CNBC's Jim Cramer wanted to reaffirm his faith in the technology sector as the tech-heavy Nasdaq index took Thursday's sell-off pain head-on, dropping 2.1 percent amid marketwide weakness.

So the "Mad Money" host decided to continue his "power rankings" of stocks with the most investment potential in each sector with the information technology space, the single largest sector in the .

"On the one hand, tech's still the second-best-performing sector in the market right now, right behind health care," Cramer said. "On the other hand, it's been annihilated over the past few weeks."

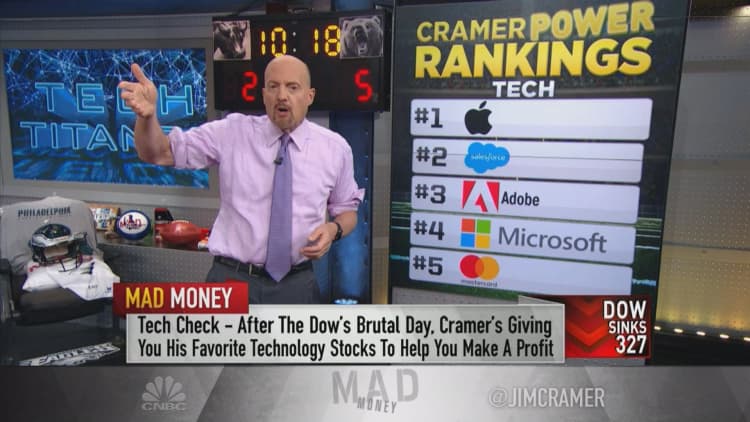

Here are the stocks he sees as the most investable right here, right now:

1. Apple

Few "Mad Money" followers would be surprised that Cramer-fave Apple took first place in his ranking. Now that Amazon's stock has slipped from its highs, Apple is the world's only trillion-dollar company by market cap.

Reiterating his motif that Apple should be valued like a consumer products company rather than a tech company, Cramer applauded the iPhone maker for creating "the most popular consumer product on earth."

"But here's the thing: Apple trades at less than 16 times next year's earnings estimates," Cramer said. "It's cheaper than the average stock in the S&P 500. More important, it's cheaper than the consumer product stocks — cheaper than Procter, cheaper than Clorox, cheaper than Kimberly-Clark — they're all more expensive, even though they have much slower growth."

The "Mad Money" host added that whenever Apple's stock is down, like it was on Thursday, it's "safe to assume" that the company is buying back its shares via its $100 billion buyback, the largest in history.

"Most importantly, Apple's become a play on the subscription economy," Cramer said. "I think expansion here will only continue to accelerate because the value proposition on this stuff is impossible to deny."

All in all, his mantra remains: own Apple; don't trade it.

2. Salesforce.com

Salesforce.com, the cloud-based enterprise software giant behind the third-best-performing tech stock in the S&P 500, took second place in Cramer's ranking, even as he said the stock would likely continue to fall in the near term.

"But once this meltdown comes to an end, Salesforce will still be a terrific company with incredibly strong numbers," he said. "The cloud remains one of the most exciting software stories around and Salesforce practically invented it."

Moreover, "every single time Salesforce['s stock] has pulled back, it's been a buying opportunity," Cramer noted. "I think you'll be rewarded if you stick with this one, although if you buy it patiently on the way down, you may get a better cost basis."

3. Adobe

Digital media and marketing colossus Adobe placed third for its shift to the cloud, its enterprise solutions for harnessing the power of the internet and management's push towards a lucrative subscription-based business model.

"I'd be more worried about the marketwide sell-off if not for one thing: we already know that Adobe's business is on fire," Cramer said. "You want to know why the whole market rebounded so hard on Tuesday? Well, Adobe was a big part of the reason."

In Adobe's annual conference on Tuesday, the company forecast a $108 billion total addressable market by 2021 and 20 percent revenue growth. The updates sent shares of Adobe up 10 percent.

"But, of course, this market has the memory of a gnat, so Adobe's stock got slammed along with everything else today," Cramer said. "I think you need to view that weakness as an opportunity because we know how well they're doing."

4. Microsoft

The ubiquitous Microsoft took fourth place in Cramer's ranking. The "Mad Money" host credited CEO Satya Nadella for steering the tech giant into the "formerly neglected growth markets" of cloud infrastructure and social networking.

"Two years ago, Microsoft's business was shrinking. They looked like they'd been left by the wayside. But Nadella turned things around, and now their sales are growing at an incredible 17 percent clip; double-digit growth across all segments; commercial cloud revenue up 53 percent. This is not your father's Microsoft," Cramer said.

"Microsoft also had fabulous earnings that make it easier to buy into weakness, because it's undeniable that this stock gets cheaper as it goes lower — it's now selling for just 22 times next year's earnings," he continued. "I like it here, but I'd like it even more lower."

5. Mastercard

Coming in fifth was Mastercard, a payments play that doubles as a financial technology company.

"Within all of tech, Mastercard is one of the best names around," Cramer said. "They've been steadily growing their payment network all over the world, and, at the end of the day, that's why I prefer Mastercard over Visa for this fifth slot: because it's got higher organic growth [and] more runway."

Better yet, with much of the market worried about the Federal Reserve's interest rate hikes negatively affecting margin growth at the big banks, fintech plays have become "go-to stocks" for money managers who want exposure to the financial sector with minimal risk, Cramer said.

Still, he told investors to wait for Visa's and Mastercard's earnings reports in the following weeks to know more.

Final thoughts

In a volatile market, it's worth staying diversified no matter how painful some sectors might seem at the moment, Cramer concluded.

"Even in this brutal market, it pays to stay diversified, which is why you should own some tech here despite the fact that the group feels like a punching bag," he said. "My favorites? They are Apple, Salesforce, Adobe, Microsoft, and Mastercard. Be my guest."

Want more sector-by-sector rankings? Find Cramer's lineups for industrials, health care, , , and here.

WATCH: Cramer's 5 most investable tech stocks

Disclosure: Cramer's charitable trust owns shares of Apple, Amazon, Salesforce.com and Microsoft.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com