Two cobalt salt plants in China’s eastern province of Zhejiang halted production on December 10 in response to local Chinese coronavirus “flare-ups,” the Global Times reported Thursday, noting the labor suspensions threaten to cause a spike in the prices of lithium-ion batteries for electric vehicles, which rely on cobalt as a key component.

The two mines affected by the closures produced a combined cobalt sulfate output of 700 tons in November 2021, a figure representing “about 12 percent of the total supply of cobalt sulfate in China that month, while their combined output of cobalt chloride reached 600 tons, accounting for 14 percent of the total supply,” Ma Rui, an analyst with the Shanghai Metals Market, an industry news site, told the Global Times on December 16.

“[I]t’s hard to tell when the two plants could resume production,” Ma said when asked how long he predicted the two cobalt mines to remain shuttered.

The average price of lithium-ion batteries used in electric vehicle production has increased by more than 60 percent over the past year, according to Ma. The metals industry analyst attributed the rising prices to a corresponding increase in the price of raw materials used to build the batteries. In addition to cobalt, lithium-ion batteries used to power electric vehicles typically contain lithium, nickel, graphite, aluminum, and copper.

Over 70 percent of the world’s cobalt supply comes from mines in the Democratic Republic of the Congo (DRC), most of which are owned by Chinese firms.

“As of last year, 15 of the 19 cobalt-producing mines in Congo were owned or financed by Chinese companies,” the New York Times reported on December 7, citing a data analysis conducted jointly by the newspaper and Benchmark Mineral Intelligence.

“Deadly rioting in July near a port in South Africa, where much of Congo’s cobalt is exported to China and elsewhere, caused a global jump in the metal’s prices, a surge that only worsened through the rest of the year,” according to the newspaper.

“Last month, the mining industry’s leading forecaster said the rising cost of raw materials was likely to drive up battery costs for the first time in years, threatening to disrupt automakers’ plans to attract customers with competitively priced electric cars,” the Times recalled on December 7.

Chile, which is closely tied to China through Beijing’s infrastructure-building Belt and Road Initiative (BRI), supplies nearly 25 percent of the world’s lithium. Roughly 30 percent of the world’s copper supply also comes from Chile.

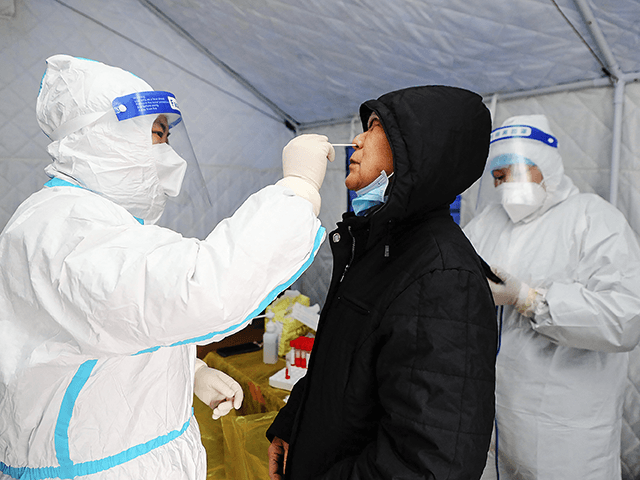

Zhejiang authorities ordered two of the province’s major cobalt salt mines to halt production on December 10 due to alleged “flare-ups” of the Chinese coronavirus, according to the Global Times. While the state-run newspaper did not provide further details about the plants’ coronavirus outbreaks, news of the mines’ closures leaked on December 16, the same day Dongguan, a major manufacturing hub in Zhejiang, severely restricted travel out of the city to contain its own coronavirus epidemic.

COMMENTS

Please let us know if you're having issues with commenting.