and workplace environment.

The careers at the top of the list below have the best aggregate score, while the jobs towards the end of the list tend to be high-stress, low-income.

The 2018 Jobs Rated Report uses median income, as well as three other key categories to compile its rankings of common careers:

- Workplace:

A score based on the relative physical and mental demands for the job - Stress:

A weighting of 11 different stress factors, which range from “deadlines” to “own life at risk” - Growth Outlook:

Factors such as employment growth, income growth potential, and unemployment

See the full methodology here, for a more detailed explanation of the above categories.

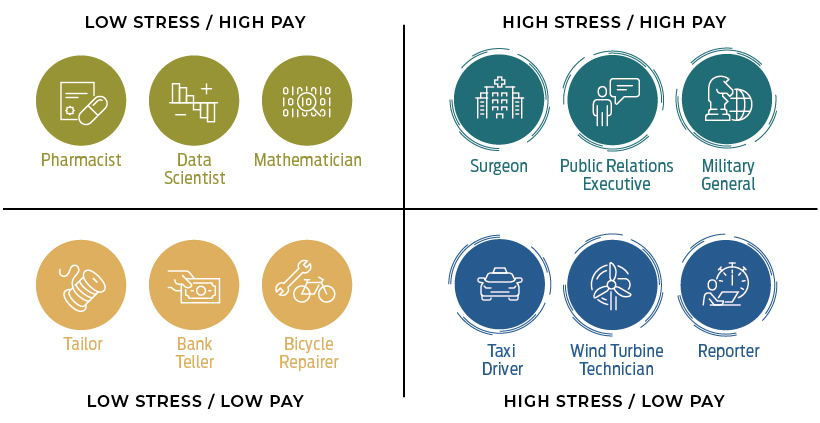

Choosing the Optimal Career

If your goal is to maximize income, then traditional high-paying careers – like being a lawyer, doctor, investment banker, or senior corporate executive – are a good way to go.

For many people, however, a good career is defined as being more than just having high earning potential. Ideally, it’s also low-stress, while providing a healthy workplace that makes workers look forward to their jobs every day.

For people that think that way, it seems like being a pharmacist or a data scientist might present the best of both worlds:

At the same time, it may be safe to say that taxi drivers and reporters get the worst of both worlds: high stress and low pay.

Where does your occupation fall on the money/stress spectrum? Do you feel like the ranking above provides an accurate representation of your career?

Wealth

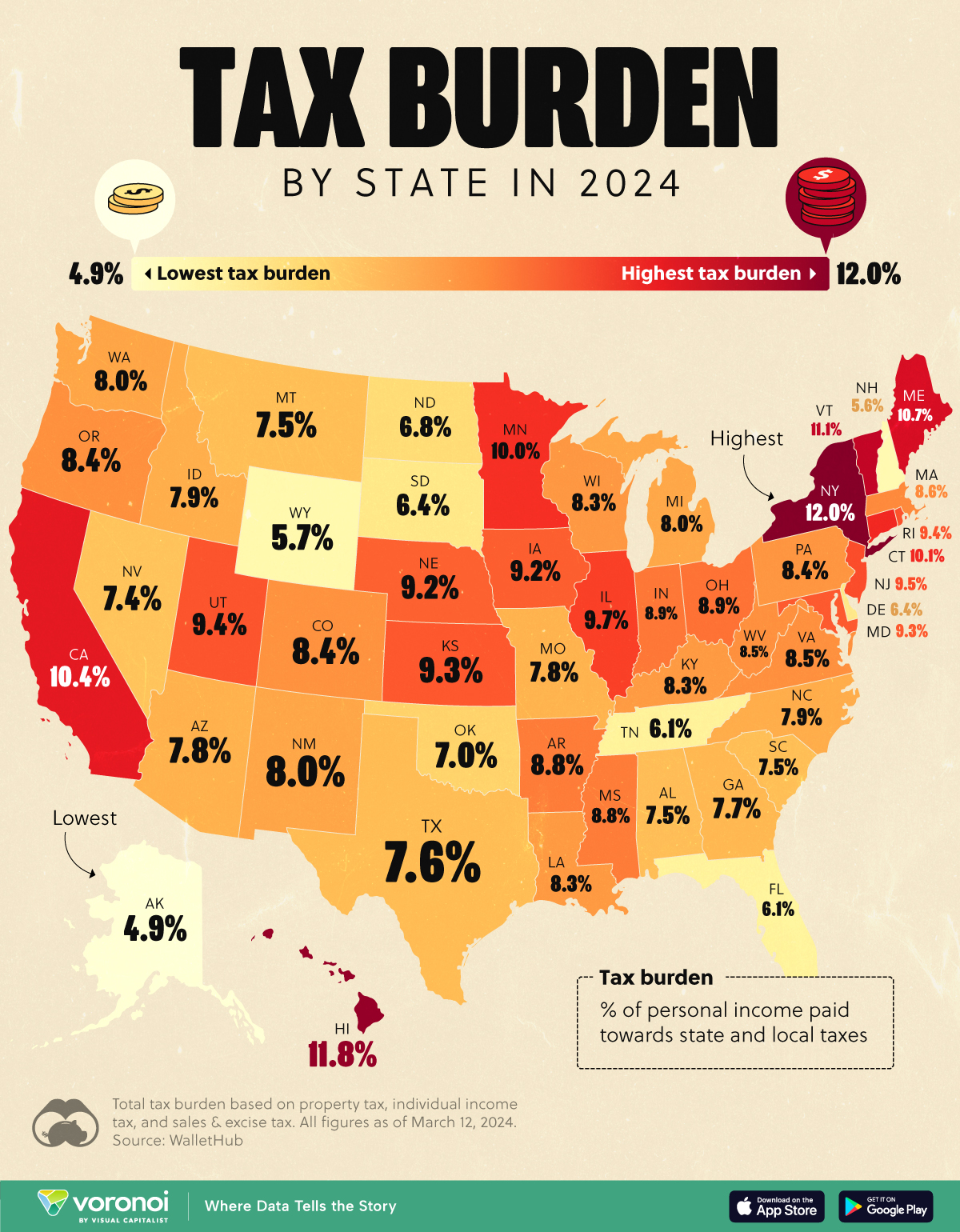

Visualizing the Tax Burden of Every U.S. State

Tax burden measures the percent of an individual’s income that is paid towards taxes. See where it’s the highest by state in this graphic.

Visualizing the Tax Burden of Every U.S. State

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This map graphic visualizes the total tax burden in each U.S. state as of March 2024, based on figures compiled by WalletHub.

It’s important to understand that under this methodology, the tax burden measures the percent of an average person’s income that is paid towards state and local taxes. It considers property taxes, income taxes, and sales & excise tax.

Data and Methodology

The figures we used to create this graphic are listed in the table below.

| State | Total Tax Burden |

|---|---|

| New York | 12.0% |

| Hawaii | 11.8% |

| Vermont | 11.1% |

| Maine | 10.7% |

| California | 10.4% |

| Connecticut | 10.1% |

| Minnesota | 10.0% |

| Illinois | 9.7% |

| New Jersey | 9.5% |

| Rhode Island | 9.4% |

| Utah | 9.4% |

| Kansas | 9.3% |

| Maryland | 9.3% |

| Iowa | 9.2% |

| Nebraska | 9.2% |

| Ohio | 8.9% |

| Indiana | 8.9% |

| Arkansas | 8.8% |

| Mississippi | 8.8% |

| Massachusetts | 8.6% |

| Virginia | 8.5% |

| West Virginia | 8.5% |

| Oregon | 8.4% |

| Colorado | 8.4% |

| Pennsylvania | 8.4% |

| Wisconsin | 8.3% |

| Louisiana | 8.3% |

| Kentucky | 8.3% |

| Washington | 8.0% |

| New Mexico | 8.0% |

| Michigan | 8.0% |

| North Carolina | 7.9% |

| Idaho | 7.9% |

| Arizona | 7.8% |

| Missouri | 7.8% |

| Georgia | 7.7% |

| Texas | 7.6% |

| Alabama | 7.5% |

| Montana | 7.5% |

| South Carolina | 7.5% |

| Nevada | 7.4% |

| Oklahoma | 7.0% |

| North Dakota | 6.8% |

| South Dakota | 6.4% |

| Delaware | 6.4% |

| Tennessee | 6.1% |

| Florida | 6.1% |

| Wyoming | 5.7% |

| New Hampshire | 5.6% |

| Alaska | 4.9% |

From this data we can see that New York has the highest total tax burden. Residents in this state will pay, on average, 12% of their income to state and local governments.

Breaking this down into its three components, the average New Yorker pays 4.6% of their income on income taxes, 4.4% on property taxes, and 3% in sales & excise taxes.

At the other end of the spectrum, Alaska has the lowest tax burden of any state, equaling 4.9% of income. This is partly due to the fact that Alaskans do not pay state income tax.

Hate Paying Taxes?

In addition to Alaska, there are several other U.S. states that don’t charge income taxes. These are: Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming.

It’s also worth noting that New Hampshire does not have a regular income tax, but does charge a flat 4% on interest and dividend income according to the Tax Foundation.

Learn More About Taxation From Visual Capitalist

If you enjoyed this post, be sure to check out this graphic which ranks the countries with the lowest corporate tax rates, from 1980 to today.

-

Brands5 days ago

Brands5 days agoThe Evolution of U.S. Beer Logos

-

Culture2 weeks ago

Culture2 weeks agoThe World’s Top Media Franchises by All-Time Revenue

-

voronoi2 weeks ago

voronoi2 weeks agoBest Visualizations of April on the Voronoi App

-

Wealth2 weeks ago

Wealth2 weeks agoCharted: Which Country Has the Most Billionaires in 2024?

-

Business1 week ago

Business1 week agoThe Top Private Equity Firms by Country

-

Markets1 week ago

Markets1 week agoThe Best U.S. Companies to Work for According to LinkedIn

-

Economy1 week ago

Economy1 week agoRanked: The Top 20 Countries in Debt to China

-

United States1 week ago

United States1 week agoCharted: Trust in Government Institutions by G7 Countries