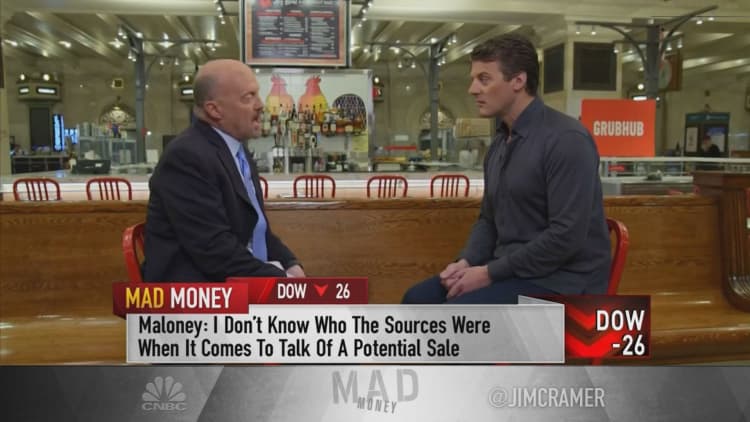

GrubHub is not actively in the market to be acquired, but the food delivery provider is open ears, CEO Matt Maloney told CNBC's Jim Cramer Thursday.

GrubHub shares surged double digits earlier this month on reports that a possible sale was on the table, and of interest from four grocers, though the company later denied rumors. The door does appear to be open.

"We would totally evaluate any offer, but we haven't had one yet," Maloney said in a "Mad Money" interview. "I think [reporters] were barking up the wrong tree."

The comments come as competition in the digital food delivery space is reaching a tipping point. Third-party delivery aggregators have been a boon for restaurants, but the business is a low-margin one, which makes it challenging to grow profits without hiking prices for the service. Morgan Stanley projects digital food delivery will grow 31% to a $467 billion market over the next five years.

Maloney said "there's a reckoning coming to the industry" and flagged that it could come within the next 12 months.

"I think it's going to be 2020," he said when asked if consolidation is necessary.

The host also posed if the collapse of WeWork in 2019 was a warning sign for the food delivery industry, which Maloney agreed.

"I think so," he said. "I think we're already like two steps — I mean, we're in the early innings, but what happens this year is going to be interesting."

Cramer, who sat with Maloney for a discussion inside of New York City's Grand Central Terminal, proposed if GrubHub would have any interest in acquiring its unprofitable rival DoorDash, the leading third-party digital food delivery provider.

DoorDash holds 33% market share, followed by GrubHub at 32%, Uber Eats at 10% and Postmates at 10%, according to analytics firm Second Measure. GrubHub commanded 43% of the market in 2018, but was surpassed by DoorDash after sales improved by triple digits lead last year.

GrubHub, who has turned full-year profits in each of the past six years, is valued by the market as roughly $5 billion. The private, SoftBank-backed DoorDash was valued at nearly $13 billion in November.

In response, Maloney said private valuations are "based on nothing," adding "if you're selling dollars for 80 cents, I feel like that's unsustainable, but it grows fast."

"If you double your business with a highly unprofitable [one], you're going — you're going to screw up your unit economics," Maloney said. "So you've got to figure out how to reconcile the business before you really see the benefits of consolidation."

There has been some consolidation in food delivery in recent years. Square left the space after selling Caviar to DoorDash for $410 million last August. Amazon ditched its own on-demand restaurant food delivery service last summer, and Uber sold off its India program to a competitor earlier this week.

GrubHub on Thursday revealed that it is offering a new service that targets restaurant pickups. With its new platform called Ultimate, the program is a step toward "revolutionizing pickup," Maloney told Cramer.

The service has gone through years of in testing at 10 major universities, including the campuses of Ohio State University and the University of Arizona, and local diners, he said. GrubHub is looking to sign stadium deals to let event goers order from their seats.

"The days of walking into a restaurant and seeing those 10 people, and in line, and having to stand there, and wait, and wait, and wait until you can talk to someone — they're gone," Maloney said.

Maloney is banking on Ultimate to separate the app from the alternatives.

"It's widely documented that over $250 billion [is] in U.S. domestic take out. Over half of that is pickup, and by the way none of my competitors are addressing pick up," he said.

GrubHub shares rose 2.4% to $57.74 in Thursday's session.

Disclosure: Cramer's charitable trust owns shares of Amazon.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com