The stocks of a few top-notch Chinese companies may have already bottomed as a result of the U.S.-China trade dispute and could soon be buying opportunities for investors, a top chartist tells CNBC's Jim Cramer.

Cramer, who has been steering investors away from Chinese stocks for the better part of the dispute, said he wouldn't blame anyone for thinking Chinese investments were too risky, especially after China announced that its economy grew at the slowest pace in nearly three decades last year.

But when he checked in with technician Dan Fitzpatrick, the founder and president of StockMarketMentor.com and Cramer's colleague at RealMoney.com, he started to see things a little differently.

"Fitzpatrick has a really interesting thesis: He thinks the current weakness is already priced into many of the largest, highest-profile Chinese stocks," Cramer said on Tuesday. "Looking at the charts, he believes they've already bottomed [and] they're not going to take that bottom out, which means dips, like the one we had today, ... should be treated as buying opportunities."

Cramer, host of "Mad Money," explained this phenomenon: because the stock market is "a forecasting machine," it tries to predict what could happen six to nine months from now. So, when China released its latest economic data, it should've already been baked into most stock prices.

"The market will almost always peak before the economy peaks," Cramer said. "It will almost always bottom before the economy bottoms, and that's what Fitzpatrick's predicting with some of the better Chinese stocks."

First, Fitzpatrick analyzed the daily stock chart of JD.com, a Chinese e-commerce company. His take? The stock just made a "totally buyable double bottom" pattern at $20 a share, and, so far, has held above that level, Cramer said.

Fitzpatrick also noted that JD.com's stock managed to hold above its 50-day moving average after trading above it earlier in January, which signaled to him that JD.com could be ready to rally higher.

But the most important signal is coming from the stock's moving average convergence-divergence indicator, or MACD, which detects changes in a stock's path before they happen. That indicator has been soaring since September, which, coupled with the stock's relative inaction, is usually a signal that a stock has "a lot more upside," Cramer said.

"Still, Fitzpatrick says that the stock is kind of caught in the middle of no man's land" between its $21 floor and its $24 ceiling, where it peaked earlier this month, Cramer said. "If the stock pulls back any lower, it could stay stuck down there for a while."

However, if the stock can break through the $24 level, and Fitzpatrick believes it can, then it could climb as high as $29, the "Mad Money" host continued. Fitzpatrick would buy in as soon as it passes the key $24 threshold.

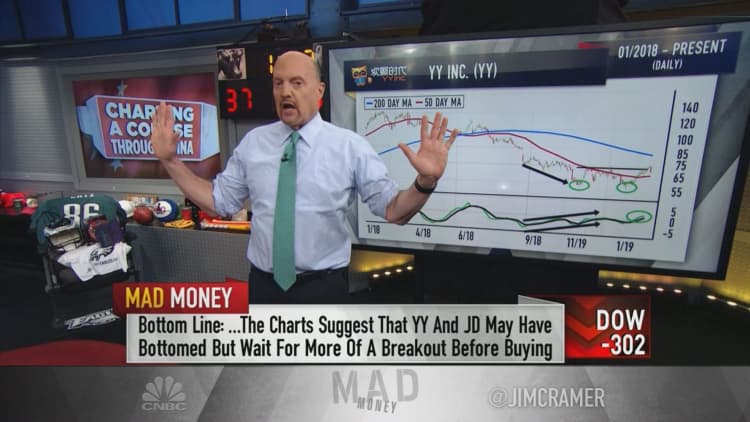

Also on the table for Fitzpatrick was the stock of YY, a Chinese entertainment streaming platform-meets-social network. Like JD.com, its stock formed a double bottom pattern and climbed above its 50-day moving average in recent months.

"Right now, YY's trading at $68 and change. Fitzpatrick likes it as long as it holds above the 50-day moving average" of $65, Cramer said. "Now, the stock has a ceiling at about $70, but if it can break out above that, Fitzpatrick thinks it's smooth sailing to $85."

All in all, while Cramer has been wary of Chinese plays, it's always worth examining "the other side of the trade," he told investors.

"After today's brutal, in-part-China-driven sell-off around the world, it's worth considering whether some of these Chinese stocks may be in better shape than you'd expect," the "Mad Money" host said. "The charts, as interpreted by Dan Fitzpatrick, suggest that the best-of-breed China internet [stocks] like YY and JD.com may have already bottomed, although Fitz says you should wait for more of a breakout before you start buying either stock."

"I don't know if he's right, and I don't recommend buying any Chinese stocks because of the trade turmoil," Cramer continued. "But when just about everyone's negative on a particular group, it's always worth giving the other side of the trade some serious consideration."

WATCH: Technician tells Cramer some Chinese stocks are buys

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com