CNBC's Jim Cramer on Tuesday suggested investors hold tight because the slide on Wall Street may not be over.

"Given that the averages hit record levels last week and the froth was as thick as I've seen it in ages, I think the slowdown still isn't [fully baked] in these stocks," the "Mad Money" host said. "That's why I continue to recommend this heavy cash position."

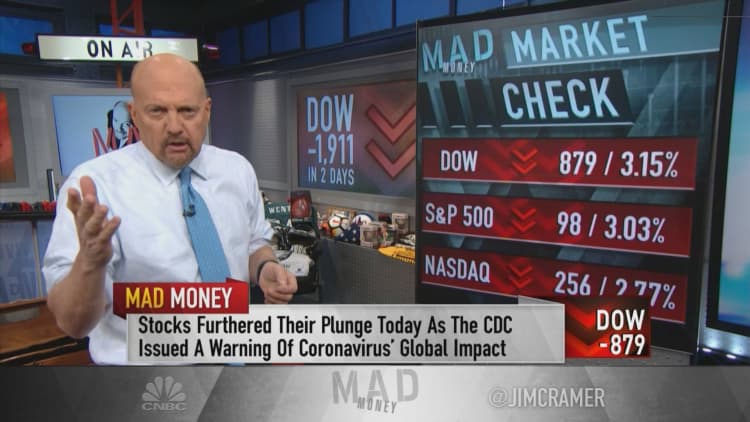

The major stock indexes suffered back-to-back drops of roughly 3% after yet another brutal trading day. Market players are concerned about how the coronavirus spread will impact corporate earnings amid the backdrop of a slowing global economy.

The Dow Jones Industrial Average plummeted almost 880 points, or 3.15%, one day after the 30-stock index dropped more than 1,030 points. The Dow has traded in the red on 8 of the last 10 trading days. The broader S&P 500 shed about 98 points, or 3%, and the tech-heavy Nasdaq Composite slipped almost 256 points, or 2.77%.

The latter two averages are as much as 8.7% off their closing highs last week.

"I want to be more aggressive — I do. I want to believe that Moderna's vaccine works, that Gilead's antiviral has an impact, that Zoom's the way to work at home, and then I will have more stocks to recommend as the market goes down," Cramer said. "But right now, I'd feel a lot more comfortable if there were even more pain in the market to reflect the true ugliness of this situation."

The two biotechnology companies, Moderna and Gilead Sciences, are working to develop a vaccine for the novel virus known as COVID-19. Moderna shares surged 27.8% during the session on news that U.S. government researchers planned to study the antidote. The company is eyeing to get clinical trials underway in late April.

Gilead Sciences also has a medicine called remdesivir in the works. The University of Nebraska Medical Center and National Institute of Allergy have been selected to run clinical trials for the drug, which is also going through tests in Wuhan, the Chinese city that is the epicenter of the outbreak. Gilead shares climbed almost 9% between Thursday's close and Monday's close, though the stock declined 3.8% to $70.10 on Tuesday.

A dozen companies are said to be scrambling to develop cures, vaccines and tests for the flu-like virus. Cramer, though, said investors must "hope for the best, but prepare for the worst" as U.S. health officials sound the alarm that the coronavirus likely cannot be contained.

"If the virus strikes here in a big way, then I think we'll end up having a lot more downside," he said. "Any sector that relies on consumers actually going out and spending money will be in very big trouble, but if it doesn't come here in large numbers, then the downside will be more limited."

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com