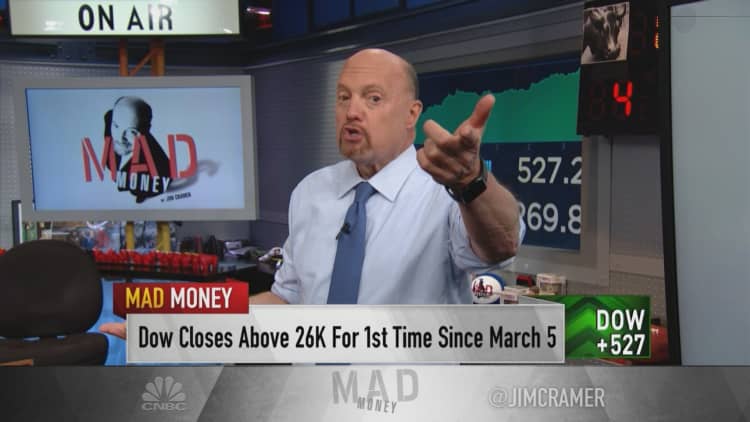

Wall Street roared on Wednesday as investors saw more signs of some sense of economic "normalcy," CNBC's Jim Cramer said after the market closed.

"Normalcy is shop until you drop. And today's action says that's exactly where we're headed," the "Mad Money" host said.

The major averages were lifted by the release of job market data that was better than feared. ADP and Moody's Analytics showed that private payrolls dropped by 2.76 million in May, less than a third of the 8.75 million that was predicted.

The Dow Jones Industrial Average shot up 527 points, or 2.05%, to 26,269.89 at the close. The S&P 500 and Nasdaq Composite rallied 1.36% and 0.78%, respectively. The latter, which is loaded with technology components, is now within 140 points of its record close in February, prior to the coronavirus-induced market meltdown.

Cramer said there was a "wholesale shift" in what stocks investors are buying on hopes of a V-shaped recovery from the Covid-19 lockdown.

"Today, we cheered when we saw that ADP report, even though it could potentially be an aberration, a number that's too bullish," he said. "We'll find out for sure on Friday when we get the Labor Department's nonfarm payroll report."

Investors are rotating stock holdings from the stay-at-home plays to the recovery ones, Cramer said. Money is also being pulled out of the bond market, he added. The yield on U.S. Treasury notes and bonds — which rise when demand falls — were all up at least 0.026% late Wednesday.

Drug stocks were also dumped by investors, and gold is less attractive when the economy appears to be recovering, he said.

"The major drug stocks either got pummeled or badly lagged the averages — they're too consistent for this market," Cramer said.

As for the stocks being bought, Cramer pointed to home hardware maker Stanley Black & Decker — which rallied 5% on the session — and home project retailers Lowe's and Home Depot, both recently setting new highs.

Mall owner Simon Properties is being bought as consumers shop more, he said. The banks and casino stocks, such as Wynn Resorts, are also showing opportunities.

"When you see this kind of animal spirits of the market coalescing with the pent-up demand from ravenous consumers," Cramer said, "you get the insane gains like we saw today."

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com