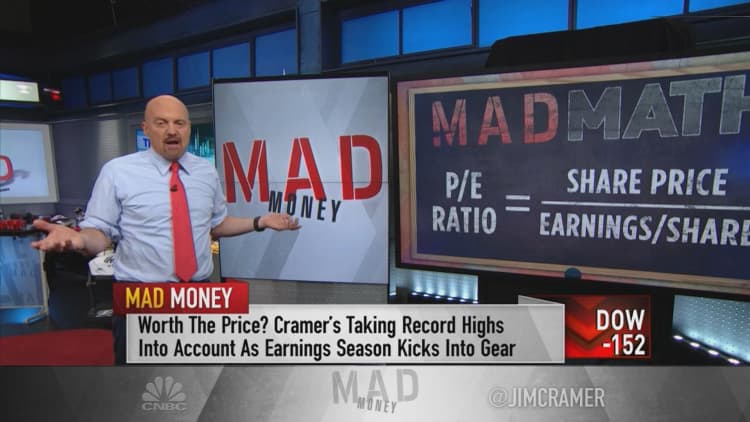

CNBC's Jim Cramer laid out a roadmap Tuesday for investors worried about the stock market's valuation as earnings season gets underway.

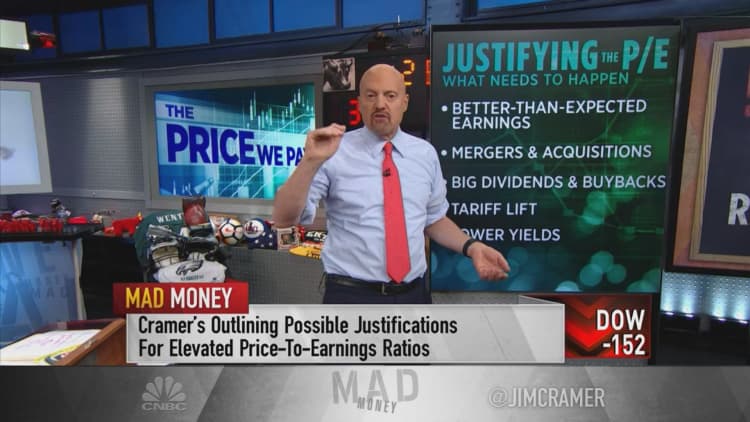

The "Mad Money" host said there are five main areas on which to focus in order to determine whether the market is overvalued.

The S&P 500 is currently trading around 22 times earnings, and "historically that's pretty expensive," Cramer said.

The current situation is reminiscent of the major sell off that came prior to the 2018 Super Bowl, Cramer said, when money managers sold off S&P 500 futures in response to fears of rising inflation.

Here's the five things Cramer said need to happen in order for the market to make it "through earnings season unscathed."

Surpass expectations

The major banks signaled the start to earnings season last week, and their reports came in better than expected, Cramer said. The strong showing will need to be replicated across other sectors, he argued.

J.P. Morgan Chase, for example, reported quarterly earnings that "made its stock look too cheap at 13 times earnings," he said.

It didn't rocket shares higher nor did they fall.

"It simply didn't go down, giving the stock a lower multiple on a higher earnings model," Cramer explained. "Now it sells for 12 times earnings."

Goldman Sachs and Morgan Stanley did not disappoint either. The former delivered a consistent number "when we expected inconsistency," Cramer said, while the latter still sells at the same multiple of 10 times earnings despite a "truly colossal quarter."

"Usually, these kind of results would trigger terrific rallies, but this is what happens in an expensive market," Cramer said.

M&A

The market reaction to the flurry of mergers and acquisitions in the fall were an indicator that stocks weren't as expensive as people worried, Cramer said in November.

That was after the news that Charles Schwab planned to buy TD Ameritrade and LVMH made a deal for Tiffany.

While a similar level of M&A activity hasn't materialized so far in 2020, Cramer said it remains an indicator of which to be mindful.

"If we see companies buying other companies, that's a sure sign that these valuations are actually legitimate, that we aren't paying too much," he said.

Dividends and buybacks

Cramer said there is a collective misreading of what dividend boosts and buybacks mean for companies' stocks.

He pointed to Citigroup, which has retired about 33% of its outstanding shares in recent years. It has plans to cut back another 8% if the stock continues trading around its book value, Cramer said.

"The buybacks put an immense floor under the stock," he explained. "Meanwhile, dividend boosts are tremendous sources of strength, albeit one that's often ignored by this show and all shows. It shouldn't be ignored."

Tariff relief

The drag caused by the U.S.-China trade war has started to be removed with last week's signing of a "phase one" agreement, Cramer said.

It's caused "many underperforming stocks to start outperforming," even thought it may take months for the tariffs to be officially rolled back.

"But once they do we have to believe it will allow the earnings of many companies to blossom," he said.

Bond yields

The state of bond yields, which move inversely to price, is in some ways what Cramer is most worried about.

"If we get a wholesale decline in bond prices, causing a surge in bond yields, suddenly the stock market will have some serious competition," Cramer said. "It can happen."

The yield on the benchmark 10-year Treasury note fell below 1.8% on Tuesday as an outbreak of a new strain of coronavirus linked to pneumonia in China caused investors to flee risk assets. The yield on the 30-year Treasury bond also was down at 2.229%.

Cramer also drew attention to the recent weakness of the dollar, which he said has transpired as overseas investors pause their "relentless purchases" of U.S. Treasurys.

"If bond yields don't roll over, this market will suddenly start seeming a lot more expensive," he explained.

Bottom line

"We need a few items on this checklist if the averages are going to tread water here," Cramer said. "We need all five for the averages to rally."

As for what happens if none of the five items?

"Well look out below," he said.

Disclosure: Cramer's charitable trust owns shares of Goldman Sachs, J.P. Morgan Chase and Citigroup.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com