Despite the persistent selling in September, CNBC's Jim Cramer said Wednesday there continue to be areas of the stock market where investors should look to put cash to work.

In particular, the "Mad Money" host said large-cap tech names such as Amazon, Apple, Alphabet and Microsoft are close to levels that represent buying opportunities, while stocks with solid dividend payments such as General Mills and Johnson & Johnson are worth adding to portfolios now.

"But when it comes to anything else, you have to be patient," Cramer said Wednesday, which was another down day for Wall Street.

The Dow Jones Industrial Average gave up 525 points, or 1.9%, while the benchmark S&P 500 retreated by 2.4%. In a session filled with technology declines, the Nasdaq Composite fell by 3%. The pullback added to what has been a tough month. The 30-stock Dow has fallen 5.9% in September, the least of the major U.S. equity indexes. The Nasdaq has given up 9.7% while the S&P 500 is down 7.5%.

Cramer said he expects the market to remain volatile "until more of those overly bullish new investors throw in any towel that they may be holding," referring to the new cadre of people who began buying stocks during the coronavirus pandemic and took part in Wall Street's massive rally. From its late March virus-era bottom to its Sept. 2 record high, the S&P 500 rose more than 60%.

"When the market's roaring, a lot of investors seem to forget the most fundamental rule in the book: buy low, sell high. Instead, they want to buy high and sell higher," Cramer said. "The problem with that strategy is that when stocks go down, they go down hard—you tend to lose money a lot faster than you make it."

But Cramer said he sees opportunities to make money in those technology stocks since they have fallen back significantly from their levels earlier this month.

Apple, for example, now sits at $107 as of Wednesday's close after it fell more than 4% during the trading session. At that price, it is about 22% below its Sept. 2 high, according to Cramer. It had sank to 25% below on Monday, at around $103 per share.

Likewise, e-commerce giant Amazon hit a peak of around $3,500 earlier this month and ended Wednesday's session at roughly $3,000 per share. For it to be 25% from its high, the stock would need to fall to around $2,600, he said.

"Given that Amazon's still up 62% for the year, while Apple's only up 46%, that seems like a reasonable level to start buying," Cramer said.

"The same back of the envelope analysis tells me that Microsoft, currently at $200, becomes attractive at around $180, $175, but considering the stock's only up 27% for the year, it might bottom sooner," Cramer said.

The host added that Google-parent Alphabet is tougher to evaluate, given the stock has lagged its other large-cap tech peers and is only up 5.23% this year. It also is facing an antitrust inquiry from the Department of Justice, a potential headwind, he said.

"But it's got a ton of cash and .. terrific growth. If it keeps falling, I think you should buy it," he said.

On the other end of the spectrum, Cramer said investors should consider adding income-paying stocks to their portfolio, especially given the low-yield environment for U.S. Treasury bonds is likely to persist for years.

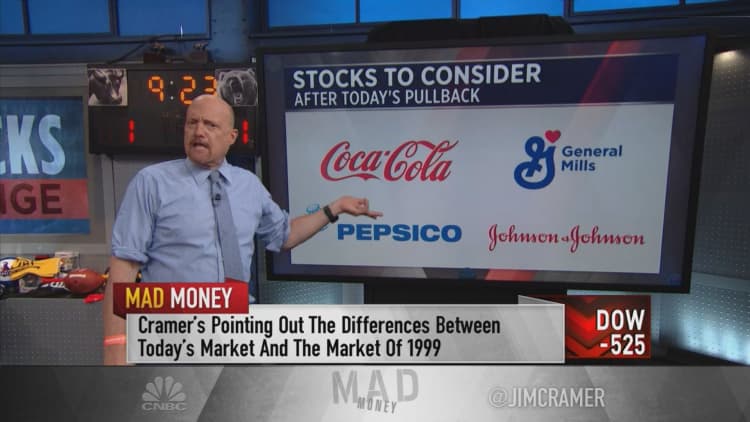

"If you want income, well here you go. These are like bonds that also have the ability to grow," he said. In addition to General Mills and Johnson & Johnson, Cramer recommended looking at PepsiCo and its chief rival, Coca-Cola. The stocks are off their highs and boast dividend yields of 3.12% and 3.34%, respectively.

"These stocks represent real value. I think you can buy some of them tomorrow and then buy more if they go lower," he said. "Plus, they have the added advantage of not having any hot money in them, whatsoever, so your fellow shareholders aren't going to panic and dump the stocks as they go lower."

Cramer stressed to investors that he was not "trying to lull you into a false sense of security" by recommending stocks to buy. After all, he said, "the market is getting pulverized" and it's impossible to predict when the selling were subside.

"But we do know when it makes sense to start buying into weakness: the high-fliers work down 25% from the top, and the defensives work when they yield north of 3%," he said.

Disclosure: Cramer's charitable trust owns shares of Amazon, PepsiCo, Johnson & Johnson, Alphabet and Microsoft.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com