SurveyMonkey tanked as much as 19 percent Thursday, a day after reporting fourth-quarter earnings results.

The stock ended trading more than 15 down at $11.85 per share.

The company reported a loss per share of 3 cents, exactly in line with Wall Street estimates, and quarterly revenue of $67.9 million, beating out consensus estimates of $65.9 million. The company also announced Tim Maly, who serves as both chief financial officer and chief operating officer, is retiring during the second quarter.

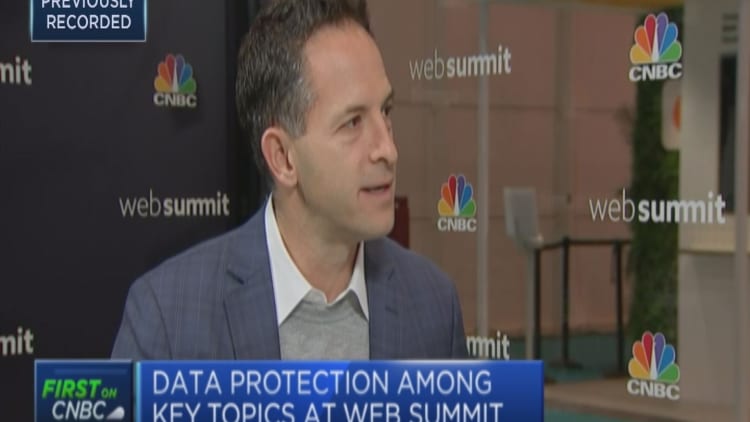

"We're a 19-year-old company, we have had a lot of private shareholders for a long time and the lock-up expiration could well contribute to some of the selling supply today," CEO Zander Lurie told CNBC's "Squawk Alley" Thursday. "But I'm super confident in our long-term focus and if we deliver results I know shareholders will profit as well."

SurveyMonkey, formally SVMK Inc., posted a GAAP net loss for the quarter of $25 million, marking a sharp decline from the $8 million in net income that SurveyMonkey brought in during the fourth quarter of 2017.

The company reported a GAAP net loss for the full-year 2018 of $155 million, compared with a net loss of $24 million the year before. SurveyMonkey has previously attributed some of its steep 2018 costs to the company's IPO in September.

The company's shares have taken a tumble since debuting on the public markets. Shares now trade more than 20 percent below the $17 per-share price it closed at on its first day.

The stock is off nearly 40 percent from all-time highs.

WATCH: Tech firms need to build trust with consumers, says SurveyMonkey CEO