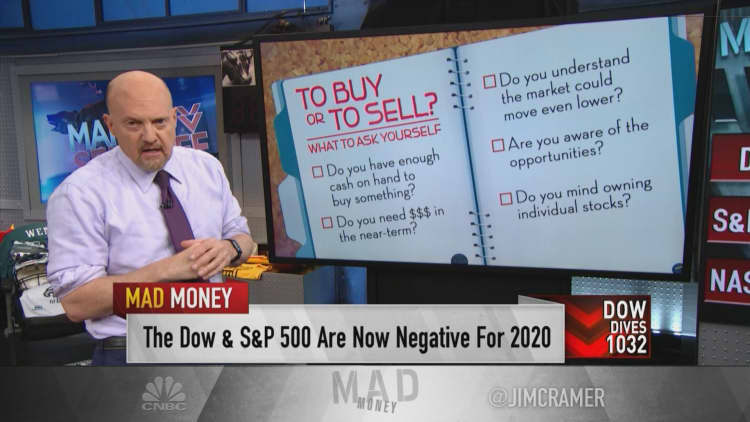

CNBC's Jim Cramer shared five things investors must consider after Wall Street dragged through its worse trading day in two years.

The Dow Jones Industrial Average plummeted more than 1,031 points on Monday as worries grew about the coronavirus spreading across continents. The S&P 500 and Nasdaq Composite also fell triple digits.

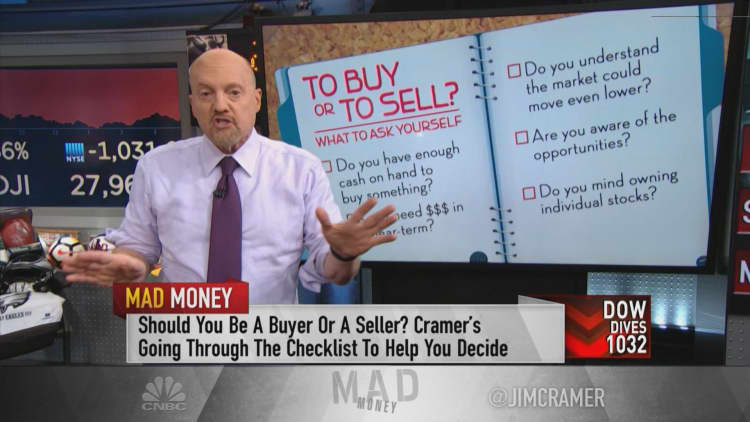

After a tough day of trading, the "Mad Money" host broke down five factors that can help investors determine whether now is a time to ditch stocks or gobble them up at a discount.

"Once you ask yourself [these] five questions, then yes, for some people it may make sense to start picking at beaten-down stocks, especially if they keep falling," he said.

"Don't try to be a hero, it's never worth it. By the way, there's no hurry. If you want to buy stocks into weakness, take your time."

Cash on hand?

Investors should not be buying stocks on margin, or borrowing money despite the lower prices, Cramer said.

"If you don't have a decent amount of cash on the sidelines, you shouldn't do any buying here," he said. "If anything, maybe do some selling the next time we get a moment of strength so that you'll be prepared for the next big down day."

Near-term priorities?

Investors who do have money stashed away need to assess their priorities. Cramer advised against risking money that's intended for something in the next 18 months.

"If you don't think you'll need it and you haven't bought anything yet, then I think it makes plenty of sense to start putting that cash to work, but only if the market gets hit again," he said. "Do not buy [on] a rally, please."

Risk-reward?

The market has taken multiday hits as more news comes out that coronavirus cases are picking up outside China, which is where the COVID-19 disease was discovered. The virus has already been declared a global public health crisis, and is spreading in Italy, South Korea and the Middle East.

More bad news surrounding the epidemic could take stocks even lower, Cramer said.

"We still aren't oversold by any means — it's hardly down at all," he said. "So while we just had the worst session in two years, it's very difficult to call this a tremendous buying opportunity, especially given all that frothy action last week."

Certificate of deposit?

Investors can get a "bare minimum return" on a certificate of deposit, Cramer said. Banks offer the investment instrument to those willing to leave a deposit with the institution for a predetermined period of time.

"I'd suggest coming in tomorrow — if it's down — and buying a utility ETF or a dividend ETF because even if the stocks are high, anything with a good yield is a bargain versus the incredibly low rates you're getting from bonds," he said.

Individual stocks?

Investors with a proclivity for individual stocks can find ways to beat the market, Cramer suggested.

"The best values here are in individual stocks, not the indexes, because the indexes are experiencing torrential selling — if not a meltdown — that takes the good down with the bad," he said.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com