CNBC's Jim Cramer said Friday that he is perplexed by the bullish reviews L Brands, the holding company of Victoria's Secret and Bath & Body Works, has received from the analyst community.

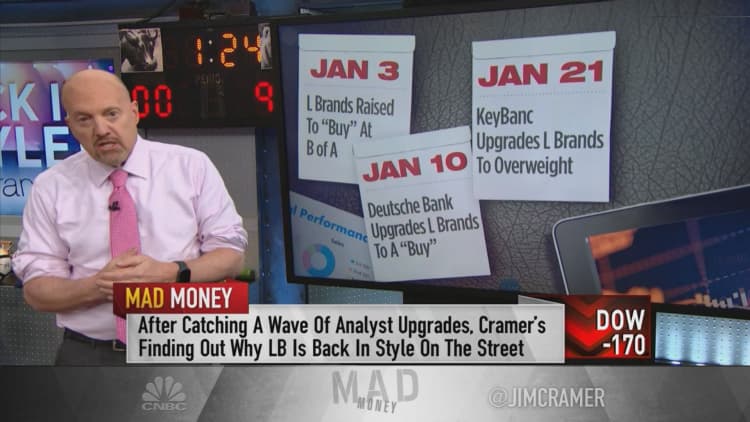

Four analysts have turned positive on the downtrodden stock since the beginning of the trading year, forecasting that a shakeup is on the horizon.

"See, L Brands is practically a disaster area," the "Mad Money" host said, noting the stock has lost most of its value since late 2015. "They have a major presence in shopping malls all over the country, especially Victoria's Secret, so the steady decline of the mall has crushed them."

L Brands peaked around $100 that year before spiraling below $16 per share by the second half of 2019. The stock, however, has had good luck thus far in the new decade, climbing 14% to almost $21 as of Friday's close.

Over the span of three weeks, analysts at Bank of America, Deutsche Bank, Keybanc and Barclays all issued upgrades on the security and are projecting an L Brands breakup in the future. On Thursday, Barclays analyst Adrienne Yih said in a note "change is afoot" because the "status quo is not an option."

Cramer, however, said that he's "wary about jumping on the bullish bandwagon" after the multiple upgrades.

"If you're going to bet on a turnaround, you have to get in early before there's any significant evidence that things are getting better," he said, adding "analysts who are rushing to upgrade the stock" after the run seem "overzealous."

Victoria's Secret is the sore spot in L Brands' recovery efforts, Cramer said. Sales at Victoria's Secret, which makes up a majority of the parent's business, have declined in eight of the last 11 quarters. In that same span, Bath & Body Works sales have grown consistently, including double-digit growth in seven of those quarters, according to FactSet.

"I think Bath & Body Works is thriving because it appeals to the millennial love for self-care," Cramer said. "This is a brand that's now as [much] in as Victoria's Secret is very much out. I want to own a standalone Bath & Body Works, but we don't have one."

L Brands, which has been restructuring since 2016, refused to embrace e-commerce as consumers began shopping digitally, Victoria's Secret and its annual fashion show has lost the luster, all the while new competition has emerged, Cramer highlighted. L Brands also sold off Canadian lingerie company La Senza and cut its dividend in 2018, the host added.

The analysts, however, are banking on activist investors such as Barington Capital to change leadership or force a breakup that unlocks value.

"Turnarounds take time and you can lose a fortune while you're waiting for an intractable management to do the right thing," Cramer said. "Even then, I don't think it will happen overnight and I wouldn't be surprised if there's another dividend cut because the pain from Victoria's Secret is so severe. If it gets any worse, I think the business will be losing L Brands' money."

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com