Snap was the best comeback stock last year, and the company poses an enticing opportunity for investors to play, though there are obstacles to work through, CNBC's Jim Cramer said Thursday.

"I do think the stock of Snap has more upside, and I am painfully aware that I am late after this run, but I don't love that it's catching so many upgrades going into its next earnings report" next month, the "Mad Money" host said. "I recommend if you like Snap putting on half your position before the quarter, then if the stock gets hit after the quarter you can go back" and buy more.

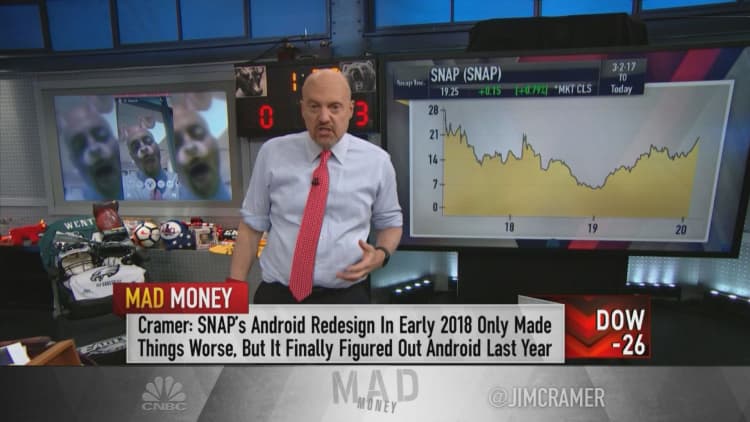

Shares of Snap, the parent of Snapchat camera app, have nearly tripled since bottoming under $5 near the end of 2018 as revenue growth slowed. The social media platform took a number of blows that caused its user base to dwindle after Facebook-owned Instagram adopted its story concept, Snapchat rolled out a new interface that was widely unpopular and Kylie Jenner said she no longer opens the app.

Snap's growth rate peaked at the end of 2017 before going through four straight quarters of slowing sales, though it continues to lose money, according to FactSet. Sales growth has picked up in the past three quarters, and multiple analysts released bullish notes on the stock in recent weeks, citing better user numbers and improved advertising.

In its research, a Jefferies analyst said the company has a pathway to profitability. Snap has surged almost 18% thus far in 2020 alone.

Snap's fortunes started to change after it turned in two better-than-expected quarters last year.

"That's the most crucial piece of the puzzle here. For its first two years as a public company, no one trusted Snap because they kept missing the numbers. That's reasonable," Cramer said. "But over time, they've steadily become more consistent to the point where they have earned the benefit of the doubt and it now makes a habit of smashing the estimates."

Facebook and Twitter still represent tough competition for Snapchat going forward, and the increasingly popular video-sharing TikTok app could be another thorn in its side. Cramer said Snap can hold its own as long as it continues beating Wall Street's estimates.

Analysts are looking for $562 million of revenue and losses of 12 cents when Snap reveals its latest quarterly results in early February. That would sum up to $1.7 billion of revenue and 69 cents in losses per share for full-year 2019, FactSet said.

"The company's expected to make 92 cents [a share] in 2023. This thing is trading at only 21 times the outyear earnings estimates. That makes it a steal even after this run, but again only if they make the numbers, but I think they are," Cramer said. "If the estimates are too low, this thing's headed into the stratosphere. It's the right stock for this environment."

Snap rose 0.79% in Thursday's session to close at $19.25 per share.

Disclosure: Cramer's charitable trust owns shares of Facebook.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com